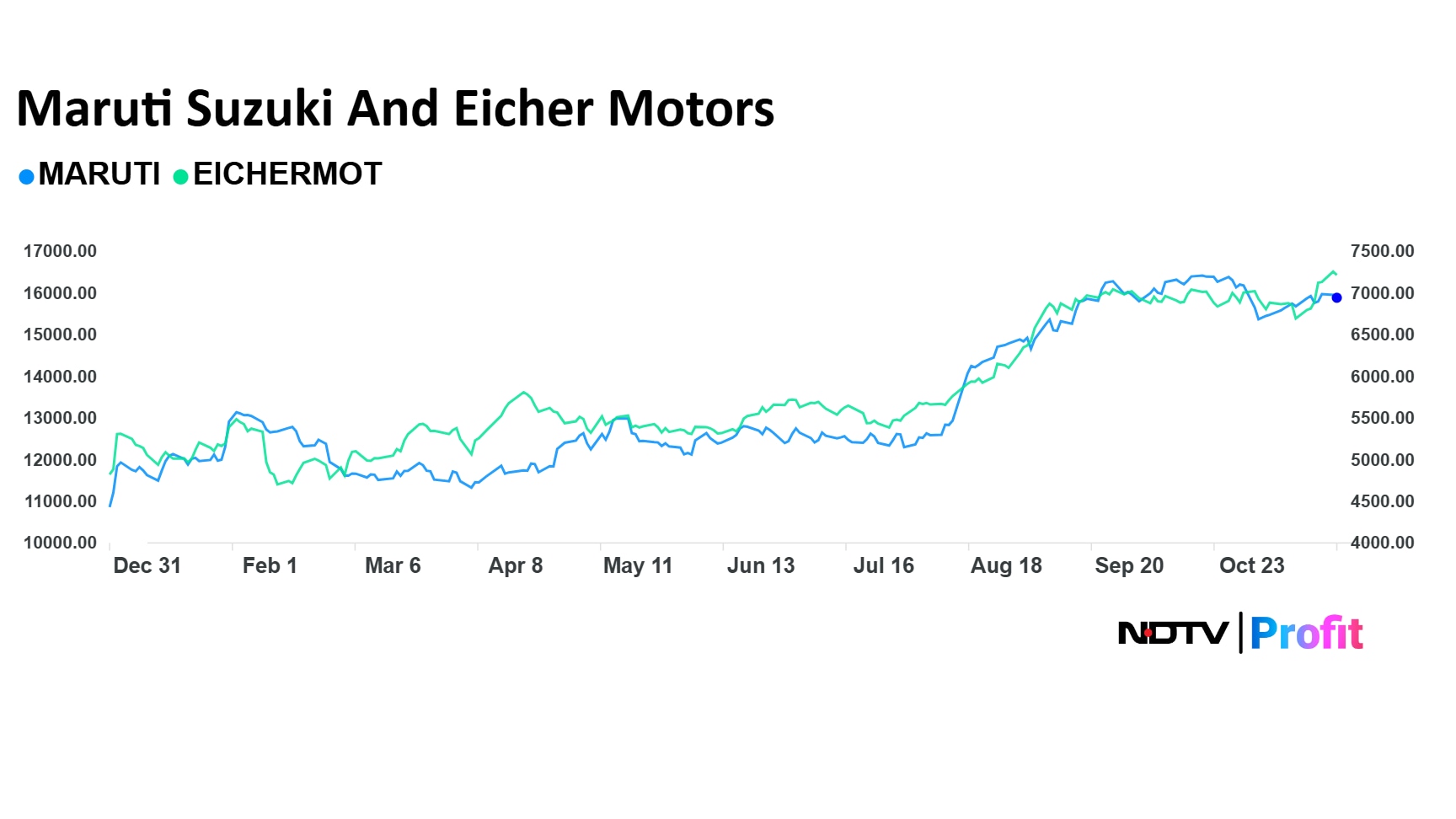

- Eicher Motors and Maruti Suzuki led NSE Nifty 50 gains in 2025 with 41% and 47% rises

