Jefferies Financial Group Inc. has downgraded Dixon Technologies (India) Ltd. and Whirlpool of India Ltd., citing softer business-to-consumer demand and stretched risk-reward ratios.

Strong business-to-business December quarter saw softness in discretionary demand impacting the B2C mix of Whirlpool, Havells India Ltd., Crompton Greaves Consumer Electricals Ltd. and Dixon, the brokerage said in a note on Feb. 26. "B2B and projects business continues to be healthy, supported by (a) capex cycle."

On this basis, the brokerage downgraded Dixon and Whirlpool to 'underperform' and has revised the target price to Rs 5,920 and to Rs 1,125 apiece, respectively.

Jefferies' small and mid-caps coverage posted strong profit, driven by capex and housing. Its top picks are Supreme Industries Ltd., Amber Enterprises India Ltd, and Kajaria Ceramics Ltd. as the brokerage is bullish on backward integration in electronics manufacturing services.

The companies under Jefferies coverage with sales growth at over 17% year-on-year, mainly driven by volumes in cables and wires business and building materials business. Capex and housing, and building materials are the key themes playing out well in the current market, it said.

Jefferies On Whirlpool

Rating: Downgrade to 'Underperform'; target price revised to Rs 1,125 apiece.

Subdued performance and has been missing estimates over recent quarters.

The company posted a miss yet again due to softer sales and margin.

Durables is a hyper-competitive market in India, with the presence of strong organised competitors and a minimal informal market.

Price elasticity in durables is higher, especially amid weaker demand. Whirlpool's operating profit margin has declined to mid-single digit.

Jefferies cuts FY25 OPM estimate by 60–70 basis points 6.2%.

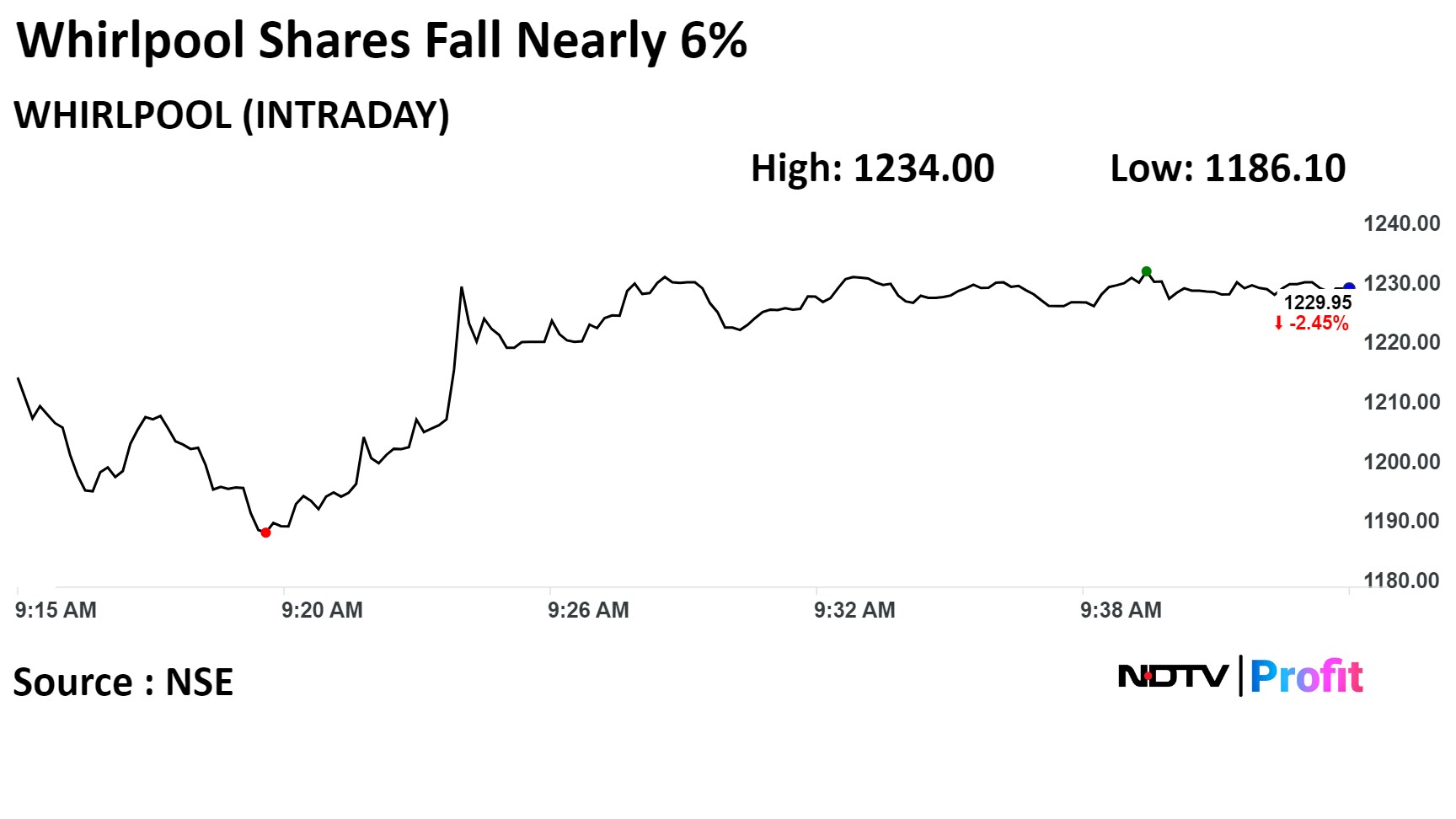

Whirlpool's stock fell as much as 5.92% during the day to Rs 1186.1 apiece on the NSE. It was trading 2.68% lower at Rs 1,227 apiece, compared to a 0.07% advance in the benchmark Nifty 50 at 9:40 a.m.

The share price has fallen 6.36% in the last 12 months. The total traded volume so far in the day stood at 0.3 times its 30-day average.

Five out of the 13 analysts tracking Whirlpool have a 'buy' rating on the stock, three recommend 'hold' and five suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 9.9%.

Jefferies On Dixon Technologies

Rating: Downgrade to 'Underperform'; Target price revised to Rs 5,920 apiece.

Risk-reward appears stretched.

Stock has sharply rallied by over 150% in the last one year and now trades at FY25 PE of 73 times.

The current growth trajectory could be a key monitorable post expiration of PLI tenure.

Softer demand warrants caution, as most of Dixon's end-user categories are B2C and discretionary.

Jefferies cuts FY25 EPS by 2–3%.

Dixon's high valuations could normalise once the high growth phase is behind.

Dixon's stock fell as much as 4.68% during the day to Rs 6,620 apiece on the NSE. It was trading 3.31% higher at Rs 6715.05 per share, compared to a 0.01% advance in the benchmark Nifty 50 at 9:42 a.m.

It has risen 141.6% in the last 12 months. The total traded volume so far in the day stood at 4.1 times its 30-day average.

Eighteen out of the 29 analysts tracking the company have a 'buy' rating on the stock, three recommend 'hold' and eight suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential downside of 4.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.