Cyient Ltd. share price rose nearly 5% in Friday's session despite a sequential decline in its net profit during April–June. Its consolidated net profit fell 10% on the quarter to Rs 154 crore from Rs 171 crore.

Cyient's revenue fell 10.3% sequentially to Rs 1,712 crore from Rs 1,910 crore. Its EBITDA fell 31% on the quarter to Rs 163 crore from Rs 235 crore. Its profit margin fell 280 basis points to 9.5% in the first quarter.

Following the weak performance, Emkay Global Research cut earnings-per-share estimates by 5–9%. The brokerage maintained a 'Reduced' rating on the stock and cut the target price to Rs 1,230 apiece, which implied 0.93% upside from Thursday's close.

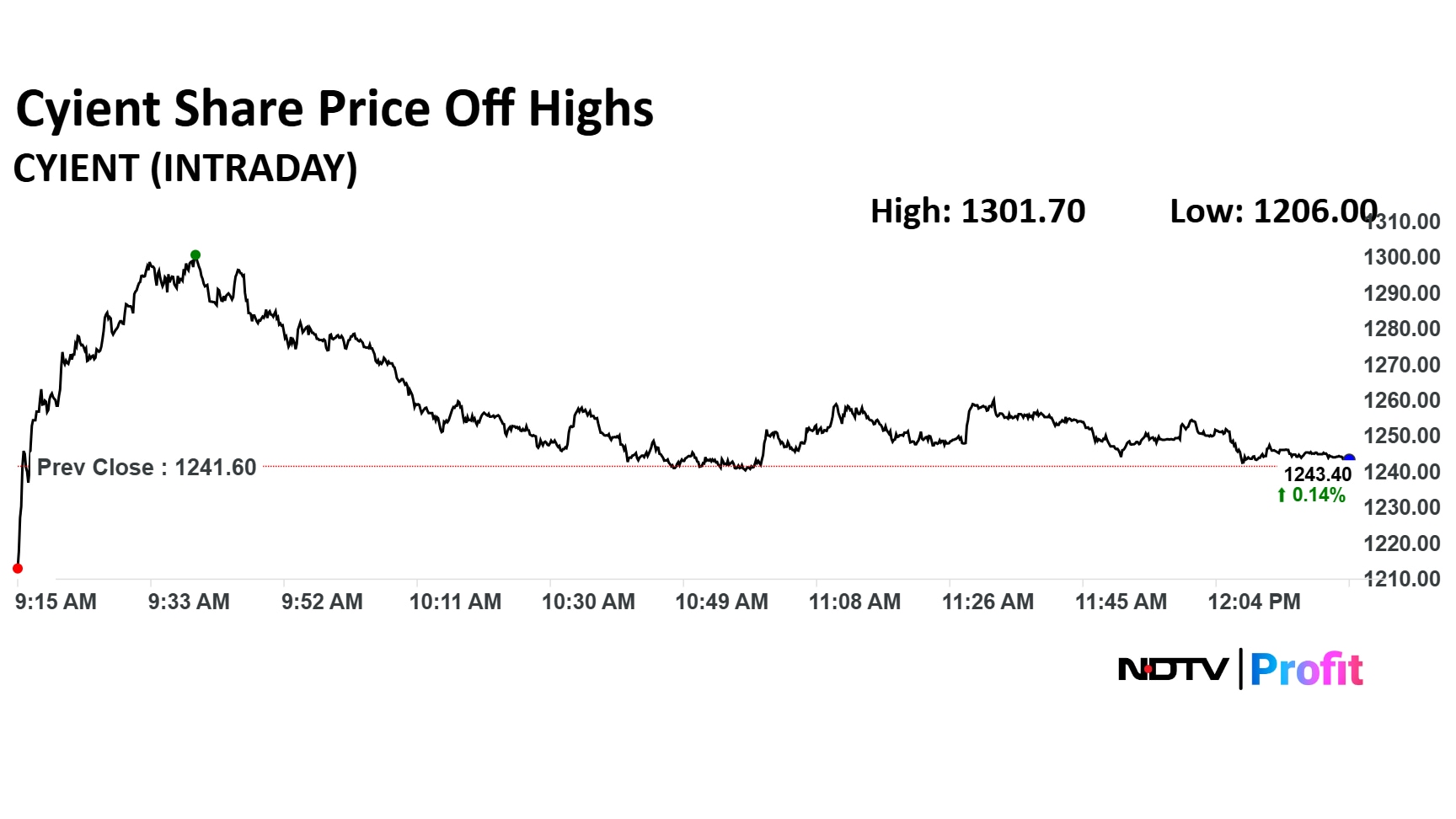

Cyient Share Price Today

Cyient share price rose 4.84% to Rs 1,301.70 apiece, the highest level since July 17. It was trading 0.65% higher at Rs 1,250 apiece as of 12:34 p.m., as compared to 0.92% decline in the NSE Nifty 50 index.

The stock declined 34.15% in 12 months, and 32.08% on year-to-date basis. Total traded volume so far in the day stood at 10 times its 30-day average. The relative strength index was at 37.85.

Out of 24 analysts tracking the company, eight maintain a 'buy' rating, nine recommend a 'hold' and seven suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 6.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.