Shares of Dixon Technologies surged by 3.96% on Wednesday after CLSA initiated coverage on the electronics manufacturing firm with a strong endorsement.

CLSA assigned a “High Conviction Outperform” rating to Dixon, setting a target price of Rs 15,800, citing the company's strategic push into high-value smartphone components as a key growth driver.

The brokerage highlighted Dixon's recent move to acquire a 51% stake in Q Tech India, a firm specialising in camera module production with a monthly capacity of 0.4 million units.

This acquisition marks a step in Dixon's backward integration strategy, allowing it to tap into one of the most value-intensive segments of smartphone manufacturing. CLSA believes this initiative, combined with supportive regulatory policies and expanding domestic demand, positions Dixon to capture a larger share of India's smartphone market and deliver robust earnings growth.

In addition to camera modules, Dixon is also venturing into enclosure manufacturing, further enhancing its value addition capabilities. The company's aggressive expansion into precision components and its alignment with India's electronics manufacturing ambitions have drawn positive attention from investors and analysts alike.

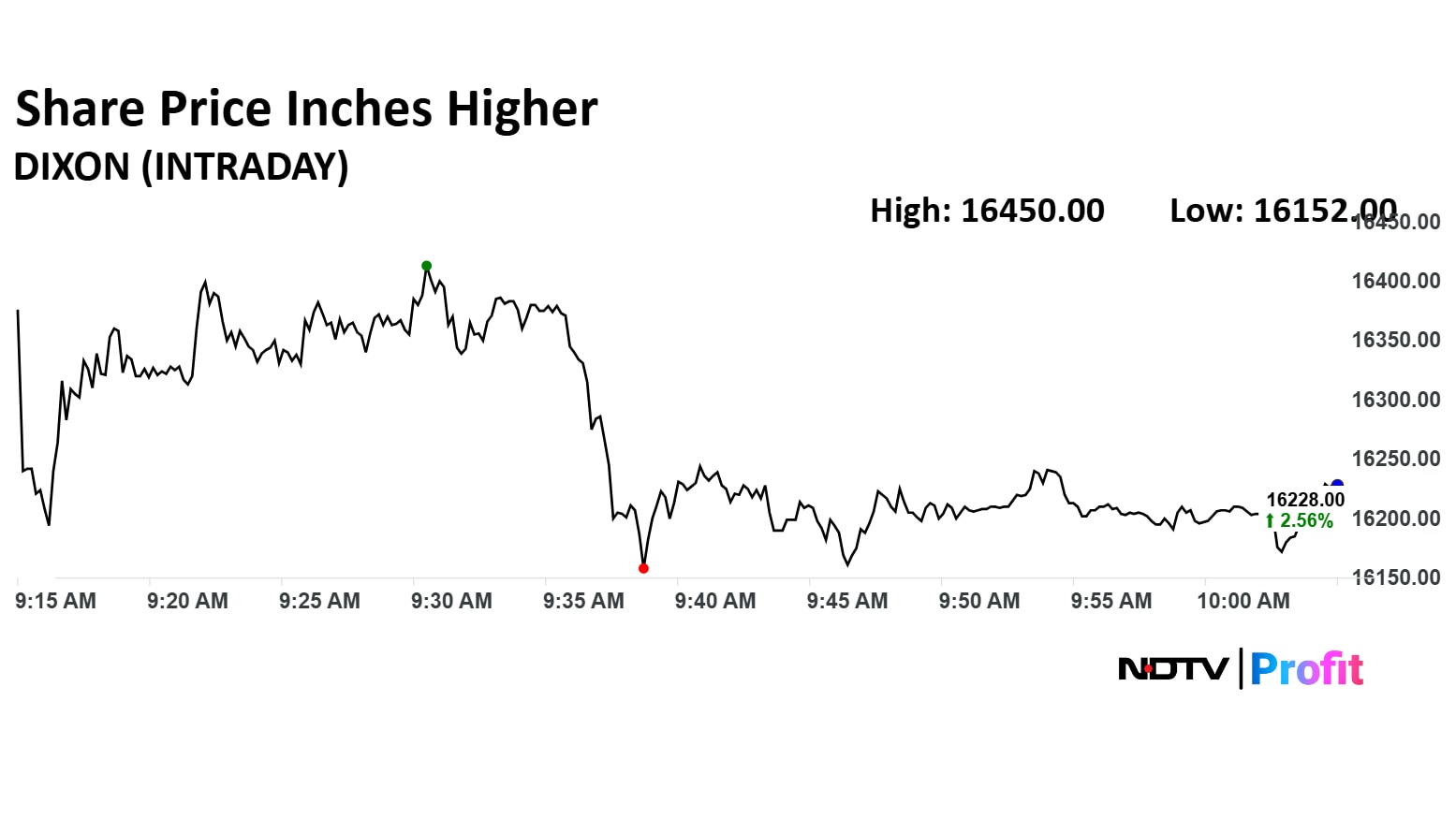

The scrip rose as much as 3.96% to Rs 16,450 apiece. It pared gains to trade 2.41% higher at Rs 16,204 apiece, as of 10:03 a.m. This compares to a 0.19% decline in the NSE Nifty 50 Index.

It has risen 29.10% in the last 12 months. Total traded volume so far in the day stood at 2.8 times its 30-day average. The relative strength index was at 68.

Out of 35 analysts tracking the company, 21 maintain a 'buy' rating, four recommend a 'hold,' and 10 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 2.7%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.