Dixon Technologies Ltd. shares fell nearly 8% on Wednesday on expensive valuations and concerns surrounding impact of PLI expiry in financial year 2027.

Dixon Technologies currently trades at 97 times price to earnings for financial year 2026, said Jefferies. The stock had rallied over 80% in the last one year on the back of new customer adds in the mobile and EMS segments, but it fell 7% year-to-date. The brokerage is of the opinion that it is trading at "a notable premium" in comparison to its trading history.

Another potential cause for concern is the expiry of PLI in financial year 2027. According to the brokerage, in view of the Mobile PLI expiry, rising competition concerns and Dixon's already high base, incremental domestic growth will be a key monitorable. However, it added that it is likely that Dixon would already be catering to a high share of domestic outsourcing by fiscal 2027.

Additionally, margin contribution by PLI is 0.6% of the company's revenue.

Dixon Technologies Q4 Performance

Dixon Technologies' consolidated net profit jumped over fourfold in the fourth quarter of financial year 2025 to Rs 401 crore on account of an exceptional gain, beating analysts' estimates.

In comparison, profit in the year-ago period was Rs 95 crore, according to an exchange filing on Tuesday. Analysts tracked by Bloomberg had a consensus estimate of Rs 217 crore. The exceptional gain for the quarter is Rs 250 crore.

Revenue for the quarter also doubled to Rs 10,293 crore in comparison to Rs 4,658 crore reported in the same quarter of the previous fiscal. The margin for the quarter ended March expanded 40 basis points to 4.3%.

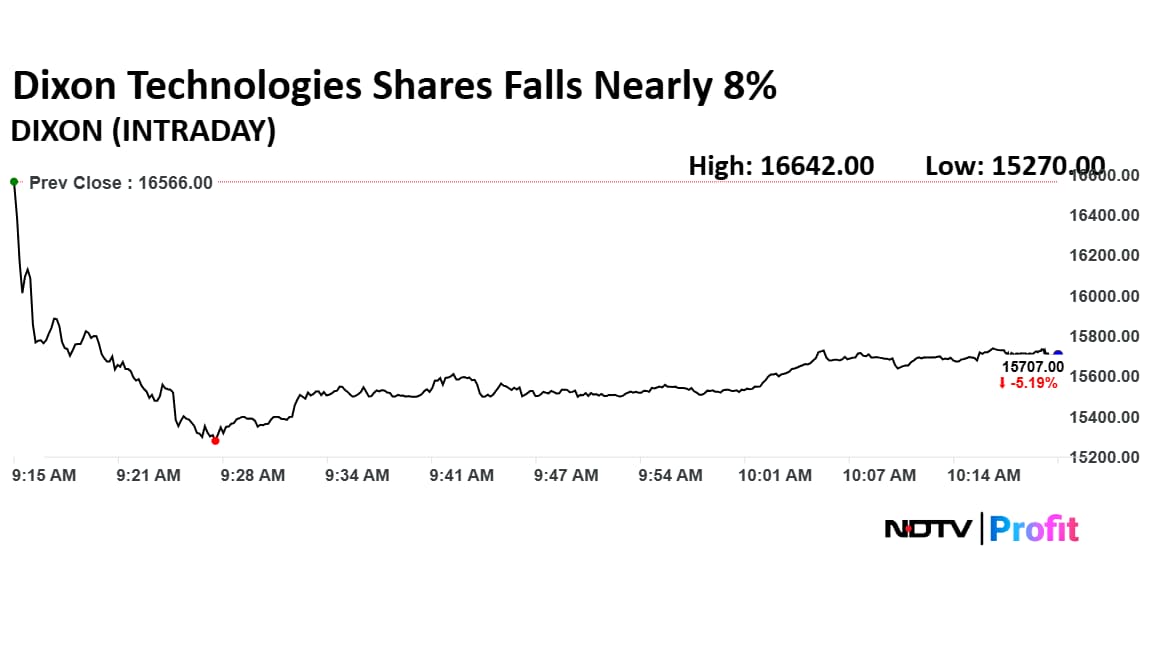

Dixon Technologies Share Price Fall

Shares of Dixon Technologies fell as much as 7.82% to Rs 15,270 apiece, the lowest level since May 9. It pared losses to trade 5.03% lower at Rs 15,732 apiece, as of 10:17 a.m. This compares to a 0.89% advance in the NSE Nifty 50.

It has risen 72.76% in the last 12 months and fallen 12.40% year-to-date. Total traded volume so far in the day stood at 6.4 times its 30-day average. Relative strength index was at 56.55.

Out of 33 analysts tracking the company, 21 maintain a 'buy' rating, four recommend a 'hold' and eight suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 4.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.