US stock-index futures rallied and the dollar weakened on news that members of President-elect Donald Trump's economic team discussed a gradual approach to ramping up tariffs to avoid an inflation spike.

A dollar gauge fell for the first day in six, with the New Zealand dollar leading gains among the Group-of-10 peers. US contracts rose after the S&P 500 closed slightly higher on Monday, wiping out a slide that approached 1% earlier in the session.

Sydney shares opened higher, but those in Tokyo were slightly down after reopening from Monday's public holiday. Futures in Hong Kong look flat.

“There is a possibility of some USD weakness post the US inauguration if tariffs are indeed implemented at a more gradual pace than the market expects,” said Felix Ryan, a foreign exchange analyst at ANZ Group Holdings Ltd. “But given global growth dynamics and the interest rate outlook for the US and globally, we don't see any probable scenarios where the USD retraces back to pre-election levels.

Bonds saw small moves after a rout that saw traders scaling back bets on rate cuts amid fears of stubborn price pressures. The yield on 10-year Treasuries fell one basis point to 4.76% after having advanced to 4.78% on Monday.

In Asia, China has ramped up its support for the yuan with tweaks to its capital controls and a vow to crack down on market disruption, after the currency dropped close to a record low against the dollar in offshore trading.

Chinese officials are evaluating a potential option that involves Elon Musk acquiring the US operations of TikTok if the company fails to fend off a controversial ban on the short-video app, according to people familiar with the matter.

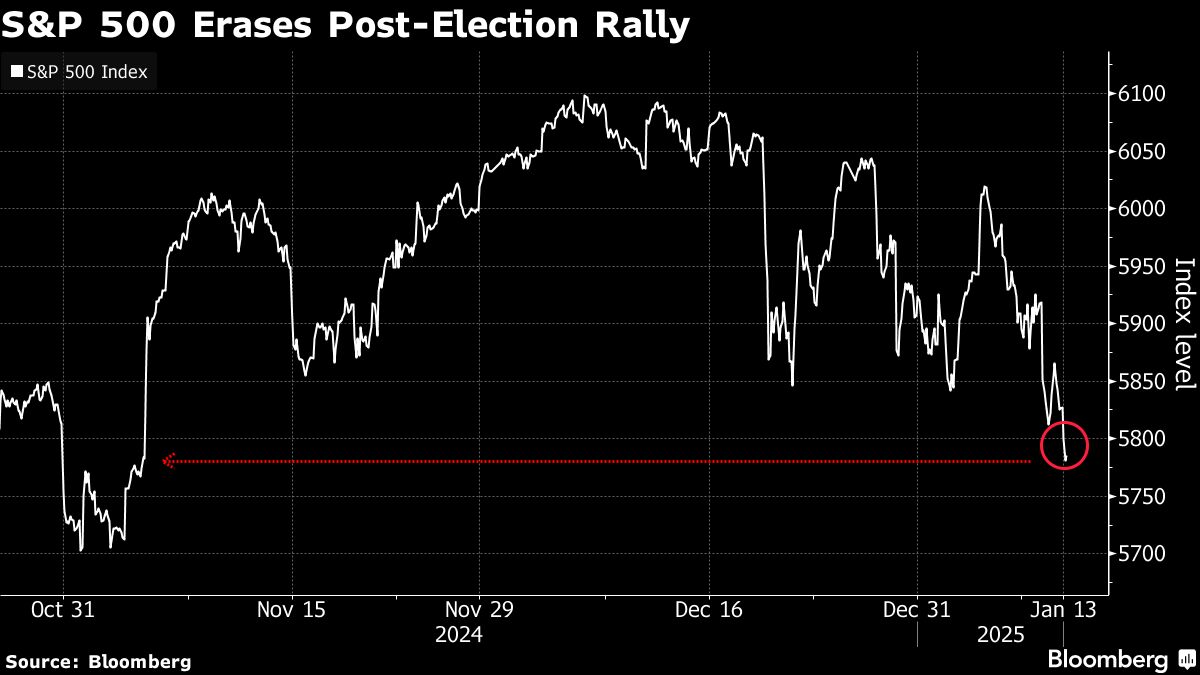

At one stage on Monday, the S&P 500 Index dropped below where it ended on Nov. 5, just before Donald Trump was elected president. Investors have been dumping stocks and interest rates are climbing as fears grow that inflation remains stubborn and the Fed will have to pare back its plans to implement more monetary easing to fight it.

“While even cooler-than-expected inflation data this week won't nudge the Fed into another rate cut this month, it may help ease some of the bearish momentum, as could a solid start to earnings season,” according to Chris Larkin at E*Trade from Morgan Stanley.

