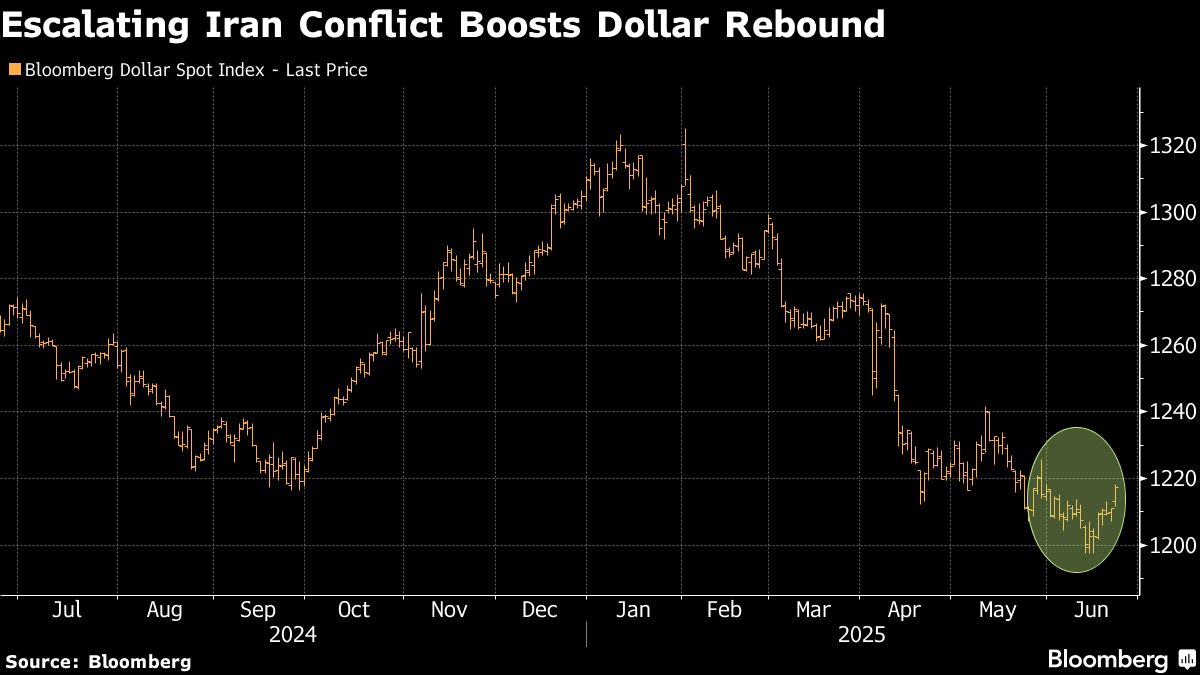

The dollar rose to the highest level in nearly a month as US strikes on Iran spurred demand for the haven currency while underscoring the risks posed by climbing oil prices.

The Bloomberg Dollar Spot index gained as much as 0.6% to hit levels last seen on May 30 as investors worried that higher oil prices could stoke inflation and prevent the Federal Reserve from cutting interest rates. The greenback jumped more than 1% versus the yen, extending gains during London trading on reports that Israel had launched a fresh attack on a key Iranian nuclear site.

“The higher level of geopolitical uncertainty and the risk of triggering another energy price shock is providing more support for the US dollar in the near-term alongside the Fed's reluctance to resume rate cuts,” Lee Hardman, senior FX strategist at MUFG, wrote in a research note.

The rapidly escalating conflict in the Middle East has boosted the dollar and the currency rebounded from a three-year low last week, posting its strongest weekly performance since late February.

Signals in the options market suggest it has more room to gain in the near term, with a rise in one-month risk reversals pointing to the most bullish sentiment for the currency since early April.

Reverting to Type

The dollar “has reverted to type by displaying a safe haven bid,” said Jane Foley, head of FX strategy at Rabobank. “This is in contrast to its behavior through most of the year to date when it has failed to rally on fears of a US tariff led global slowdown.”

Investors are watching for signs that Iran could respond to strikes by Israel and the US by seeking to disrupt shipping in the Strait of Hormuz, a major route for oil and natural gas. While the reaction on global stock markets has been muted, Brent crude hit a five-month high on Monday.

Higher oil prices could stoke inflation and make the Federal Reserve reluctant to cut interest rates in the coming months as it seeks to avoid stagflation — a period of rising prices that coincides with weaker economic growth.

This risk weighed on Treasuries, which slipped on Monday, pushing the 10-year yield as much as 3 basis points higher to 4.40%.

Traders meanwhile dialed back their expectations for US interest rate cuts, pricing the possibility that the Fed will deliver an additional 48 basis points of cuts by the end of the year, down slightly from the roughly 50 basis points expected late last week.

“Prolonged conflict and inflationary pressures could complicate the US Federal Reserve's policy stance even as the dollar initially strengthens after the attack,” said Gregor Hirt, CIO of Multi Asset at AllianzGI.

“Over the medium term, structural concerns – such as the US twin deficits and weakening safe-haven credibility – may weigh on the currency,” Hirt said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.