Bitcoin's latest downturn is exposing a fundamental shift as the dramatic price swings that once drew in retail risk-takers have softened, reflecting Wall Street's growing influence on crypto's market plumbing.

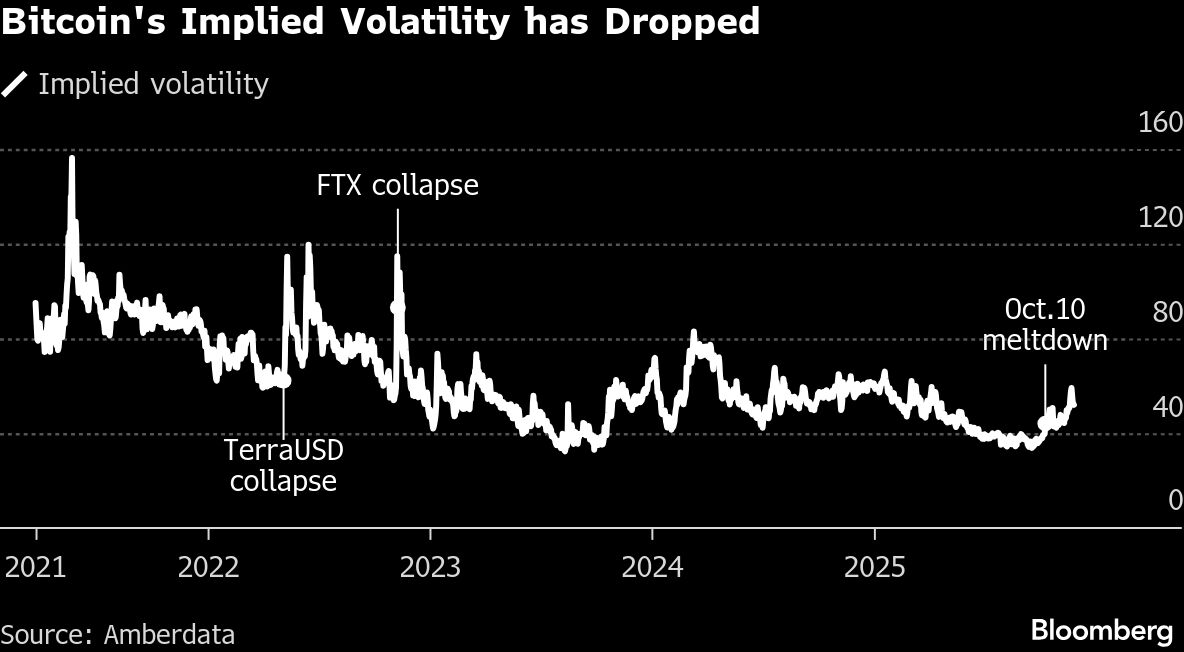

Despite the retreat of as much as 36% since the record high reached in early October, implied volatility has remained contained, a shift that reflects how the institutionalization of the token is reshaping risk transmission. Early in its history, Bitcoin's value was primarily driven by speculation from traders seeking to profit from its frequent large price swings.

The original cryptocurrency is hovering around $87,000 on Wednesday after clawing back from a seven-month low last week. The drop has erased more than $1 trillion in digital-asset market value and unleashed a wave of forced liquidations. Yet implied volatility, normally quick to spike during steep selloffs, has remained subdued.

That's a departure from past drawdowns, when price collapses were typically accompanied by violent surges in volatility. In the last crypto winter, after peaking in 2021, Bitcoin took over a year to bottom, and another 15 months to reclaim its highs.

“As the Bitcoin market matures, both implied volatility and drawdowns should become more subdued. We're already seeing that play out,” said Greg Magadini, director of derivatives at Amberdata.

Magadini cites three structural changes underpinning the shift: a more dispersed investor base, growing use of professional options hedging, and the simple physics of a bigger market. “ETF holders are routinely buying puts and selling covered calls, which naturally reduces tail risks,” he said. “And as market cap grows, it takes increasingly more money to push prices around.”

An increase in implied volatility generally means market participants are less confident about the direction of prices and traders are usually willing to pay more to protect existing positions or to speculate on potential prices moves — up or down. A lower reading suggests that market-watchers anticipate stable prices.

