DreamFolks Services Ltd.'s shares plunged over 6%, before erasing losses to rise on Friday, after reports said major clients including ICICI Bank Ltd., Axis Bank Ltd., and Mastercard are looking to move away from the global travel and lifestyle services aggregator. The stock has fallen 7.79% since June 18.

ICICI Bank, Axis Bank and Mastercard are among the stakeholders who are mulling over a disassociation with DreamFolks, news agency PTI reported, citing sources. Other lenders and card services providers may also follow, it added.

On Thursday, the company's shares plunged as much as 14%. DreamFolks, however, said in a stock exchange filing that its relationships with all partners "remain strong and fully intact".

"Contract negotiation is a part of the regular business process, which is carried on annually with the clients and has no relation with the alleged news," it said.

On Sept. 22 last year, DreamFolks — that offers lounge access services at several airports — had witnessed 'a temporary disruption in services' impacted lounge access of thousands of customers of banks and card networks. Though the issue was resolved the next day, it sent the banks and card networks to explore other alternatives, three sources familiar with the matter said.

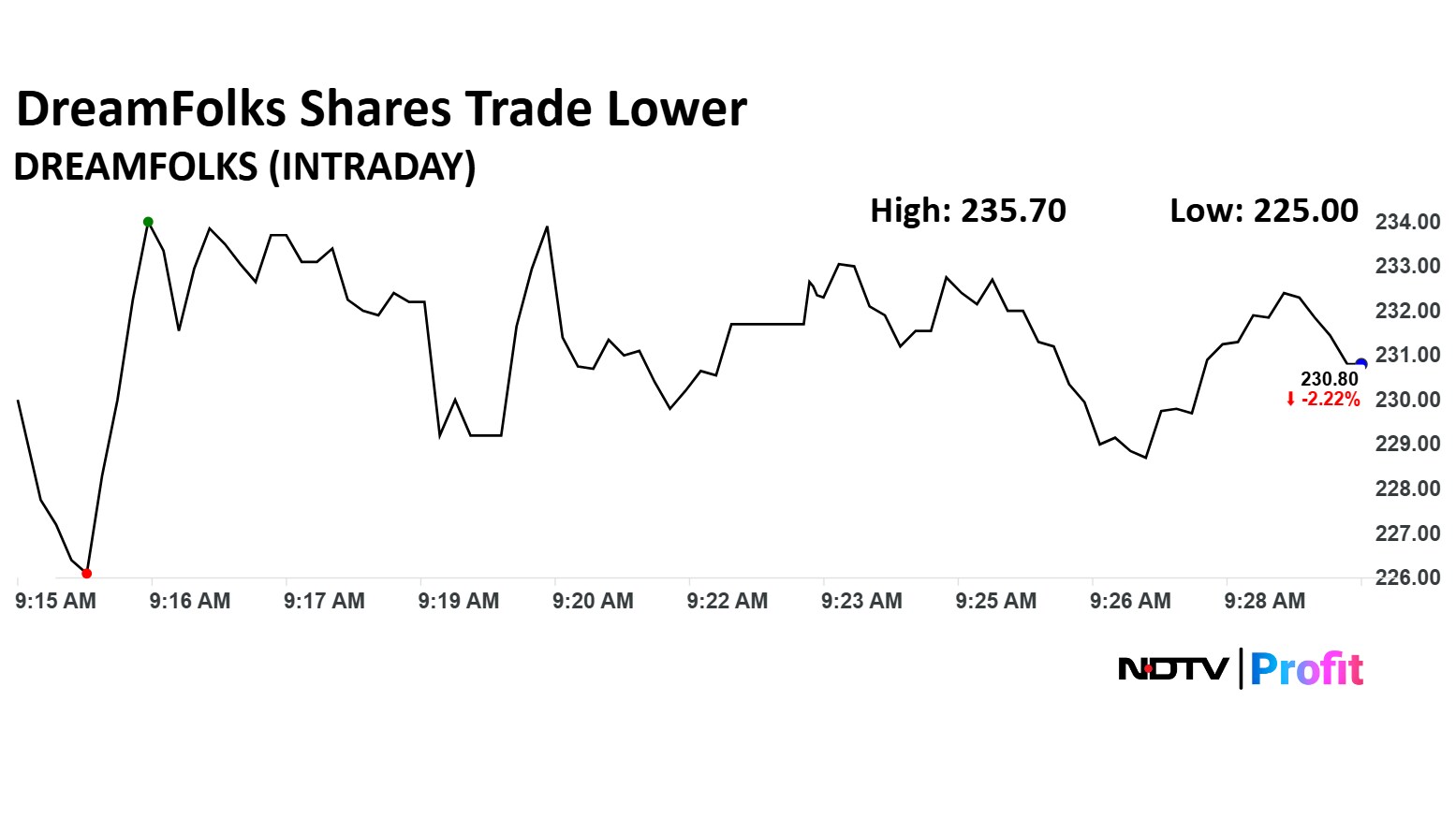

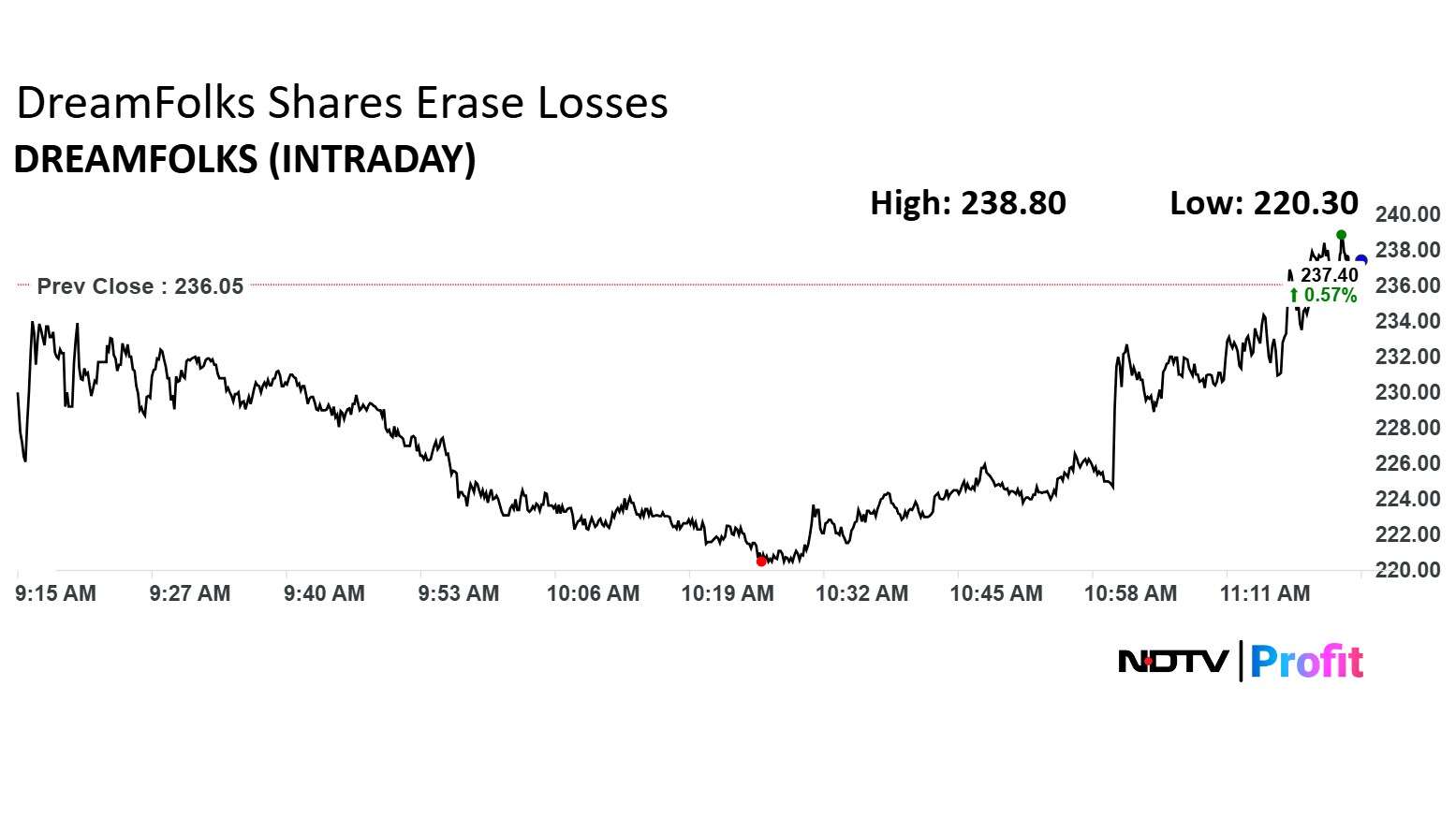

DreamFolks Share Price

Shares of DreamFolks fell as much as 6.67% to Rs 220.30 apiece. They erased losses to trade 0.57% higher at Rs 237.40 apiece, as of 11:24 a.m. This compares to a 0.88% advance in the NSE Nifty 50.

The stock has fallen 50.10% in the last 12 months and 38.44% year-to-date. Total traded volume so far in the day stood at 0.30 times its 30-day average. The relative strength index was at 49.75.

Two analysts tracking the company maintains a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 50.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.