- The shares of American Bitcoin Corp. dropped over 50% shortly after Tuesday's market open

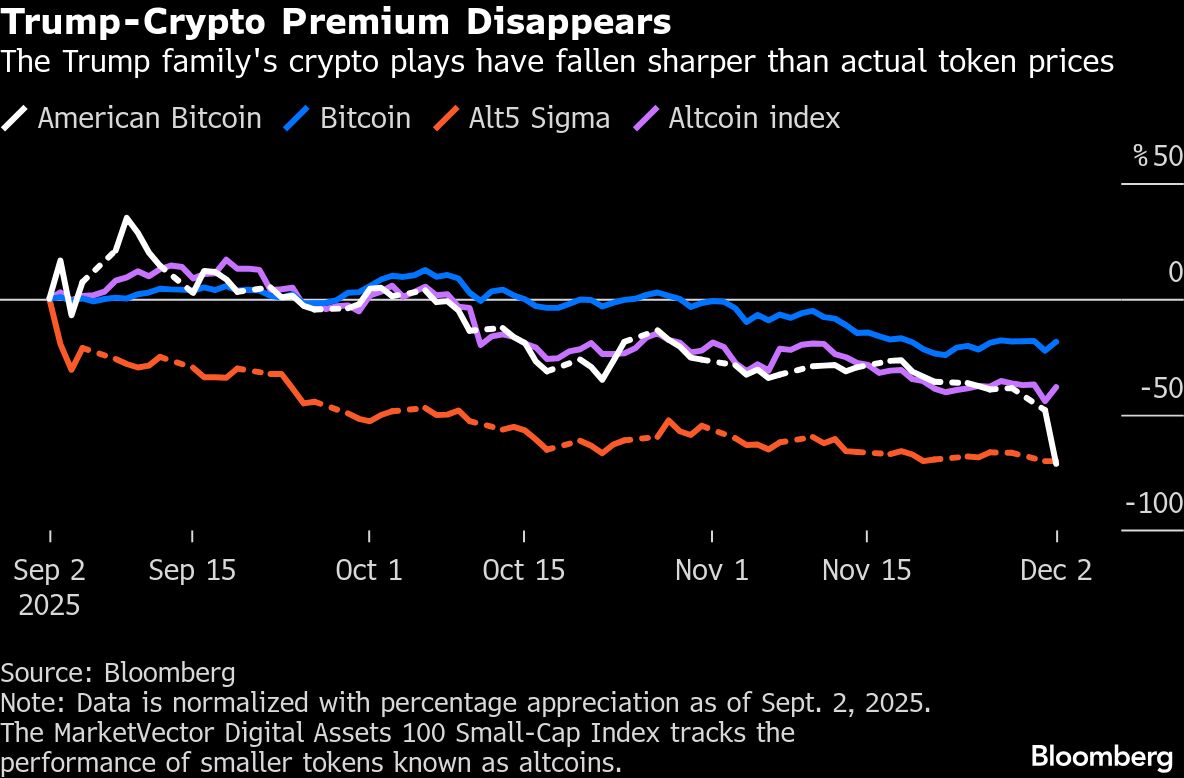

- Trump-linked crypto projects have fallen significantly more than the broader crypto market

- Memecoins named after Donald and Melania Trump lost 90% and 99% from their January highs

The crash Tuesday in the crypto miner American Bitcoin Corp. was instantaneous. At 9:31 a.m. on Wall Street, just one minute after trading opened, its shares were down 33%. Five minutes later, losses had ballooned to 42% and then, for a brief moment, to more than 50%.

It was all so spectacular that American Bitcoin quickly became the symbol of not just the crypto market wipeout of late 2025 but also the collapse of the myriad ventures that the Trump family has been promoting in the digital-currency world over the past year. For as much as broader crypto markets have sunk these past two months — roughly 25% in the case of bellwether Bitcoin — projects that are tied to the Trump family are down far, far more.

World Liberty Financial, co-founded by President Donald Trump and his sons, has seen its WLFI token tumble 51% from its peak in early September, more than both Bitcoin and an index of smaller digital tokens. Alt5 Sigma, a company promoted by the Trump sons, has plunged around 75% as it deals with a growing number of legal problems.

