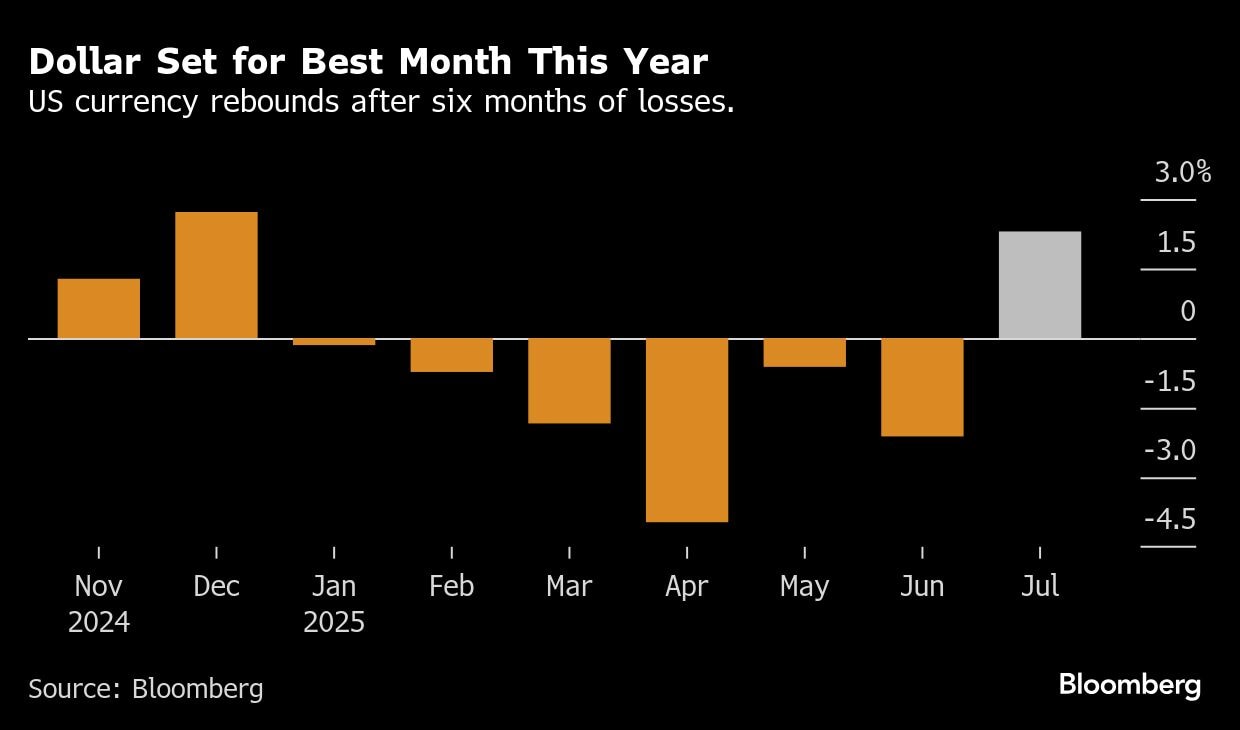

The dollar is wrapping up its best month of 2025 as the world's largest economy powers ahead and President Donald Trump inks trade deals.

The Bloomberg Dollar Spot Index has risen 2.5% in July, the only positive month since President Donald Trump was sworn into office back in January. While Federal Reserve officials have said growth is moderating, data showed this week showed the US economy expanding at a 3% pace in the second quarter, a solid print given the backdrop of changing trade policy.

Fed Chair Jerome Powell also hinted on Wednesday that interest rates may stay elevated for longer, helping push the dollar index higher and trimming overall losses for the year to 7%. The greenback rose on Thursday, extending a five-day winning streak.

“After a period of significant weakness, we have seen the dollar find some bids given resiliency in US economic data, progress on tariff negotiations, and exhaustion in selling,” said Nathan Thooft, a senior portfolio manager at Manulife Investment Management.

The Bloomberg dollar index rose to day's high after data showed that Fed's preferred measure of underlying inflation increased in June at one of the fastest paces this year, underscoring limited progress on taming inflation.

Interest-rate swaps now show just a 40% chance the Fed reduces rates in September, and an 80% chance of a move in October — which was seen as a sure thing before Powell spoke on Wednesday.

The rebound in the dollar marks a reversal, even if it turns out to be brief, in what's been a historically bad year for the currency. The economic turmoil created by Trump's trade war and constant policy U-turns, along with a tax-cut bill that has pledged to expand the US budget deficit, has undermined the greenback's status as the ultimate reserve currency.

The dollar's plunge also reflected a rush among non-US investors to hedge against further declines in the currency. Standard Chartered Plc chief financial officer Diego de Giorgi said in an interview earlier Thursday that a lot of the bank's large corporate clients and wealthy individuals put hedges in place last quarter to protect against further dollar weakness.

The next jobs report on Friday will give investors another reading on how the US economy is faring. Powell also flagged that there are several economic reports, including two months of data on employment and inflation, that might shift their thinking before the September meeting.

The soaring US stock market is also lending support to the greenback. With the S&P 500 on track for a third month of gains, that's pulling in money from investors around the world. As well, blockbuster earnings from big tech companies underscore America's dominance in the race for artificial intelligence.

While some had feared during the selloff that international investors would ditch their US holdings, recent data suggests that hasn't happened. Foreign investor holdings of Treasuries climbed in May, and US dollar's share of allocated foreign-exchange reserves held by global monetary authorities was steady in the first quarter of 2025.

“To keep shorting the dollar against a currency basket, we're going to need something drastic from Trump or a US-centric slowdown,” said Ben Ford, FX strategist at Macro Hive.

Another theme boosting the case for the dollar versus other currencies, like euro or yen, is that Trump extracted a trade deal that is more beneficial for the US than its trading partners. The euro has fallen almost 3% against the dollar this month, with German industry leaders warning tariffs will make Europe less competitive.

The accord “reinforces the old paradigm of US dominance,” said Brent Donnelly, president of Spectra Markets and a veteran FX trader. “However you slice and dice the details, the trade deal appears to be an embarrassment for Europe.”

The yen and the British pound were the worst performers in the Group of 10 against the greenback in July, with both currencies losing 3.5% or more. The Canadian dollar fell the least.

For the months ahead, options shows that traders are expecting modest gains. That's in contrast in May and June, when they were betting on more depreciation.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.