Emmvee Photovoltaic Shares Surge As Jefferies Initiates First Buy Call — Here's Why

Jefferies has initiated coverage on Emmvee with a 'buy' rating and a price target of Rs 320.

Shares of Emmvee Photovoltaic Power surged in early trade on Tuesday, as India’s solar build-out is entering an acceleration phase, and Jefferies believes this counter is positioned at the heart of it. The brokerage projects India’s solar installations to grow at a 24% CAGR over FY25–28, powered by falling tariffs, energy storage adoption and policy support.

Against that backdrop, Jefferies has initiated coverage on Emmvee with a 'buy' rating and a price target of Rs 320, indicating an upside of 73%. The brokerage notes that the stock currently trades at around a 50% discount to peers.

A major catalyst is the shift toward solar plus battery energy storage systems. Jefferies highlights that solar tariffs have been cheaper than new thermal tariffs for the past four years, driving adoption. The brokerage expects solar to dominate India’s renewable expansion, forecasting annual solar PV installations of 65GWdc in FY28, up from 34GWdc in FY25, translating into the 24% CAGR over FY25–28E.

Policy is another strong tailwind. Jefferies notes that ALMM rules and Domestic Content Requirement norms have effectively ring-fenced the domestic market for Indian manufacturers. These policies have created a shortage of domestic cell capacity, pushing up module prices and profitability. The brokerage adds that similar protection for ingot and wafer is likely, supporting industry profitability over the medium term.

Within this landscape, Emmvee is seen as a technological early mover. Jefferies highlights that Emmvee is only the second adopter of high-efficiency TOPCon cells in India, with 3GW operational since September 2024. The company has partnered with Fraunhofer, Germany, for PV cell process equipment selection and optimization, and its German-sourced cell line carries lower operating costs than Chinese equipment.

Jefferies argues Emmvee retains an edge. The brokerage cites early entry into TOPCon, superior DCR-driven profitability, and an adequately funded balance sheet as competitive strengths. These, along with elevated margins in the DCR market, ensure strong cash flows to fund expansion and backward integration.

Key risks, the brokerage cautions, include weak domestic solar demand and the possibility that all announced capacities actually materialize, worsening oversupply.

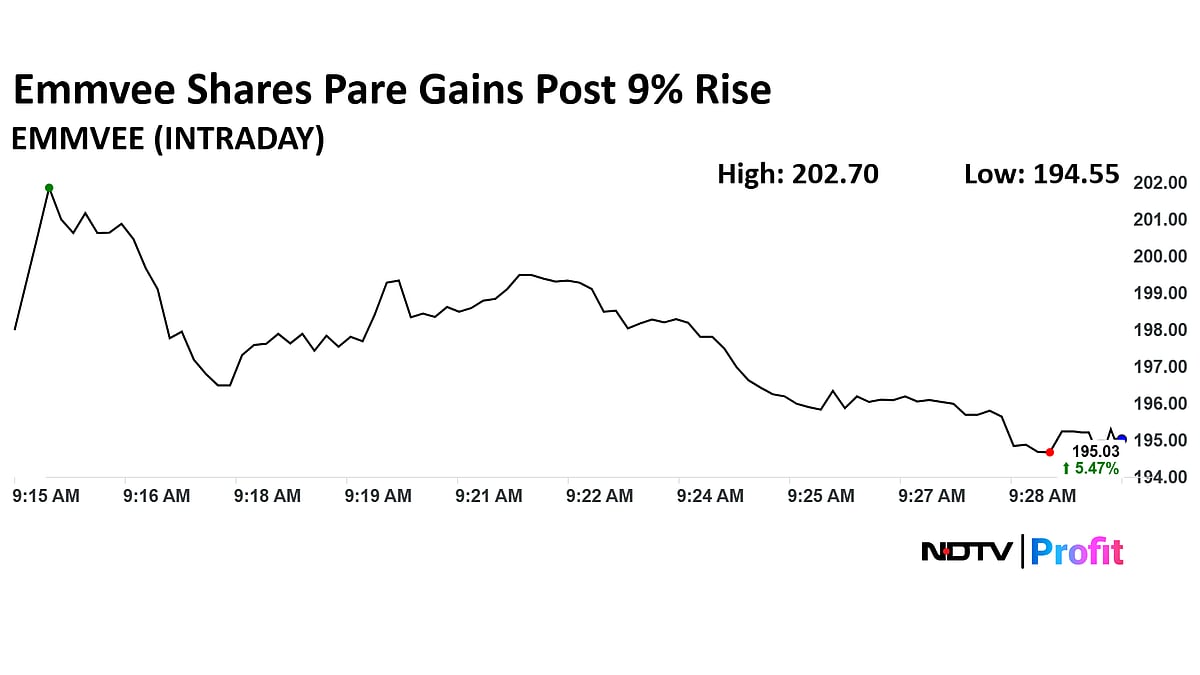

Emmvee Share Price Today

The scrip rose as much as 9.62% to Rs 202.70 apiece, the highest level since Dec. 10, 2025. It pared gains to trade 5.46% higher at Rs 195.01 apiece, as of 09:35 a.m. This compares to a 0.09% decline in the NSE Nifty 50 Index.

It has fallen 10.8% since listing in Nov. 2025. Total traded volume so far in the day stood at 0.44 times its 30-day average. The relative strength index was at 61.