Nifty Defence Index advanced for the second day after multinational investment firm Goldman Sachs initiated coverage on eight Indian defence stocks, placing bullish share price targets on seven of them.

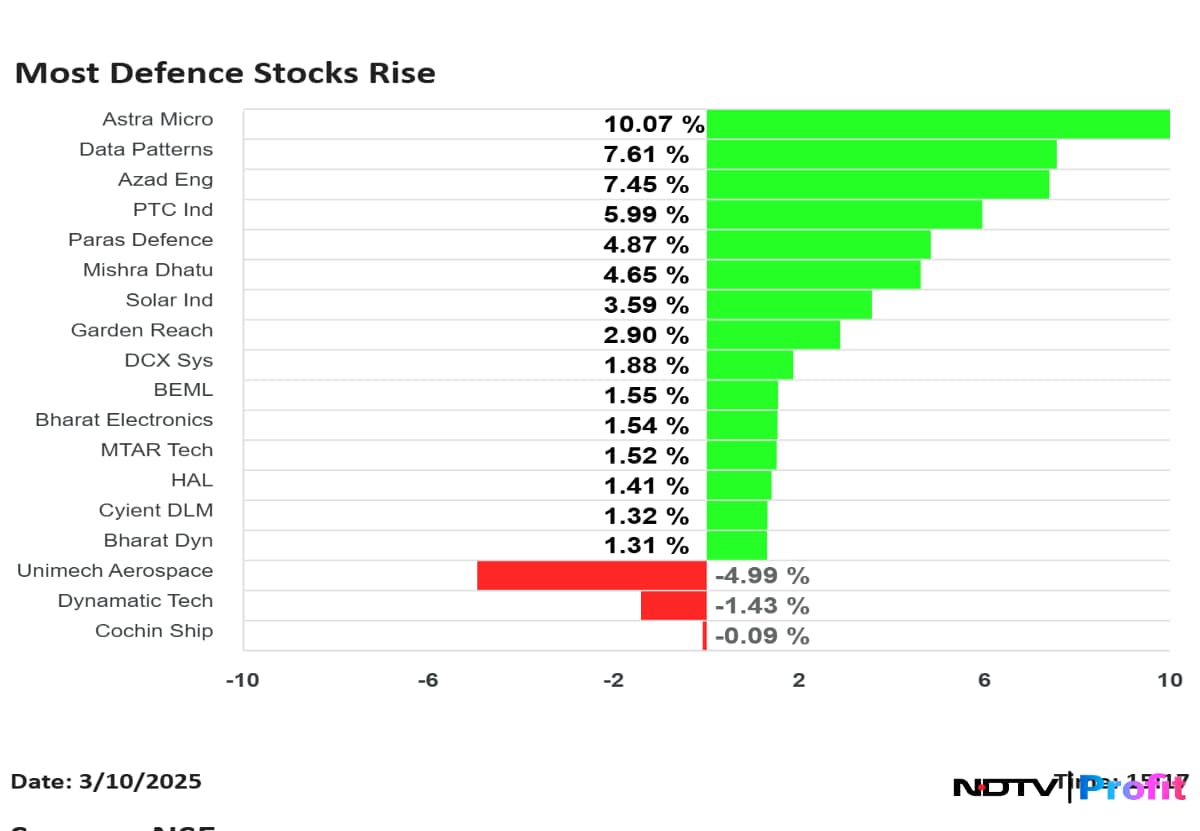

The surge in the defence stock was led by Astra Microwave Ltd., Azad Engineering Ltd. and Data Patterns Ltd. that rose 13.25%, 11.45% and 9.24%, respectively. Solar Industries Ltd., PTC Industries, Bharat Electronics, Hindustan Aeronautics and Bharat Dynamics were among the other picks by Goldman Sachs that were in the green on Friday.

While PTC Industries was up over 9%, Solar Industries rose nearly 5%. BEL, HAL and Bharat Dynamics gained nearly 2% on Friday.

According to Goldman Sachs, out of the eight, PTC Industries Ltd. and Astra Microwave Products Ltd. are seen to have the most upside potential. PTC's return on equity is likely to improve to more than 30% by financial year 2028. Astra Microwave's RoE is likely to be aided by improving profit margins even as capex intensity may decline.

Bharat Dynamics is the only outlier in the new coverage list, getting a 'sell' rating. Analysts have cited steep valuations for this call with the share price target implying a downside potential of 11% over previous close.

Defence PSU Hindustan Aeronautics Ltd.'s upside potential is seen to be in single digit as execution challenges offset attractive valuation.

Solar Industries' ROE could be better than comparable companies, according to Goldman Sachs.

Data Patterns' net profit margin is likely to remain better compared to peers, analyst said. On the other hand, capex intensity may taper off.

Azad Engineering's huge market share potential and robust order book will drive sustained high growth, analysts said.

For Bharat Electronics, Goldman Sachs see the defence PSU as well positioned to be a leading supplier of defense systems. Moreover, diversification offers downside support.

In the report, analysts Amit Dixit and Kumari Rishika, have said that their picks are beneficiaries of three key themes: increase in the estimated domestic defence market share potential by more than sixfold to Rs 10 lakh crore over the next 20 years, scope for indigenisation at the bottom of the technology pyramid like in components and processed materials where local players have been under-represented, and higher defence exports.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.