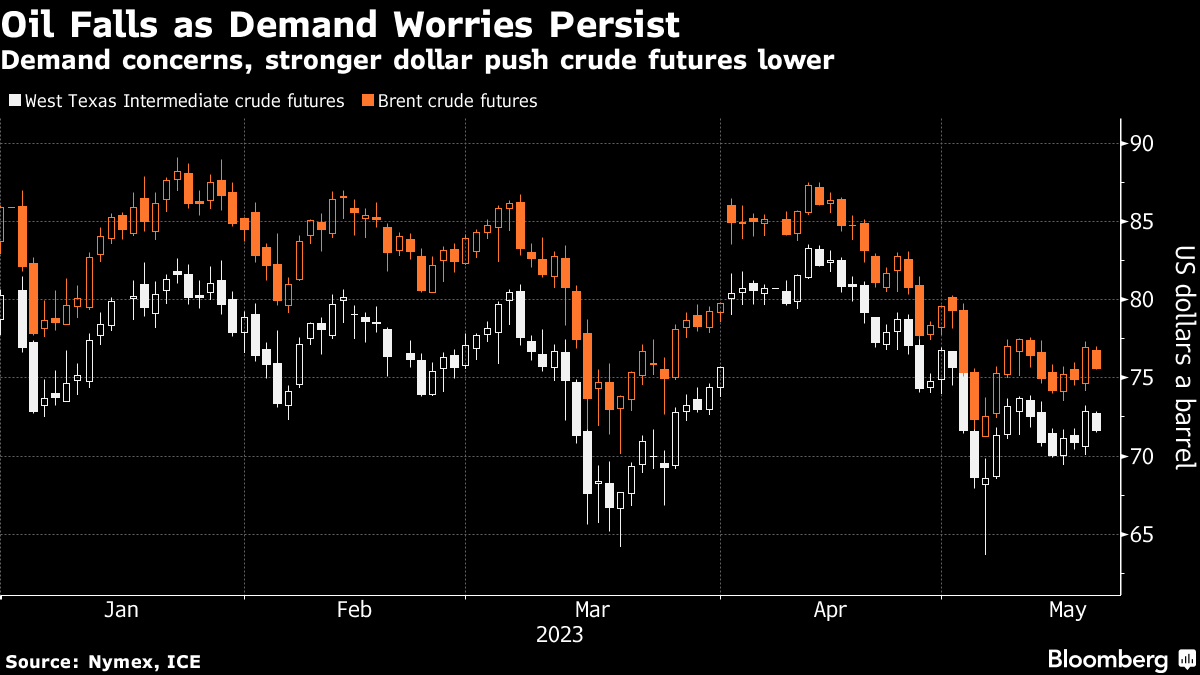

(Bloomberg) -- Oil edged lower as the potential for additional rate hikes from the Federal Reserve underpinned concerns about a recession that would weaken demand.

West Texas Intermediate settled below $72 a barrel after Dallas Fed President Lorie Logan said the case for a pause next month isn't clear, raising expectations of an economic slowdown. Also looming over sentiment are the negotiations to increase the US government's spending limit and avoid a catastrophic default.

“Crude is really struggling to keep up with other risk-on assets,” said Rebecca Babin, a senior energy trader at CIBC Private Wealth, attributing the move to a potential interest-rate hike in June.

Crude prices have fallen about 10% this year as China's slower-than-expected recovery from Covid-19 restrictions disappointed markets. UBS Group AG was the latest to trim its bullish oil price forecast, lowering its year-end outlook for Brent to below $100 a barrel. That still implies a rebound in prices from current levels, with the bank forecasting a 1.5 million barrel-a-day market deficit in June.

The world's demand for oil climbed by 3 million barrels a day to hit a record in March, according to the Riyadh-based International Energy Forum. In Asia, refiners in South Korea and Taiwan recently snapped up millions of barrels of US crude, while India is considering refilling its strategic hoard. Elsewhere, Angola's crude exports are set to rise to 1.2 million barrels a day in July, a jump of almost 20% compared with the June plan.

Read More: The Oil Market's Weakness Is Supply, Not Demand: Javier Blas

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.