“With DATs and ETFs being long-term and somewhat non-price-sensitive buyers, implied volatility has been cratering all year and even in the first part of the October selloff, as institutional buyers have been busy monetizing income via selling volatility,” Augustine Fan, partner at SignalPlus said. He added that downside protection has become meaningfully cheaper, with “heavy protection strikes being bought around the $80,000 level into year-end.”

The relative calm comes as macro forces remain central to the narrative this cycle. Expectations for a Federal Reserve rate cut have surged — futures now imply an 80% probability of a December move, up from 42% last week — helping steady risk assets broadly.

“For the crypto ecosystem, rising prospects of an imminent Fed rate cut is the “medicine“ needed to repair and heal the damage done during the recent crypto deleveraging episode,” said Tony Sycamore, an analyst at IG Australia.

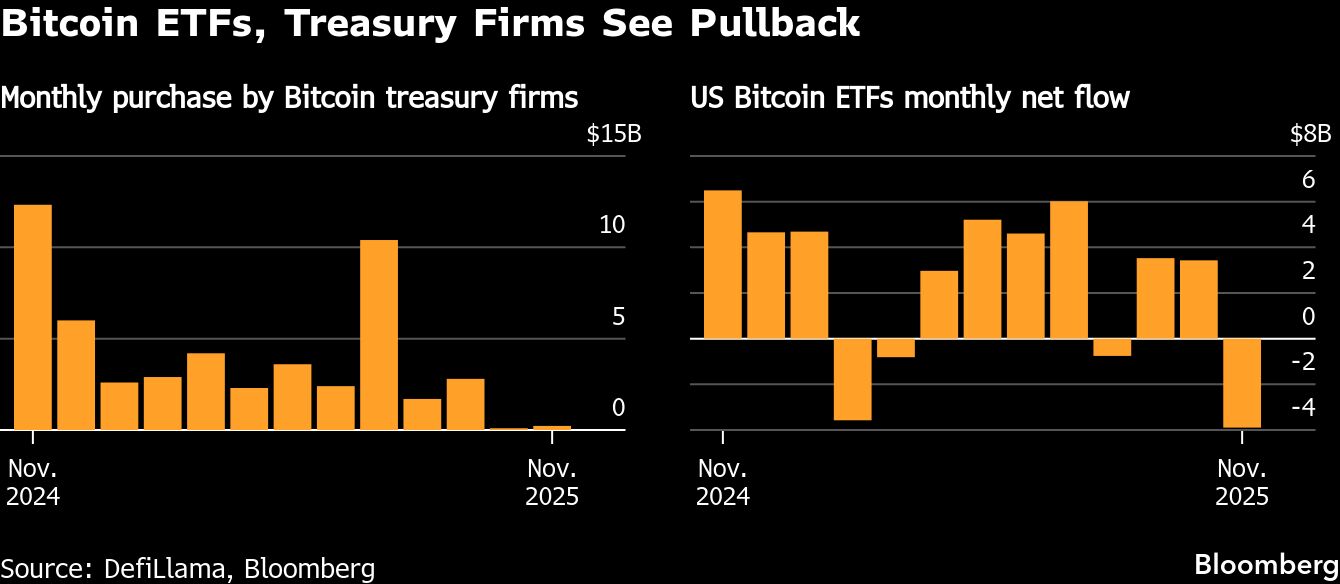

Still, the October selloff was brutal. Bitcoin plunge of as much as 36% is the sharpest drawdown since US spot Bitcoin ETFs debuted in early 2024, and its worst monthly performance since the meltdown of 2022.

ETF flows reflected the strain. Investors pulled nearly $3.6 billion from the 12 US-listed Bitcoin funds in November, the heaviest monthly outflow since the products launched and the first real stress test of the ETF era. Yet rather than amplifying chaos, the funds may be absorbing some of it: they now hold more than $40 billion in open interest, essentially doubling options activity versus a year ago, when trading was concentrated on offshore crypto derivative platforms.

“ETFs have clearly dampened volatility,” said Justin d'Anethan, head of research at Arctic Digital. “The 37% drop from $126,000 felt sharp, but any crypto-native investor has lived through far deeper pullbacks. The ETF share of supply — now more than 5% — makes price action more reflexive but also more orderly.”

Institutional participation is recasting Bitcoin as a high-beta macro asset rather than a retail-driven speculative vehicle. “Prior Bitcoin cycles are irrelevant now,” Fan said. “With ETFs and traditional finance controlling the biggest marginal wallets, Bitcoin increasingly moves with overall macro risk sentiment.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.