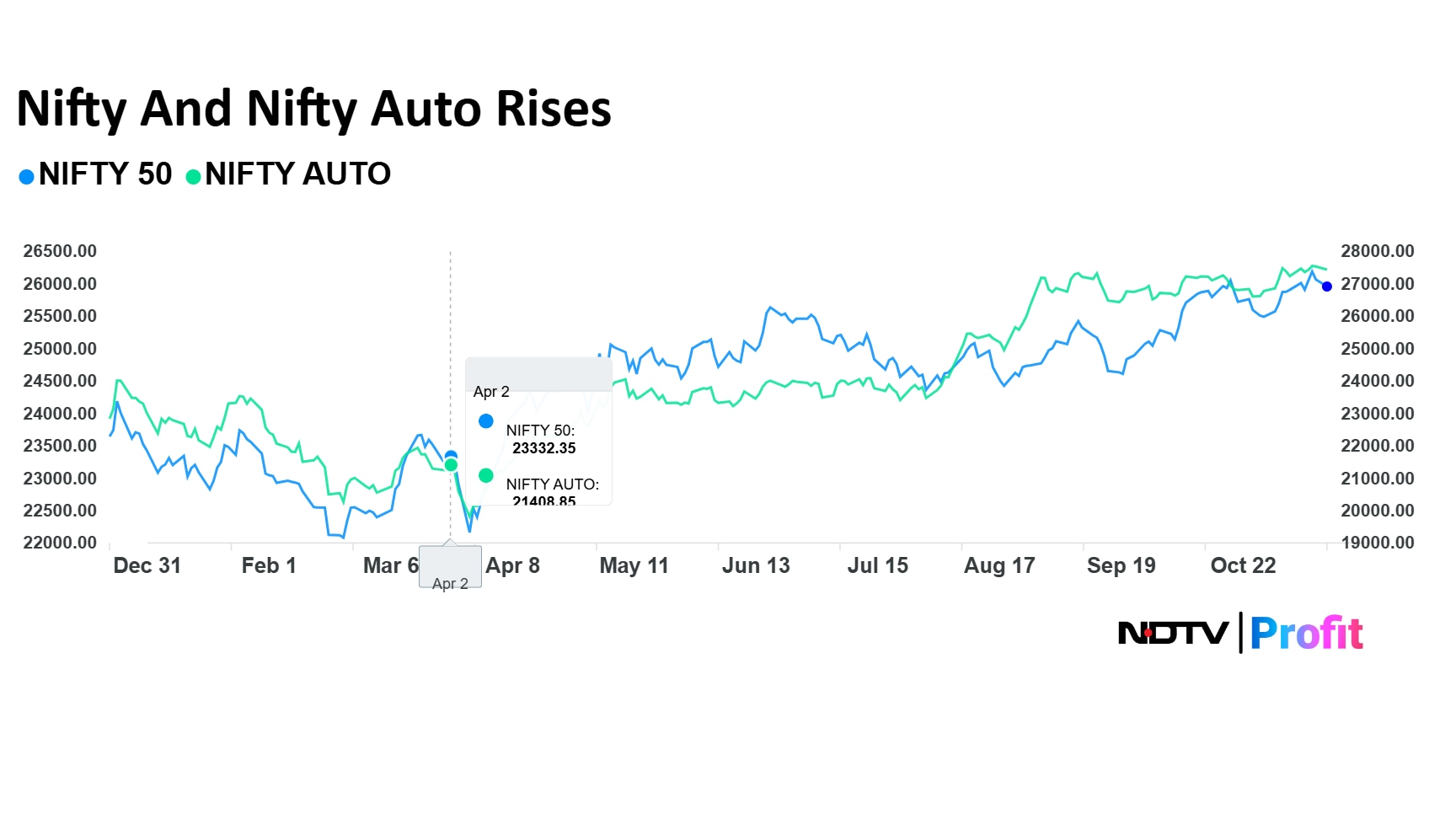

- Nifty 50 index rose 9%, while Nifty Auto gained 18% in the calendar year 2025 so far

- GST reform boosted small-car sales and bike pre-buy under 350cc benefiting both companies

Eicher Motors Ltd. and Maruti Suzuki India Ltd. emerged as the top drivers of gains the benchmark NSE Nifty 50 index in 2025 so far. The two auto stocks also drove rally in the NSE Nifty Auto index as well.

Eicher Motors and Maruti Suzuki India share prices have risen 41% and 47%, respectively, on a year-to-date basis. Meanwhile, the NSE Nifty 50 index rose 9% and the NSE Auto gained 18% in calendar year 2025 so far.

What Worked For Eicher Motors, Maruti Suzuki In 2025?

Maruti Suzuki India is the largest manufacturer of small cars in India. The outlook for small-car sales improved after the Government of India rationalised the Goods and Services Tax structure. The expectation is that the GST 2.0 will revive the small-car sales in the domestic markets, which supported gains in Maruti Suzuki India share price.

The automobile manaufacturer saw a strong response to new launches in Dzire and Victoris range.

Maruti Suzuki India set a target to reach 4 lakh vehicle exports for the financial year 2026. Its Fronx variant already crossed 1 lakh exports.

For Eicher Motors, GST 2.0 boosted the pre-buy in bikes under 350-cc. The automotive company is bringing back popular models like Black Bullet and Battalion.

Eicher Motors reported 49% growth in exports on a year-to-date basis.

What To Watch in 2026?

Maruti Suzuki India has planned to launch E-Vitara in India in the calendar year 2026. The automobile manufacturer has a target to launch eight new models by financial year 2030.

Key things to watch are whether the weight criteria in Café Norms gets approved, which will be a positive for Maruti Suzuki India, and the momentum of small cars sustains or not.

As of now 77% brokerages have a Buy call for the MarutI Suzuki India stock, compared to 70% earlier. It has 14% Hold calls and 8% Sell calls.

Eicher Motors will launch electric motorcycle, Flying Flea, which will be a crucial event investors may keep an eye for. They should also actively monitor how the growth pans out for VE Commercial Vehicles after new launches in the light commercial vehicle.

GST rates have increased to 40% over 350-CC motorcycles from 28% earlier. Market participants will likely analyse the impact of the price rise for motorcycles in this category.

The incremental margin upside looks limited for Eicher Motors.

Buy calls for Eicher Motors remained unchanged at 51% as of now, while the Hold calls icnreased to 37% from 27%. Sell call for the stock reduced to 14% compared to 22% at the start of the year.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.