Shares of Dabur India Ltd. slipped in Thursday's trade as brokerages held out a bleak outlook citing limited growth triggers, after the company's bottom line fell in the final quarter of fiscal 2025, as well as for the financial year.

Dabur reported a decline of 8.4% in net profit for the quarter to Rs 320.13 crore, while the bottom line for the full year also declined 4% to Rs 1,767.63 crore.

This propelled Citi and Macquarie's bearish takes on the FMCG major, with the former reiterating its 'sell' call with a target price of Rs 470. Macquarie maintained a 'neutral' call with target price to Rs 480.

Dabur's revenue during the quarter under review rose marginally by 0.6% to Rs 2,830.14 crore from Rs 2,814.64 crore. The topline in fiscal 2025 rose 1.3% to Rs 12,563 crore.

Standalone India revenue declined 5% on an annual basis, dragged by weak performance across key segments. Home and personal care, which contributes 48% to the domestic business, declined 3%. Oral care and hair care each fell 5%, with the former likely losing share to Hindustan Unilever Ltd., suggested Macquarie.

Healthcare, comprising 38% of the India business, declined 4%, with flagship products like 'chyawanprash' and honey impacted by a short and delayed winter, as per the Citi note.

Both brokerages expect fiscal 2026 to benefit from a low base, with Dabur management targeting high single-digit sales growth. Citi projected an 8% annual revenue growth, noting that the first quarter of fiscal 2026 had already seen 6% growth, as compared to the downslide in the remaining quarters of fiscal 2025.

Macquarie highlighted optimism from management around gradual demand recovery in both urban and rural markets, aided by premiumisation and strength in international business.

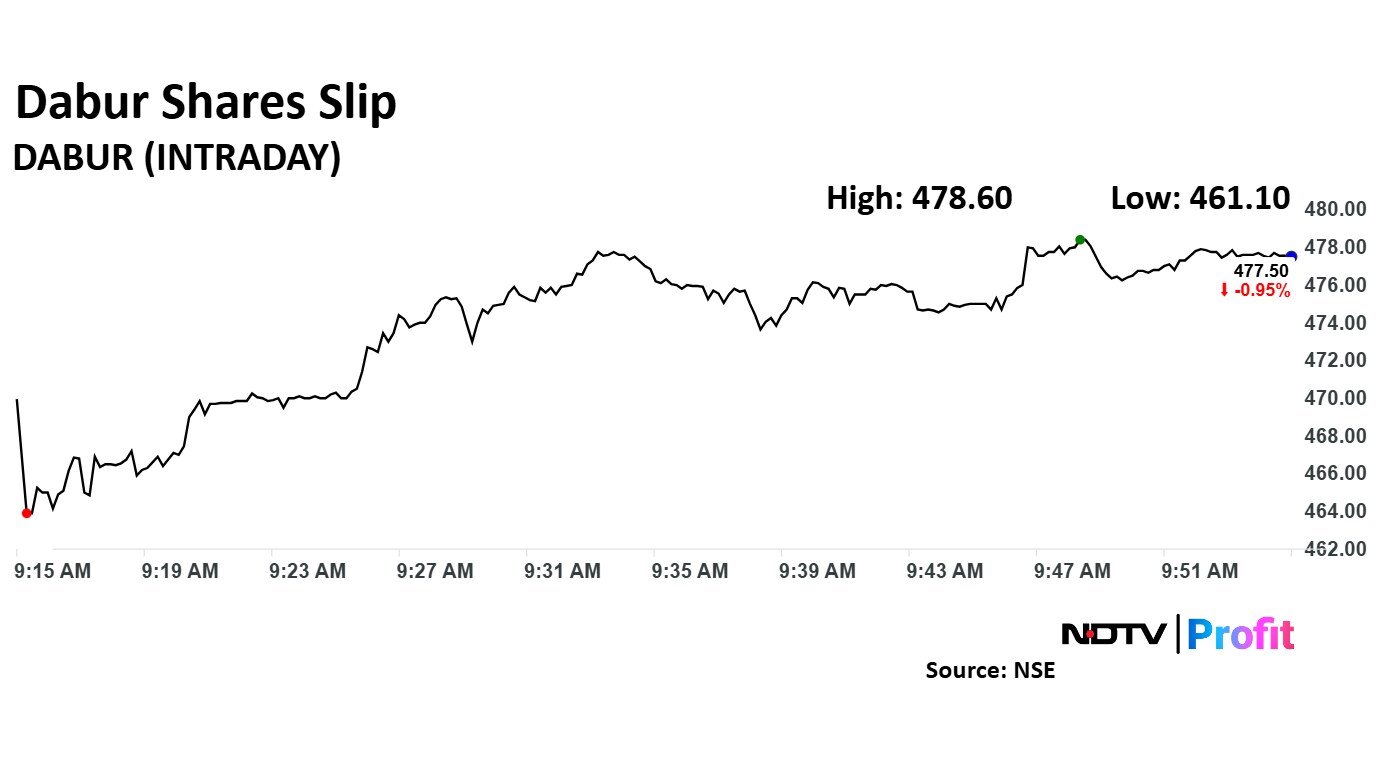

Dabur Share Price Today

Shares of Dabur India fell as much as 4.36% to Rs 461.10 apiece, the lowest level since April 11. They pared losses to trade 1.20% lower at Rs 476.50 apiece, as of 09:49 a.m. This compares to a 0.16% decline in the NSE Nifty 50.

The stock has fallen 6.96% on a year-to-date basis, and 14.22% in the last 12 months. Total traded volume so far in the day stood at 9.6 times its 30-day average. The relative strength index was at 44.58.

Out of 42 analysts tracking the company, 18 maintain a 'buy' rating, 17 recommend a 'hold' and seven suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 11%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.