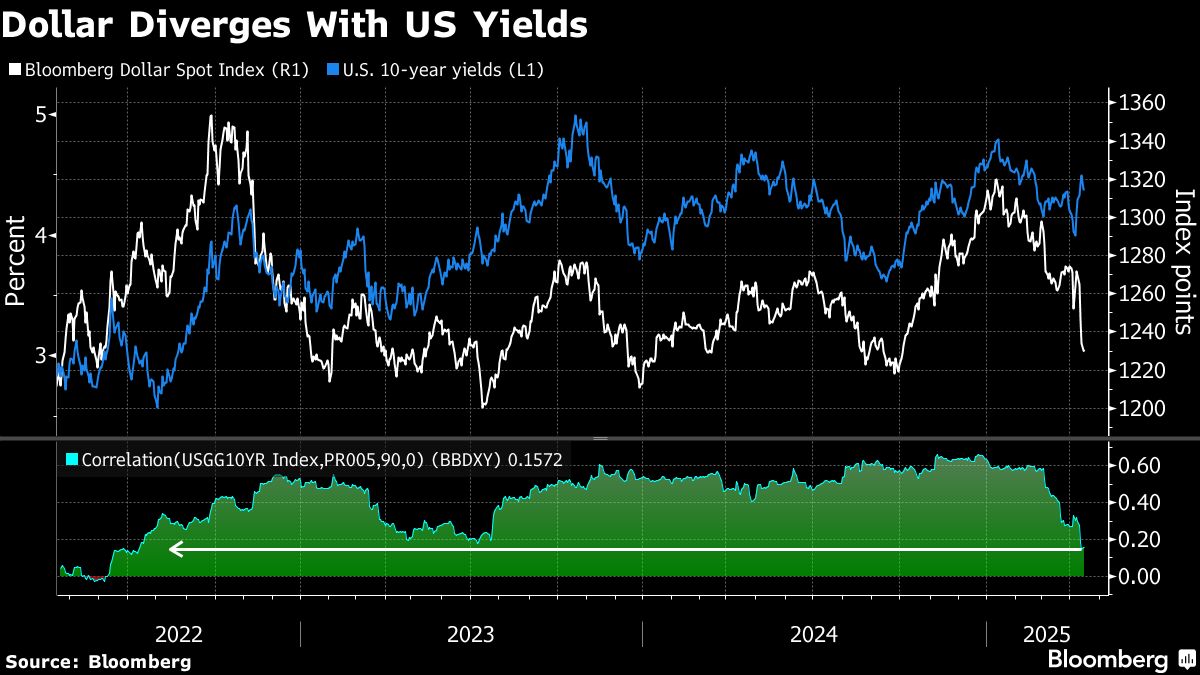

The traditional relationship between the dollar and Treasury yields is the weakest in three years as investors rethink the safety of US assets in times of stress.

The dollar's rapid decline has been caused by investors pulling out of US assets as the Trump administration's trade war risks sending the economy into a recession. Meanwhile, yields on US long-term debt remain near 17-month highs.

Usually, higher bond yields are supportive of the US currency. But in this case, the two have diverged as more investors question the dollar's haven status and central role in the global financial system. Options positioning shows show that traders expect more losses for the dollar.

“The dislocation between the dollar, yields, and traditional risk proxies is striking, and increasingly reminiscent of past stress episodes,” Danske Bank A/S analysts including Jens Naervig Pedersen wrote in a note.

The Bloomberg Dollar Spot Index fell last week by the most since November 2022 and extended declines on Monday. Roughly two-thirds of options traded in the past week targeted a weaker dollar against the euro, yen, and Swiss franc, Depository Trust & Clearing Corp. data show.

Last week was only the third time in more than 50 years that the dollar declined more than 2.5% while the 10-year Treasury yield rose by at least 25 basis points, Pedersen said. The other occasions were in July 1985, during the so-called Plaza Accord aimed at devaluing the dollar, and in May 2009. Both of those episodes “were followed by sustained dollar weakness,” he said.

The options market suggests traders are positioning for such a development. So-called risk reversals, a barometer of investor sentiment that measures the premium on options to sell the greenback over those to buy it, show traders wagering on a weaker dollar over many time spans, from the next week to the next year. It's the first time since early 2020 that all tenors of risk reversals have shown that trend.

“There has been a lot of focus over the past week on the pressure on Treasuries and the shifting correlations to the dollar,” said Alvaro Vivanco, head of strategy at TJM FX. “Selling away from US assets but without consistent panic could be the right framework over the next few weeks to months.”

The dollar-yields correlation is at the lowest since the aftermath of Russia's invasion of Ukraine, when haven flows supported the greenback even as it decoupled from Treasury moves. Today, it's the opposite: the dollar is no longer benefiting from its haven status, and the dislocation reflects an accelerating exodus from U.S. assets.

“The sustainability of the greenback as a reserve currency is slowly put under question,” said Alberto Gallo, chief investment office at Andromeda Capital Management. “There is damage to the US brand and the ability of investors to keep duration in the long end.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.