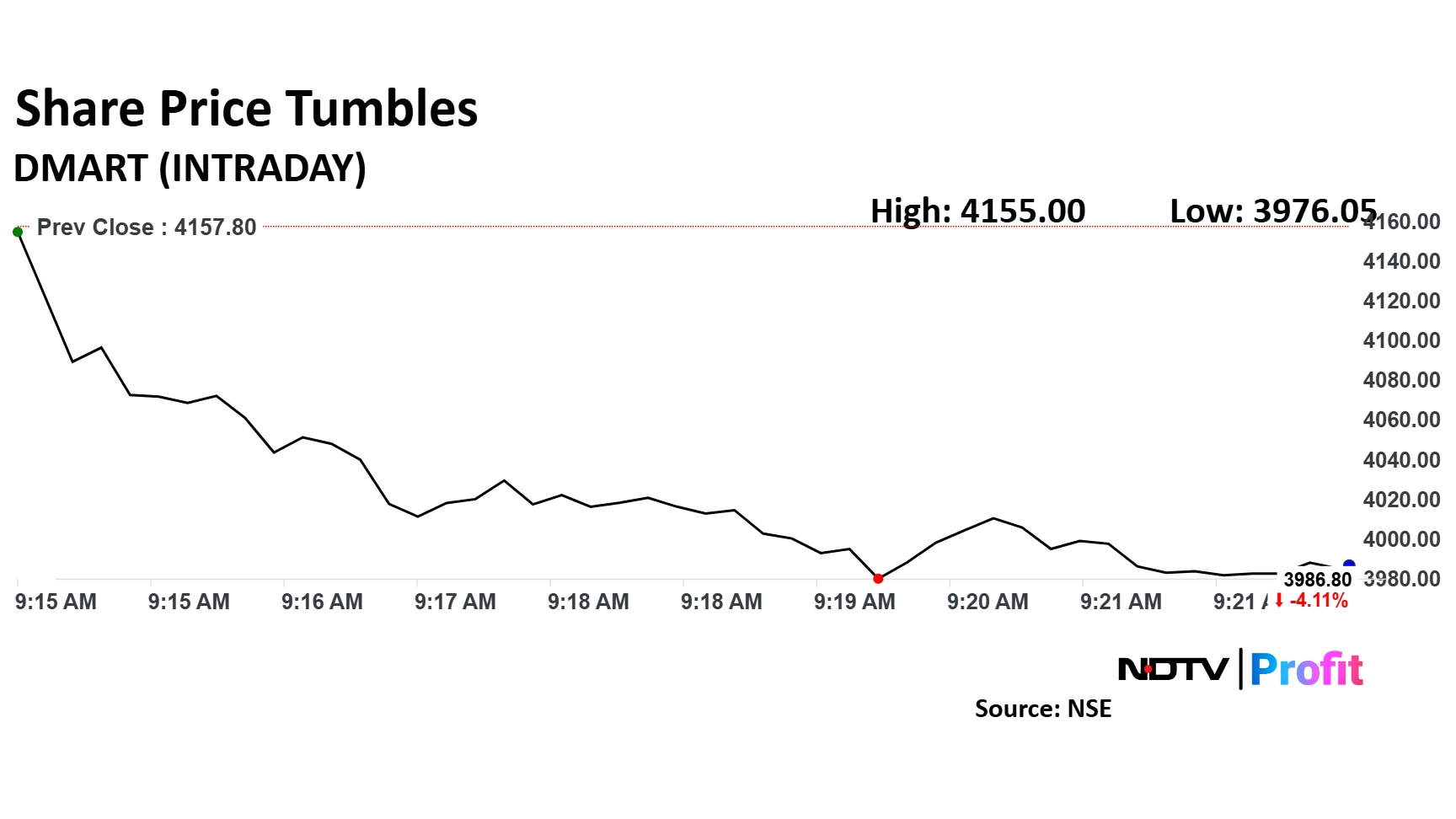

DMart's share price declined nearly 4% on Friday following the company's business update for the fourth quarter of FY25 and a bearish commentary from Citi.

Avenue Supermarts, the parent company of DMart, reported standalone revenue from operations of Rs 14,462 crore for Q4 FY25. The total number of stores as of March 31 stood at 415, reflecting the company's continued expansion efforts.

Citi's analysis of Avenue Supermarts' Q4 FY25 update highlighted a 16.7% year-on-year revenue growth. The average revenue per store grew by 3.1% YoY, while the average revenue per square foot (throughput) increased by 2.8% YoY. Despite these positive figures, Citi expressed concerns about the company's performance.

Citi believes that throughput continues to be impacted by an adverse product mix, a slowdown in discretionary consumption, store additions in smaller towns, and increasing competitive intensity from quick commerce. During the quarter, Avenue Supermarts added 28 new stores, bringing the total for FY25 to 50, compared to 41 in FY24 and 40 in FY23.

Citi remains cautious about Avenue Supermarts due to risks associated with same-store sales growth (SSG), increasing competitive intensity, store additions, and resultant revenue growth. The brokerage also highlighted concerns about earnings, given lower throughput and an adverse product mix impacting gross margins. Avenue Supermarts has reported a year-on-year Ebitda margin decline in 9 out of the last 11 quarters.

Citi has maintained its "Sell" rating on Avenue Supermarts with a target price of Rs 3,350.

The scrip fell as much as 3.94% to Rs 3,994 apiece. It pared losses to trade 3.87% lower at Rs 3,997 apiece, as of 09:20 a.m. This compares to a 0.72% decline in the NSE Nifty 50 Index.

It has fallen 13.95% in the last 12 months. The relative strength index was at 58.

Out of 31 analysts tracking the company, 12 maintain a 'buy' rating, nine recommend a 'hold,' and ten suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 1.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.