DMart Share Price At One-Month High As Q3 Earnings Deliver Surprise Beat

However, Goldman Sachs flagged the margin spike as largely one-off, attributing it to trade discounts from FMCG companies clearing pre-GST channel inventory.

.jpeg?auto=format%2Ccompress&fmt=avif&mode=crop&ar=16%3A9&q=60)

Shares of Avenue Supermarts Ltd. rose to hit a one-month high in early trade on Monday after the company's December quarter earnings report. During this period, DMart's revenue grew over 13.3% to Rs 15,973 crore. The net profit of the company stood at Rs 856 crore compared to Rs 724 crore that it clocked in during the previous year.

The earnings before interest, taxes, depreciation and amortisation saw an 20.2% uptick at Rs 1,463 crore this quarter compared to Rs 1,217 crore in the previous year. The margins saw an expansion to 8.1% this year from 7.6% last year.

The firm's like-for-like sales growth stood at 5.6% compared to the year ago period's 8.3%. This was reported as the slowest in five quarters. The total bill cuts were the highest in five quarters.

However, Goldman Sachs flagged the margin spike as largely one-off, attributing it to trade discounts from FMCG companies clearing pre-GST channel inventory. As a result, it does not see the gross margin expansion as sustainable. Jefferies echoed the view that margins, not growth, drove the earnings beat.

ALSO READ

Avenue Supermarts Q3 Review: DMart Rides Margin Tailwind, But Competitive Pressures Remain High

DMart Share Price Today

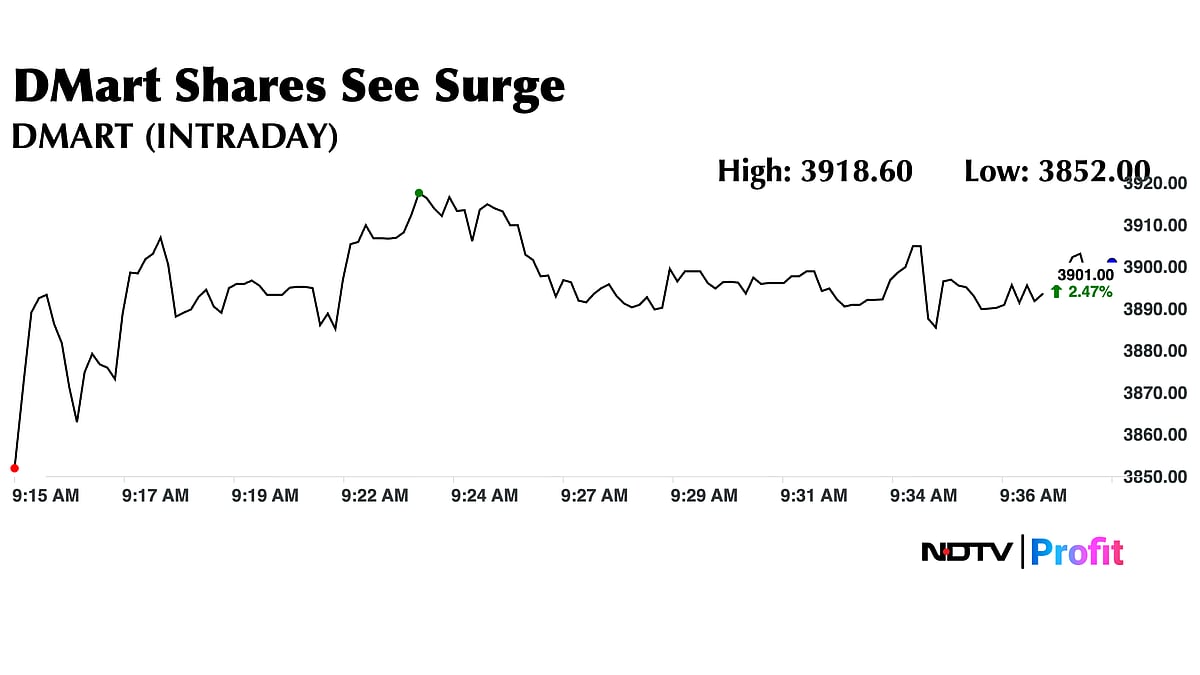

The scrip rose as much as 2.93% to Rs 3,918.60 apiece, paring gains to trade 2.31% higher at Rs 3,895.10 apiece, as of 9:45 a.m. This compares to a 0.49% decline in the NSE Nifty 50 Index.

Share price of the company has risen 5.72% in the last 12 months. Total traded volume so far in the day stood at 1.44 times its 30-day average. The relative strength index was at 48.80.

Out of 29 analysts tracking the company, 10 maintain a 'buy' rating, 11 recommend a 'hold,' and eight suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 6.4%.