(6).jpeg?downsize=773:435)

The share price for Delhivery Ltd. fell more than 3% after Jefferies downgraded the stock to 'underperform'.

The stock rallied 41% post the Ecom Express deal in April 2025, reflecting optimism on industry consolidation. But Meesho's insourcing could pressure its third party logistics express parcel or EP business, the brokerage said. "We prefer TCI Express in the space on valuations."

Jefferies estimates a 10% compound annual growth rate for Meesho's EP industry volumes over FY25-30, against 30% CAGR that happened over FY20-25E. Meesho, a top-3 marketplace player (est. 45-50% of 3PL volumes), launched its logistics vertical, Valmo, to insource logistics. Jefferies expects "10% annual decline in 3PL volumes over FY25E-27E, leading to only 1% FY25E-30E CAGR vs. 26% FY20-25E CAGR".

Therefore, the brokerage does not consider Delhivery to be "out of the woods" yet, as the key customer revenue share for fiscal 2025 from Meesho remained flat. This implies 10% yearly growth (vs. EP segment +5% YoY), suggesting insourcing impact is yet to play out, it said.

On the other hand, Jefferies remains bullish on TCI Express and Allcargo Logistics.

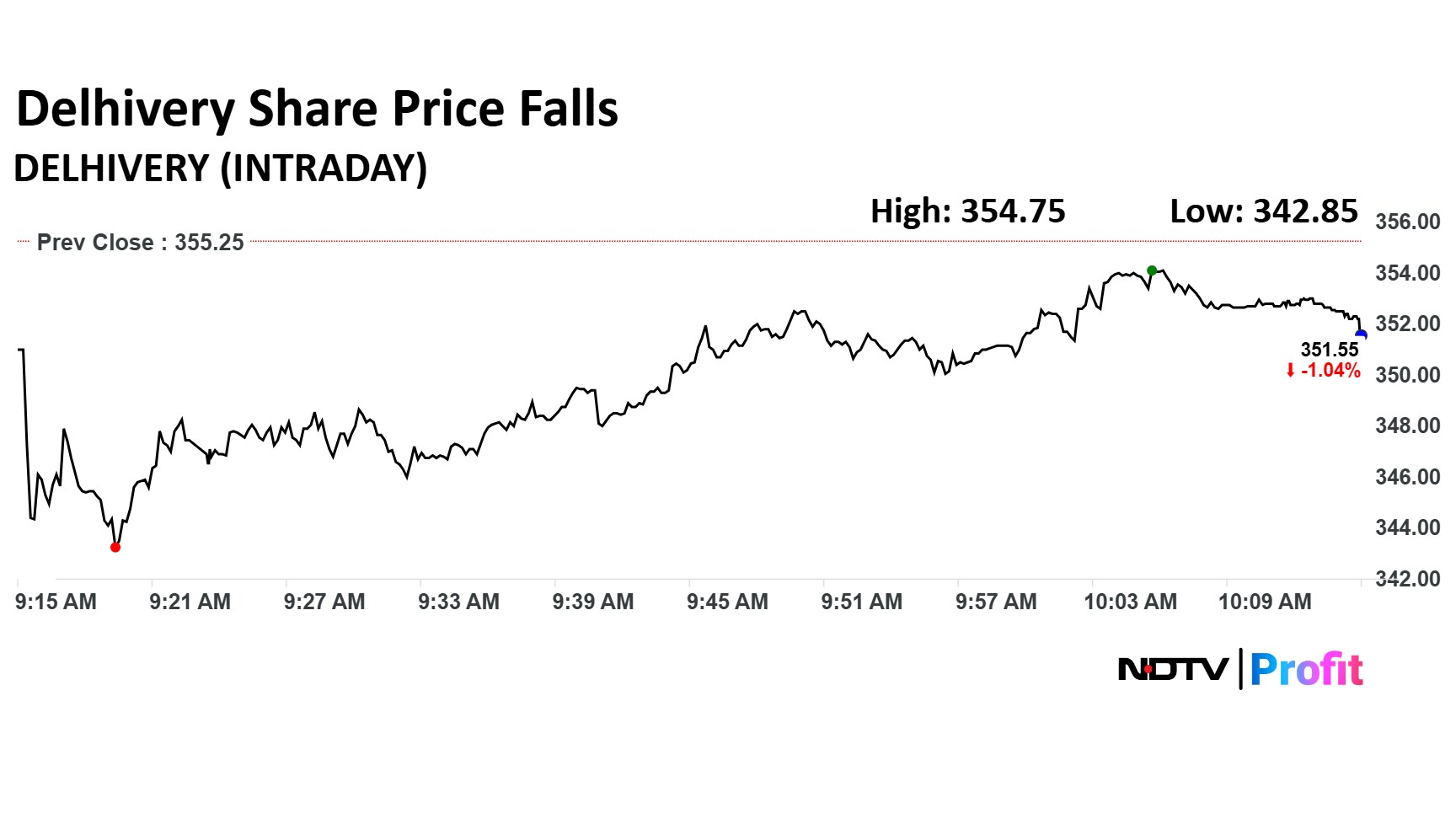

Delhivery Share Price Today

The scrip fell as much as 3.49% to Rs 342.85 apiece, the lowest level since May 21, 2025. It pared losses to trade 0.72% lower at Rs 352.70 apiece, as of 10:10 a.m. This compares to a 0.38% advance in the NSE Nifty 50.

The stock has risen 1.92% on a year-to-date basis, and is down 11.90% in the last 12 months. The relative strength index was at 55.04.

Out of 24 analysts tracking the company, 18 maintain a 'buy' rating, four recommend a 'hold' and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 12.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.