DMart Ready, which is operated by Avenue Supermarts Ltd., maintains its value-focused positioning through higher discounts in relative to peers, even on e-commerce, according to Morgan Stanley.

The stock-keeping-unit availability in DMart Ready is leading in comparison to peers and it is improving sequentially, the research firm said in a March 12 note.

For Dmart Ready and Big Basket, the price of private-label brands across food products are cheaper than third-party brands, with discounts ranging between 6% and 54%, Morgan Stanley said. "More importantly, the average discounting among private-label brands for DMart Ready is higher than that for Big Basket."

With a smaller monthly active-user base and implied share, Morgan Stanley observed DMart Ready is seeing the growth rate in app downloads continuing in line with its recent history.

It maintains an 'overweight' rating on Avenue with target price of Rs 4,471 apiece, implying a potential upside of 12%. Avenue remains Morgan Stanley's top pick.

Discounting

On a basket of selected 10 goods across categories, Morgan Stanley observed the highest discounting to the maximum retail price for DMart Ready, followed by Jio Mart, across different periods.

The discounting intensity is higher across players than what it was in March 2022, but has reduced in comparison to January 2024. DMart Ready's discounts have been higher versus peers through March 2022 to March 2024, according to the research firm.

SKU Availability

DMart Ready is leading vs. peers and improving sequentially too. "Of the total 41 products we track across e-commerce and quick commerce players, we observe that the availability of products on that particular day remains the highest for DMart Ready, followed by Amazon and Big Basket," it said.

The SKU availability has improved further for DMart Ready over the past three months vs. a dip for peers.

Delivery

The terms of delivery on DMart Ready are comparable to peers on numerous parameters, Morgan Stanley said.

DMart Ready charges a Rs 49 delivery fee, which is comparable to peers, though it does not deliver below an order value of Rs 500. The time for delivery is much higher vs. quick commerce — 12/24 hours vs. 10–15 minutes to less than an hour — but getting similar to large e-commerce players like Amazon and Flipkart, the research firm said. "Additionally, DMart Ready offers an option to modify the order — add or delete items — before the products are packed."

Upside Boost

Share gains from traditional retailers.

Aggressive store-expansion strategy.

Improvement in product mix and discretionary consumption.

Downside Risks

Store ownership model vs. leasing, which may inhibit rapid store expansion.

Failure to successfully expand DMart Ready in large cities, which could hurt incremental market share gains.

Product mix and discretionary consumption remain weak.

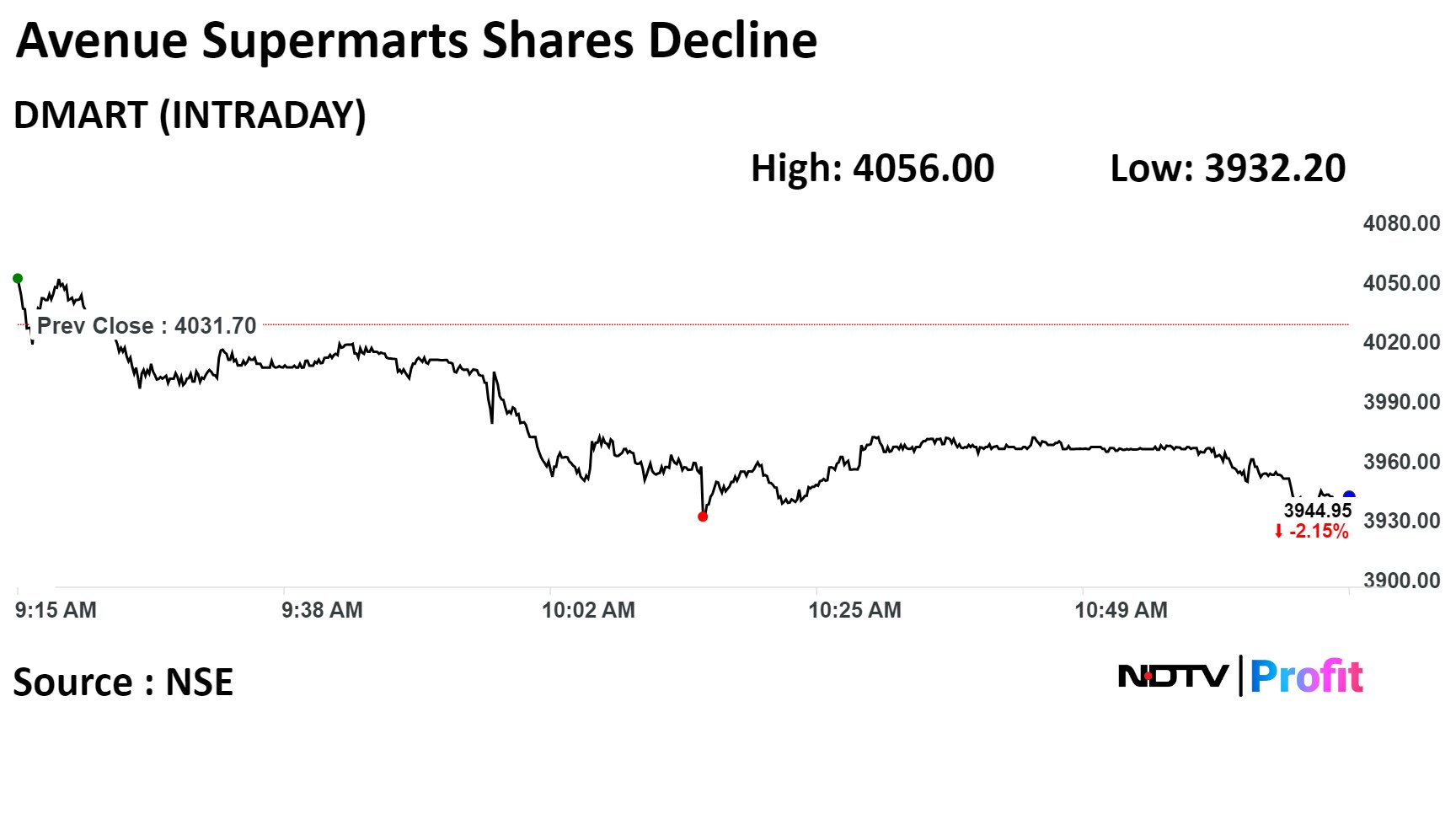

Avenue's stock fell as much as 2.47% during the day to Rs 3,932.20 apiece on the NSE. It was trading at 2.25% lower at Rs 3,941.10 per share, compared to a 0.95% decline in the benchmark Nifty 50 at 11:50 a.m.

Ten out of the 25 analysts tracking the company have a 'buy' rating on the stock, six recommend 'hold' and nine suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 2.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.