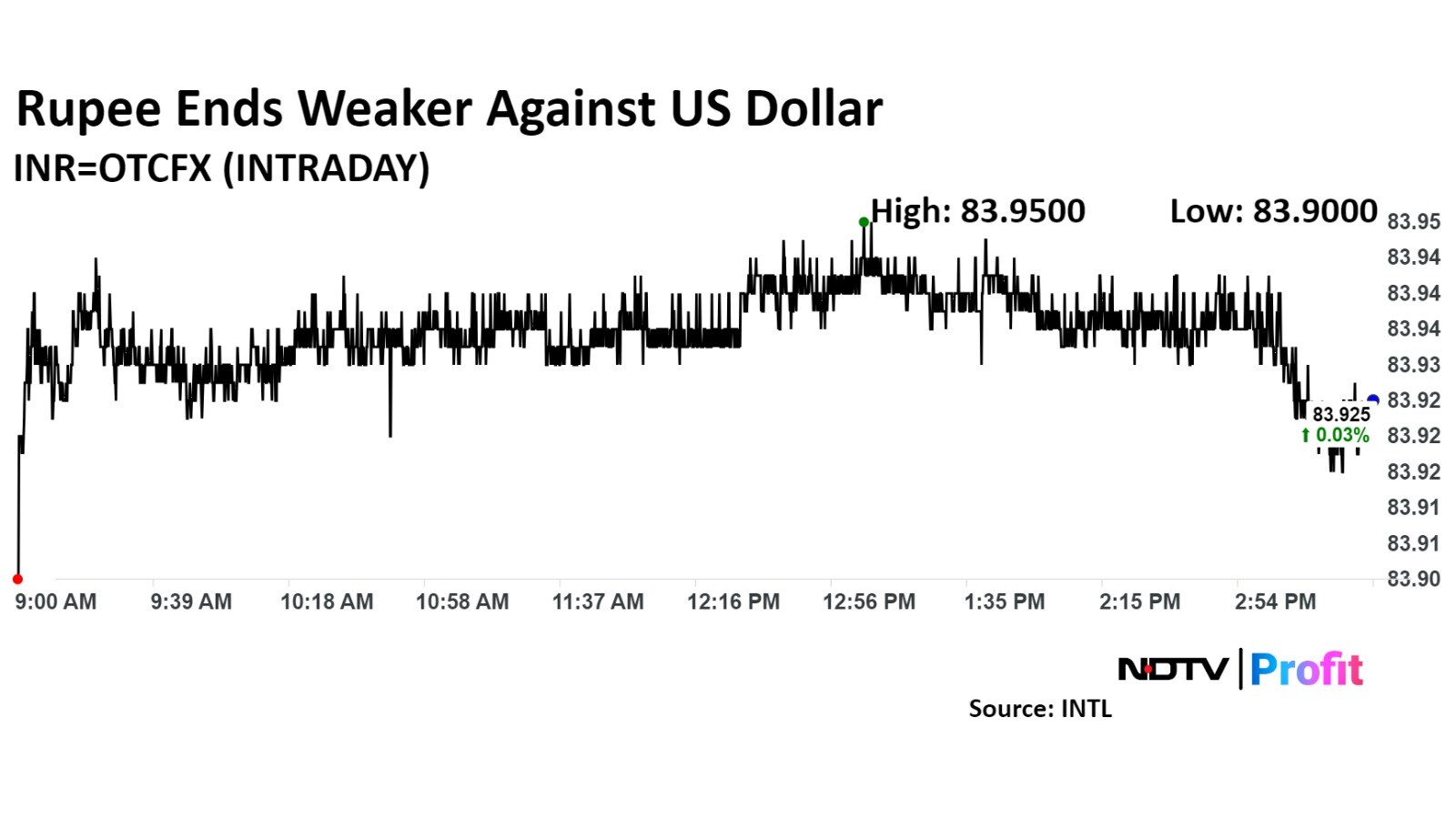

The Indian rupee closed weaker against the US dollar on Tuesday amid falling crude prices and an expected weightage increase in the MSCI Index.

The local currency depreciated by 2 paise to close at 83.92, according to Bloomberg data. It had closed at 83.90 on Friday.

The dollar index, which tracks its performance against a basket of 10 leading global currencies, opened flat and was trading 0.04% lower at 100.82 at 3:40 p.m. IST.

India's weightage in the MSCI Global Standard Index is set to increase, potentially attracting nearly $3 billion into the Indian market by the end of the month, said Amit Pabari, managing director at CR Forex Advisors. "This influx of capital could provide much-needed support for the rupee."

"All eyes are on the upcoming Personal Consumption Expenditures data release this week. A weaker-than-expected result could weigh on the dollar index, potentially offering some relief to the rupee. Conversely, a stronger outcome might give the dollar the boost it needs, adding pressure on the rupee," he said.

International benchmark Brent oil was at $79.74, down 0.76%, at 3:42 p.m. IST. It was initially at $81.22, down 0.26% following Monday's rise as the eastern Libyan government announced that it will halt exports.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.