Then there are the memecoins named after the president and his wife, Melania, which have fallen around 90% and 99% respectively from their record highs back in January. American Bitcoin, which was co-founded by Eric Trump, is now down 75% after the big drop on Tuesday.

These moves have put a big dent in the huge piles of crypto wealth that the first family amassed earlier in the year. But they also carry a broader significance for both the digital asset industry and the president's public image. Trump's embrace helped boost a wide array of crypto tokens during the early months of his second term and turned the price of Bitcoin into a marker of his political success.

Now, though, what looked like a Trump premium has suddenly turned into a Trump drag, taking out one of the central pillars holding up cryptoassets and offering an indication of just how quickly confidence in these speculative markets — and even in the president himself — can dissolve.

“The Trump presidency has been a double edged sword for legitimacy,” said Hilary Allen, a law professor at American University's Washington College of Law. “Trump started launching his own crypto projects, many of which lost value very quickly. If the goal was to achieve legitimacy through the Trump family, that's not helped.”

World Liberty Financial and the company behind Trump's memecoin, Fight Fight Fight, did not immediately respond to requests for comment.

While the president has recently toned down his public promotion of crypto, Eric Trump took to social media on Tuesday to blame American Bitcoin's bad performance on the end of a lockup period for its shares, rather than any broader weakness.

“Our fundamentals are virtually unmatched,” he wrote in a post on X. “I'm 100% committed to leading the industry.”

To be clear, the dramatic moves in the assets associated with the Trump family are hardly new for an industry that has been defined by its volatility. Digital tokens have experienced big drops in the past, before bouncing back. On Tuesday, as American Bitcoin struggled, the original cryptocurrency had one of its best days in the last few weeks, rising around 6%.

Earlier this year, though, it seemed like Trump's embrace of the technology might be enough to take digital tokens out of their endless cycle of boom and bust and turn them into a more reliable part of the financial system. If nothing else, many crypto believers figured Trump would have enough power to ensure the success of the projects he cared about the most.

And for a while, the various cross-promotions seemed to be working. People looking to express their support for the president brought up Trump tokens and pushed up their value. Gryphon Digital shares surged 173% when it announced that it was merging with Eric Trump's American Bitcoin in May. On the first day of trading after the merger, in September, shares of American Bitcoin rose another 16%.

These projects were all helped by policies and regulatory changes that Trump promoted, led by legislation that aimed to bring crypto stablecoins, tied to the value of the dollar, into the mainstream.

But the signs of trouble have been mounting over time. The memecoins that were launched right before the inauguration, with lots of promotional muscle from Trump himself, have steadily lost steam over time, with just occasional moments of relief, like the rally in April after the president offered to join some of the biggest holders of the coin for dinner.

Joel Li, the chief executive of an online marketplace for electric vehicles, bought the memecoin so he could attend the dinner, but sold out soon after. He noticed things getting particularly bad after Trump launched a new salvo of tariffs against China in October.

“People started to realize, this might not be what they thought,” Li said.

Michael Terpin, a long-time crypto investor, said that the tariff moves have served as a cold reminder: “Trump giveth and Trump taketh away.”

The problems, though, have gone beyond the vagaries of the broader markets. American Bitcoin has had to deal with a report that the mining machines it uses, from a Chinese manufacturer, have been investigated as a risk to US national security. Meanwhile, Alt5 Sigma, a public company that set out to buy one of the tokens issued by World Liberty Financial, has faced an exodus of executives after announcing that one of its subsidiaries had faced a criminal probe in Rwanda.

Alt5 Sigma did not respond to requests for comment on the recent developments.

The downdraft since October has taken out more than $1 billion of the wealth that the Trumps generated through their crypto ventures and other businesses. But they are still sitting on significant profits, according to the Bloomberg Billionaires Index. It is retail investors who bought into assets when they were flying near their peaks that are nursing the most painful losses.

Kevin Hu, a 22-year-old student in Vancouver, had positioned for a continued rally, but instead saw his portfolio of digital tokens drop by as much as 40% by mid-November.

“You'd think with the president being so pro-crypto, it would create a floor,” he said. “But the market didn't respond that way. And the stuff around the memecoins, it just turned a lot of people off.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.