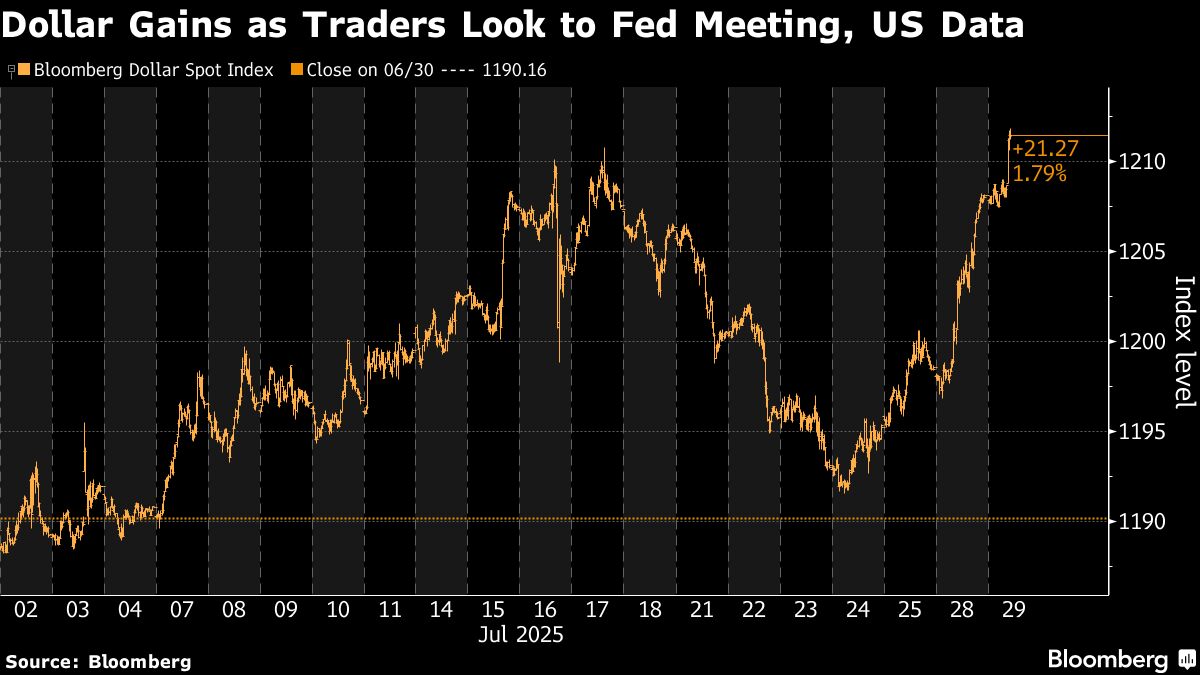

A gauge of the dollar rose to its strongest level in more than five weeks on speculation a slew of US data releases will offer further signs of economic resilience.

The Bloomberg Dollar Spot Index advanced as much as 0.3% to the highest level since June 23 as the greenback rose against all its Group-of-10 peers. The euro extended its slide to the weakest level in more than a month amid concern over the economic impact of the European Union's recent trade deal with the US.

US consumer confidence data is expected to have improved in July and JOLTS job openings statistics are also due Tuesday. On Wednesday, the Federal Reserve is forecast to keep interest rates unchanged, while growth and inflation numbers are seen reinforcing the picture of a buoyant economy.

“For now at least, the focus for FX market participants has shifted away from the trade uncertainty and on to the resilience of the US economy,” said Derek Halpenny, head of research for global markets at MUFG. “That is clearly helping to prompt some short dollar position liquidation built up through the first half of the year.”

The greenback has clawed back some of its losses this month as traders got more clarity around President Donald Trump's tariff policies.

The EU and the US clinched their deal on Sunday, while Commerce Secretary Howard Lutnick said a 90-day extension of a trade truce with China was likely.

What Bloomberg's Strategists Say...

“The narrative over the coming weeks will turn to focus on Europe's sluggish economy, constrained fiscal room in certain key countries, disappointing real yields and now a trade loss to boot. Expect a lot of chatter about US exceptionalism making a comeback.”— Mark Cudmore, macro strategist for MLIV. Click here for the full analysis.

Treasuries moved between gains and losses, marginally outperforming UK and European government bonds. Yields on two-year Treasuries traded 1 basis point lower at 3.92% as traders kept their bets on the chance of a September interest-rate cut from the Fed at 60%.

US rate setters “may not signal a dovish pivot just yet,” said Valentin Marinov, head of G-10 FX strategy at Credit Agricole. “The USD could receive a boost if the outcome of the July policy meeting and data releases keep markets guessing about the timing and aggressiveness of Fed easing.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.