The dollar strengthened the most in a month as investors reached for safe havens amid a broad pullback in global stock and bond markets.

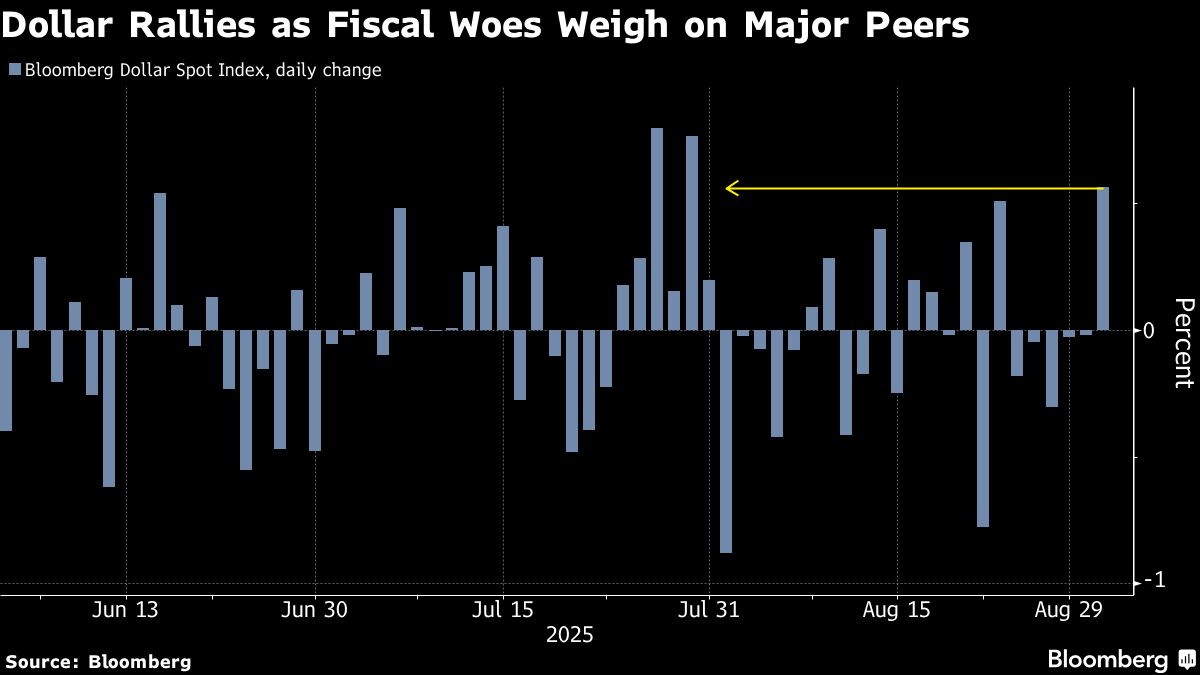

The Bloomberg Dollar Spot Index rose as much as 0.7%, the biggest intraday advance since July 30. The currency was stronger against all its Group-of-10 peers, with the Japanese yen and British pound falling sharply.

Traders sought out the relatively stability of the dollar on a day dominated by headlines about the Britain's precarious budget and the potential for political upheaval in Japan. Despite the prospect of softer employment figures, the dollar could find support in a stalled yuan appreciation, potential BRICS tariffs and its typical seasonal September strength, according to ING Bank's analysts including Chris Turner.

The pound sank 1.2% to $1.3379. The UK's benchmark 10-year yield is the highest among Group-of-Seven nations and rising debt costs threaten to worsen a perilous fiscal backdrop facing Chancellor of the Exchequer Rachel Reeves ahead of her autumn budget.

The yen also underperformed, dropping more than 1% to 148.79 per dollar, the lowest in a month. Pressure mounted after a report that ruling Liberal Democratic Party Secretary-General Moriyama plans to step down. Meanwhile, comments from Bank of Japan Deputy Governor Ryozo Himino offered little in the way of hawkish signals.

Currency hedging costs rose across maturities, with demand for short-dated options standing out as traders positioned ahead of Friday's US payrolls report.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.