Bitcoin is struggling to climb out of a $330 billion hole, and the forces that once powered its ascent are in retreat.

After a bruising October, the digital currency has staged only a halting recovery — climbing, dipping and stalling above $100,000. What's missing this time is the powerful tailwind that defined much of 2025: institutional conviction.

Over the past month, many of the biggest buyers — from exchange-traded fund allocators to corporate treasuries — have quietly stepped back, depriving the market of the flow-driven support that helped propel the token to records earlier this year. Their retreat hasn't sparked an industry-wide panic. But it has upended expectations.

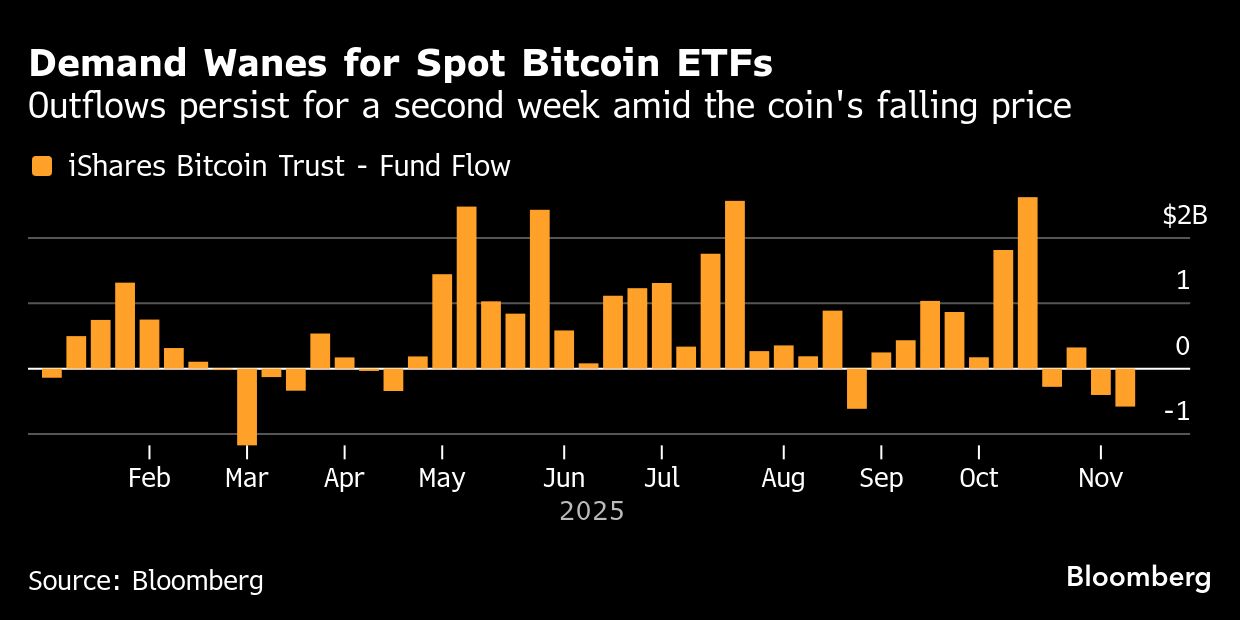

For much of the year, institutions were the backbone of Bitcoin's legitimacy and its price. ETFs as a cohort took in more than $25 billion, according to Bloomberg data, pushing assets as high as roughly $169 billion. Their steady allocation flows helped reframe the asset as a portfolio diversifier — a hedge against inflation, monetary debasement and political disarray. But that narrative — always tenuous — is fraying afresh, leaving the market exposed to something quieter but no less destabilizing: disengagement.

Markus Thielen, chief executive officer at 10X Research and a former portfolio manager at Millennium Management LLC, sees mounting signs of fatigue. Some professional investors, he argues, are losing patience after Bitcoin's underwhelming 10% gain this year, far behind the performance of gold or tech stocks. And if the price starts to trend downwards afresh, per Thielen, risk advisers are likely to urge institutional clients to scale back positions into the end of the year.

“At one point the risk manager may step in and say, ‘you need to eliminate or lighten your position',” he said. “There's a risk that Bitcoin is going to continue to underperfom because people need to rebalance their portfolios. You probably need to buy more Nvidia for when you send out your statement to investors.”

Bitcoin traded up 2% Wednesday in early New York trading at just below $105,000.

In the past month, spot Bitcoin ETFs have offloaded about $2.8 billion, according to Bloomberg data. If price momentum stalls further, he believes billions could be offloaded before December's Federal Reserve meeting, Thielen estimated.

That risk isn't just hypothetical. On-chain signals suggest long-time holders have been liquidating into strength. While much of the speculative leverage was cleared out during the October 10 market wipeout, Thielen warns that if the token slides toward $93,000 – a key technical level — more holders may be forced to exit. “There's this big gap where a lot of people are quickly underwater,” he said. “The weaker balance sheets may have to liquidate their positions.”

Citigroup Inc. sees similar red flags. “My sense is new money is cautious and there is not much urgency or rush to get invested,” said Alex Saunders, head of quant macro at Citi Research. “Maybe people lost excitement.”

He points to a shift in wallet behavior. Citi analysis shows so-called Bitcoin whales — wallets that possess more than 1,000 Bitcoin — are gradually declining. In contrast, the retail cohort, those that hold less than one token, has seen an uptick.

Citi suggests $1 billion in weekly flows typically adds about 4% to price, meaning the current lull is capping gains.

The term “whales” can refer to a wide range of holders — from early adopters who bought Bitcoin when it traded for a few dollars to institutional accounts and exchanges. Wallet movements don't always signal outright selling; large holders often shift tokens between wallets for liquidity or custody purposes.

While momentum has faded, there is little sign of panic. Bitcoin remains up sharply over the past 18 months, and speculative appetite across markets of all stripes remains robust.

Analysts at crypto exchange Bitfinex caution against interpreting recent data as panic selling or a market top. Its research shows wallets holding over 10,000 Bitcoin reduced balances by 1.5% in October — hardly a fire-sale. And they said that the ETF outflows are a “temporary weakness, but not structural risk.”

“The takeaway is that whales are not dumping in fear but gradually taking profits into a softer ETF demand environment — a pattern observed repeatedly in prior cycles,” Bitfinex analysts wrote. “These rebalancing periods typically reset positioning and volatility before the next leg higher, once inflows and liquidity conditions improve.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.