The S&P 500 rose 0.2%. The Nasdaq 100 fell 0.3%. The Dow Jones Industrial Average climbed 0.9%. A Bloomberg gauge of the “Magnificent Seven” megacaps slid 0.4%.

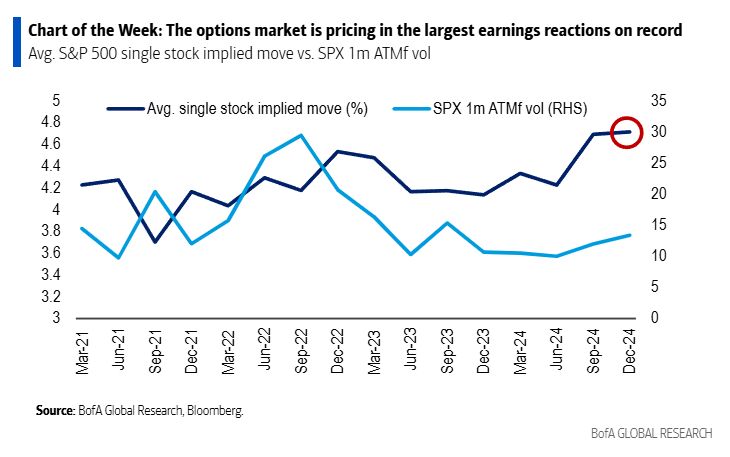

Meanwhile, options traders in the US are bracing for one of the most-volatile earnings periods in history. They expect individual stocks in the S&P 500 to move 4.7% on average in either direction after reporting their results, the largest earnings-day moves on record, according to strategists at Bank of America Corp.

Reports from banks including JPMorgan Chase & Co. and Wells Fargo & Co. are this week expected to show continued gains from trading and investment banking, which helped offset net interest income declines caused by higher deposits and sluggish loan demand.

Lenders will also be quizzed about the 2025 outlook — as the Fed has signaled fewer rate cuts this year, which could stunt future profit growth.

“The big banks often give us a good insight into what we can expect to see from the more consumer oriented companies, which report earnings later on in earnings season,” said Michael Landsberg at Landsberg Bennett Private Wealth Management. “If credit card usage is up, that typically bodes well for companies that sell directly to consumers.”

Underlying US inflation probably cooled only a touch at the close of 2024 against a backdrop of a resilient job market and steadfast economy, supporting the Fed's go-slow approach to further rate cuts.

The consumer price index excluding food and energy is seen rising 0.2% in December after four straight months of 0.3% increases, according to the median projection in a Bloomberg survey of economists. The core CPI, a better snapshot of underlying inflation, is forecast to have risen 3.3% from a year earlier — matching readings from the prior three months.

Wednesday's CPI report will be followed a day later by December retail sales numbers, which are expected to confirm robust spending during the holiday season.

Oil was little changed early Tuesday after rallying to the highest level in five months in the previous session.

Key events this week:

US PPI, Tuesday

Fed's John Williams and Jeffrey Schmid speak, Tuesday

Eurozone industrial production, Wednesday

Citigroup, JPMorgan, Goldman Sachs, Bank of New York Mellon, Wells Fargo and BlackRock earnings, Wednesday

US CPI, Empire manufacturing, Wednesday

Fed's John Williams, Tom Barkin, Austan Goolsbee and Neel Kashkari speak, Wednesday

TSMC earnings, Thursday

ECB releases account of December policy meeting, Thursday

Bank of America, Morgan Stanley earnings, Thursday

US initial jobless claims, retail sales, import prices, Thursday

China GDP, property prices, retail sales, industrial production, Friday

Eurozone CPI, Friday

US housing starts, industrial production, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.2% as of 9:14 a.m. Tokyo time

Hang Seng futures were little changed

Japan's Topix was little changed

Australia's S&P/ASX 200 rose 0.5%

Euro Stoxx 50 futures fell 0.5%

Currencies

The Bloomberg Dollar Spot Index fell 0.3%

The euro was little changed at $1.0252

The Japanese yen was little changed at 157.41 per dollar

The offshore yuan was little changed at 7.3429 per dollar

Cryptocurrencies

Bitcoin rose 0.2% to $94,392.92

Ether rose 0.5% to $3,128.54

Bonds

The yield on 10-year Treasuries declined one basis point to 4.77%

Japan's 10-year yield advanced four basis points to 1.240%

Australia's 10-year yield declined two basis points to 4.62%

Commodities

West Texas Intermediate crude was little changed

Spot gold rose 0.2% to $2,668.78 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.