Dr Reddy's Laboratories' logged its biggest fall since December 2023 following brokerage target price cuts after the company announced its results for the December quarter. Brokerages believe that the pharma major's loss in market share of generic Revlimid or gRevlimid will negatively impact its performance.

Revlimid is a medicine used for the treatment of certain cancers and serious conditions affecting blood cells and bone marrow, namely multiple myeloma, myelodysplastic syndromes and mantle cell and follicular lymphoma.

The pharmaceutical company posted a bottom line of Rs 1,413.7 crore in the quarter ended December, according to an exchange filing on Thursday. That compares with the Rs 1,507-crore estimate that analysts tracked by Bloomberg had projected.

According to Nuvama, "As gRevlimid is nearing the cliff, investor attention is focused on how DRL offsets the gRevlimid impact on earnings."

We think it can retain large part of gRevlimid earnings if it can deliver Abatacept and Semaglutide, it added, the brokerage has retained a 'buy' with a lower target of Rs 1,533, compared to Rs 1,553 earlier.

Citi Research reiterated its ongoing pair trade-- underweight on DRL / overweight on SUN--and believes DRL's margins may fall below 15-17% in some of the quarters in FY26/27E, once gRevlimid starts coming down.

It noted that 3Q numbers were subdued and missed expectations (Adj. PAT c10% below) as the decline in the US was more pronounced due to erosion and market share loss in certain products while gRevlimid was also down to some extent. "Consolidation of NRT (Nicotine replacement therapy), lower R&D spend, and decline in base-line SG&A helped the company report flattish EBITDA QoQ," it said.

The brokerage has a target of Rs1,110, implying 14% downside. According to Jefferies which ,maintained 'underperform' and cut its target to Rs 1170 from Rs 1210, Q3 miss was on weak core revenue and high SG&A while underlying revenue growth moderated to 7.5% YoY.

Weak US and core India sales were offset by strong performance in Russia, UK while SG&A (sales, general, & administrative) spend to remain high in the near term.

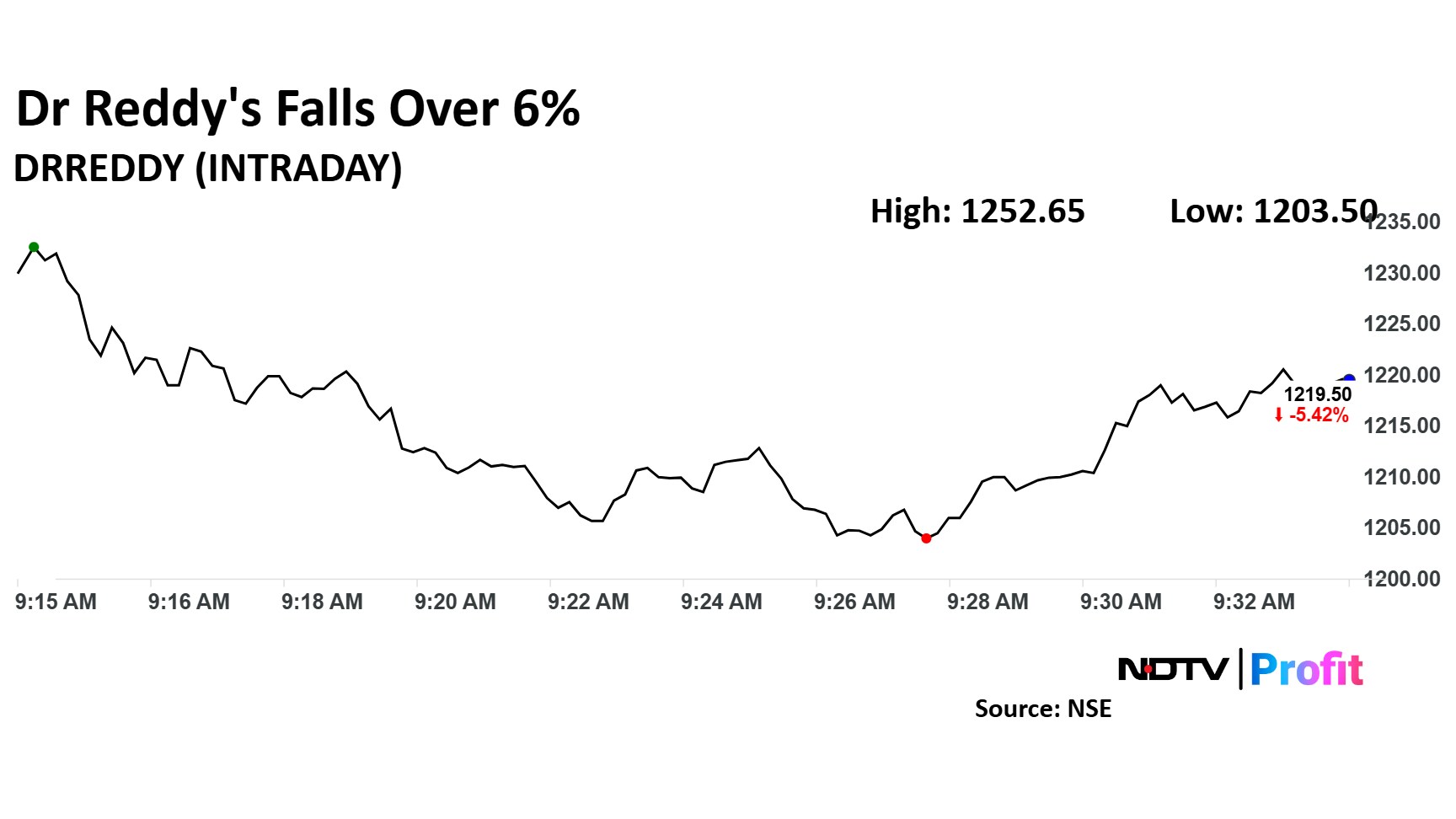

On Friday, the stock fell the most among Nifty stocks.

The scrip fell as much as 6.66% to Rs 1,203.50 apiece, the lowest level since December 2. It pared losses to trade 5.2% lower at Rs 1,221.70 apiece, as of 9:37 a.m. This compares to a flat NSE Nifty 50 Index.

It has fallen 0.1% in the last 12 months. Total traded volume so far in the day stood at 1.10 times its 30-day average. The relative strength index was at 29.1, indicating that the stock may be oversold.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.