Indian stock markets are "ripe" for a short-term bounce after being largely range-bound for a while, according to a senior Jefferies India analyst. "Two-thirds of emerging market investors are underweight on India," Mahesh Nandurkar, head of research and managing director at the multinational investment firm, told NDTV Profit.

He drew attention to the foreign capital outflow from the domestic market this year for the first time since 2022. Foreign investors have moved nearly Rs 98,000 crore or $11.2 billion out of Indian debt and equity markets so far in 2025, as per NSDL data. From stocks, they have taken out Rs 1.4 lakh crore.

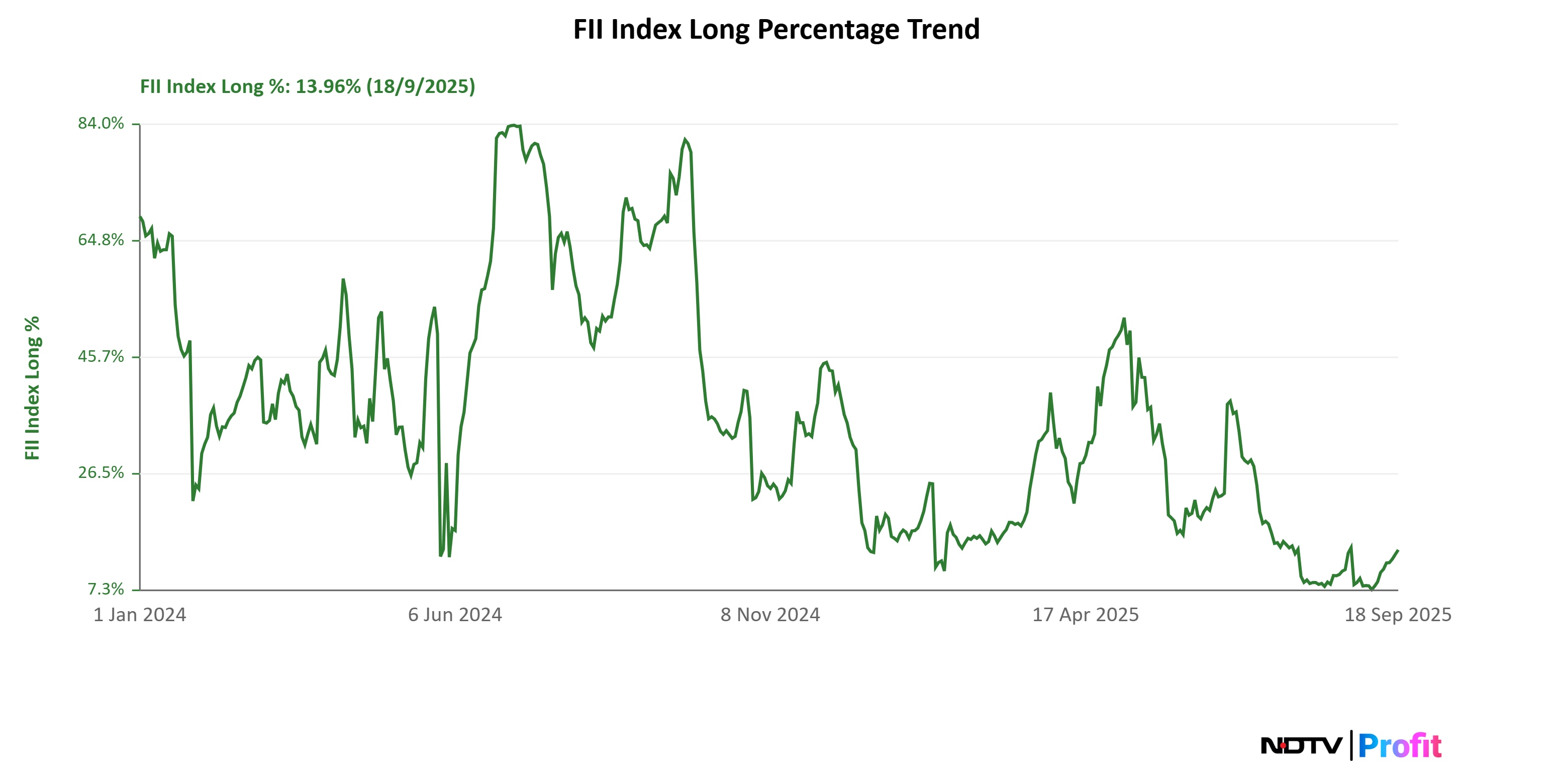

Foreign investors are sitting on a record amount of short positions, the Jefferies analyst said. The FII Nifty Long ratio dipped to its lowest in nearly two years earlier this month, indicating a bearish mood among overseas investors.

The FII Nifty Long ratio dipped to its lowest in nearly two years earlier this month.

On the other hand, Asian peers have run up on hopes of better economic prospects after several export economies struck trade deals with the US to limit high tariffs. Given these factors and an expected improvement in India Inc's earnings after GST and other reforms, Nadurkar said markets are ripe for a short-term bounce.

Improvement in India-US trade relations and a bilateral deal will add steam to the positives. "The market is now ideal for a bottom-up approach. I would prefer discretionary consumption, auto, cement, housing, NBFCs, and banks," Nandurkar said. He also noted an increased supply of fresh equity into the market from IPOs, private equity deals, and promoter share sales.

Moreover, Nandurkar said the government should carry out long-pending reforms in PSU-dominated India's power sector. "Power sector reforms will be the next big reform after GST. We may be looking at the privatisation of state discoms in states like Uttar Pradesh."

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.