- Ellenbarrie Industrial Gases listed on July 1 following its IPO

- The company produces gases like oxygen, nitrogen, and argon for various industries

- Price target set at Rs 680, implying 30% upside and 40 times FY27 estimated EPS

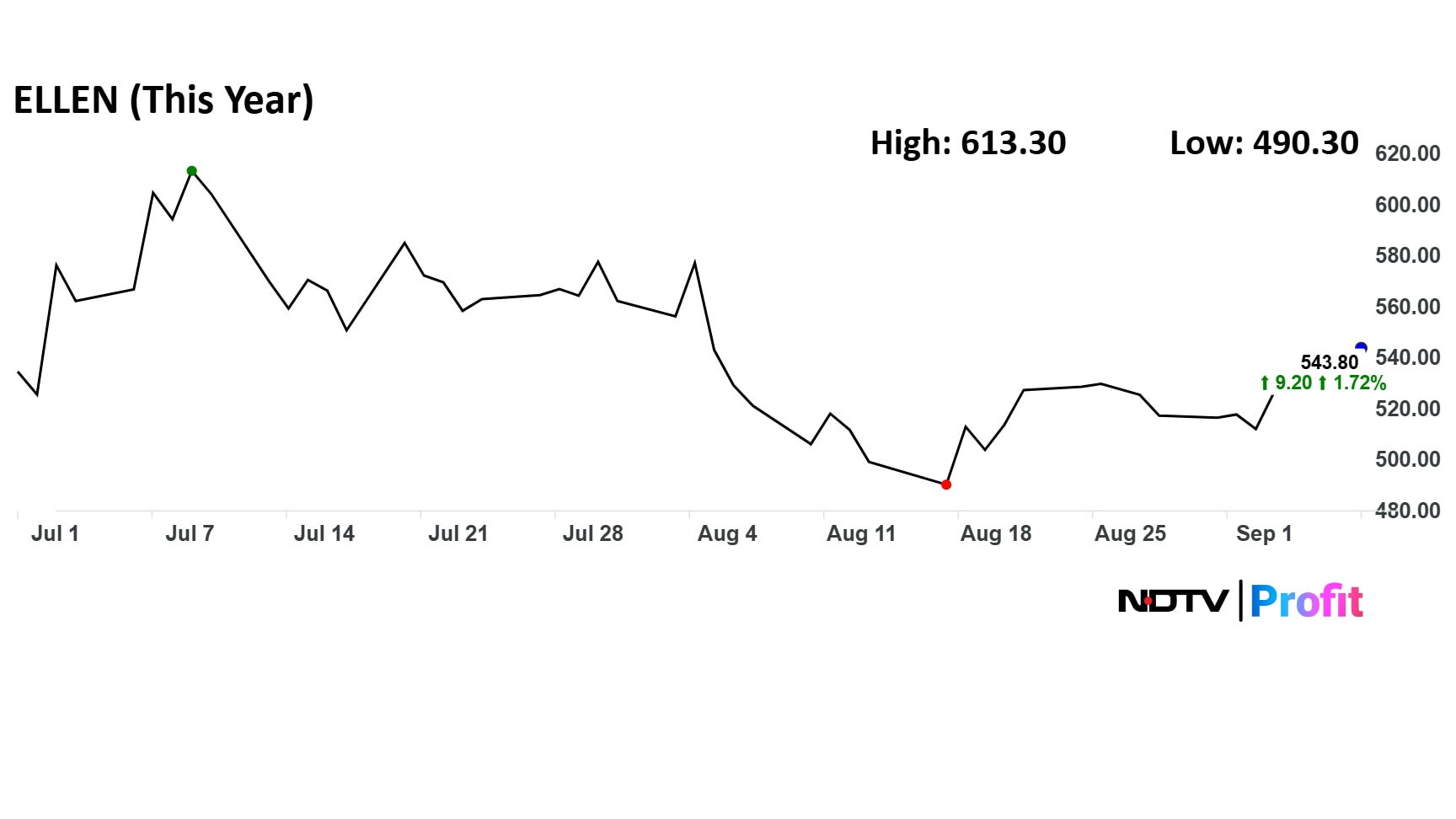

Recently listed Ellenbarrie Industrial Gases Ltd. has received a bullish price target with a 'buy' initiation from brokerage Motilal Oswal Financial Services. The company debuted on the stock market on July 1 following an IPO. After the initial gain, the stock performance has been subdued.

The company manufactures and supplies a broad portfolio of gases, including oxygen, nitrogen, argon, hydrogen, helium and carbon dioxide. These gases are integral to essential systems and applications across industries such as steel, pharmaceuticals, healthcare, engineering, defense, energy, and food and beverages.

The Indian industrial gas market is projected to grow to $1.75 billion by 2028 at a 7.5% CAGR, which provides a favorable backdrop.

Ellenbarrie delivered a CAGR of 23% in revenue, 81% in Ebitda, and 71% in net profit over FY23-25, a note from Motilal Oswal said. Moreover, the company has scaled its capacity 4.5 times over FY23-25 to 3,870 tons per day and aims to increase its capacity to 4,630 tpd by FY27.

Given such a track record, analysts estimate the company to deliver a CAGR of 39% in revenue, 49% in Ebitda, and 52% in net profit over the next three years, driven by capacity additions, a better product mix, and market share gains.

They noted Ellenbarrie's aim to improve margins through higher contributions from argon, green energy initiatives, capacity ramp-up leading to operating leverage, and lower power consumption in the new plants.

Ellenbarrie Industrial Gases stock movement since listing.

Ellenbarrie Industrial Gases Target Price

Motilal Oswal has placed a target of Rs 680 on the Ellenbarrie Industrial Gases stock, implying a potential upside of 30% over its previous close.

In terms of valuation, the target is based on 40 times the FY27 estimated EPS. It also represents a 51% discount to larger rival Linde India Ltd. The company is currently trading at 49 times its FY26 price-to-earnings.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.