(Bloomberg) -- Emerging-markets assets started the week lower after Federal Reserve Chair Jerome Powell said over the weekend that the US may have to wait beyond March for the central bank to cut interest rates.

MSCI Inc.'s index for developing-nation currencies fell 0.3%, with declines across regions, led by the Thai baht. Chile's peso dropped to the lowest level since November 2022.

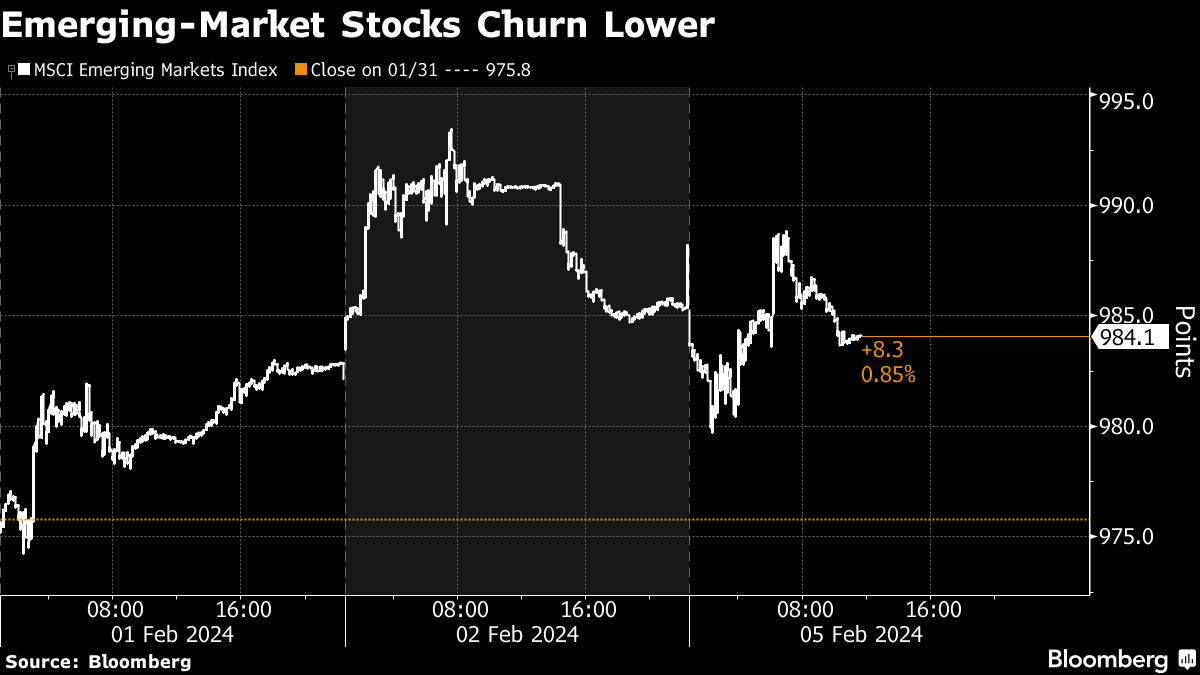

Stocks also declined, with the MSCI index down 0.5%. Equities in China, which account for a large share of global EM benchmarks, had another volatile session after last week's rout, as investors assessed pledges by policymakers to stabilize the market.

At the end of the session in Asia, authorities tightened trading restrictions on domestic institutional investors as well as some offshore units, according to people familiar with the matter.

Turkish assets took the surprise change of guard at the central bank largely in their stride, with the lira down 0.2% against the dollar. Turkish data on Monday showed monthly inflation jumped the most since August, an upswing that could test the central bank's resolve to quell price increases quickly after halting interest-rate increases last month.

Senegal's Spreads

Senegal's Eurobonds fell sharply after President Macky Sall postponed this month's presidential elections and as lawmakers gathered to consider extending his mandate until a successor takes power.

While it's premature to fully discard a positive trajectory, uncertainty has risen for the west African nation's markets, Barclays Plc economist Michael Kafe and strategist Andreas Kolbe wrote in a report Monday.

“We believe that, at least in the short-term, this will need to be reflected in additional political risk premia in Senegal spreads,” the Barclays report said.

In Nigeria, central Bank Governor Olayemi Cardoso said the country has almost cleared a backlog of foreign-exchange contracts that have weighed on the naira and repeated that the currency is undervalued, following a 38% slump last week.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.