- Brent crude traded above $66 a barrel after a 2.8% decline over four days

- West Texas Intermediate oil held near $62 a barrel in early Singapore trading

- Canada urges swift western secondary sanctions on Russian energy exports

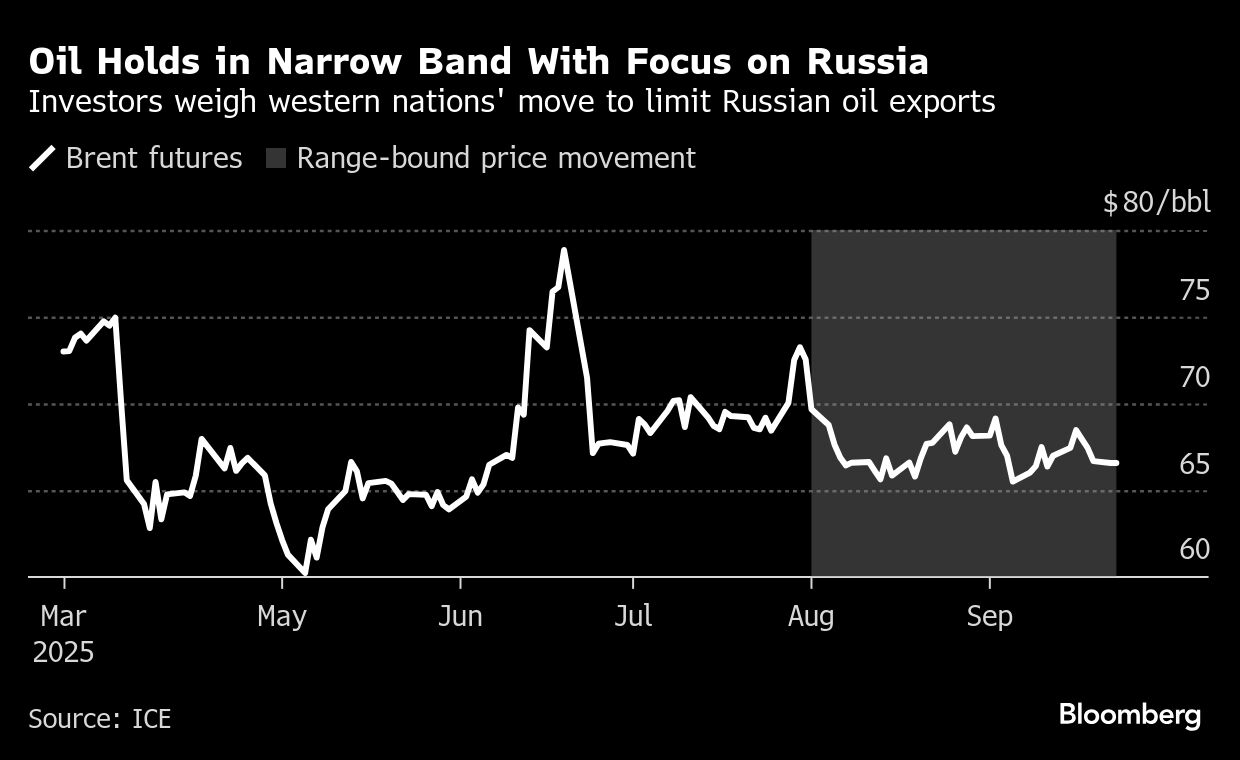

Oil was little changed after a four-day decline as investors assess the potential impact of moves by western nations to curtail Russian energy exports.

Brent traded above $66 a barrel after slipping 2.8% over the previous four sessions, while West Texas Intermediate was near $62. Canadian Prime Minister Mark Carney said he wants to see western allies impose secondary sanctions on Russia quickly in order to dramatically ramp up pressure on President Vladimir Putin.

The latest threat to the OPEC+ member's supply comes after President Donald Trump urged European countries to stop buying Russian energy as he seeks to stem the biggest source of funds for the war in Ukraine. However, the US has so far spared China — the biggest buyer of Moscow's barrels — from additional tariffs after slapping a 50% rate on India for its purchases last month.

The lack of concrete new measures has left oil in limbo — with prices stuck in a narrow $5 a barrel band since early August as traders also assess forecasts for a glut later in the year. A rapid return of shuttered barrels by the Organization of the Petroleum Exporting Countries and its allies and increased production from outside the group have seen market watchers including the International Energy Agency increase their forecasts for the surplus.

Meanwhile, Iraq may shortly resume exports via Kurdistan after they were halted for more than two years over a payment dispute. That could see about 230,000 barrels a day of crude return to international markets, according to people familiar with the matter.

Prices:

Brent for November settlement was little changed at $66.56 a barrel at 8:38 a.m. in Singapore

WTI for November delivery held steady at $62.29 a barrel.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.