- President Trump urged Russia to reach a ceasefire in 10-12 days or face sanctions

- West Texas Intermediate crude traded around $67 a barrel after a 2.4% rise on Monday

- Brent crude closed near $70 a barrel, up 2.3% on Monday

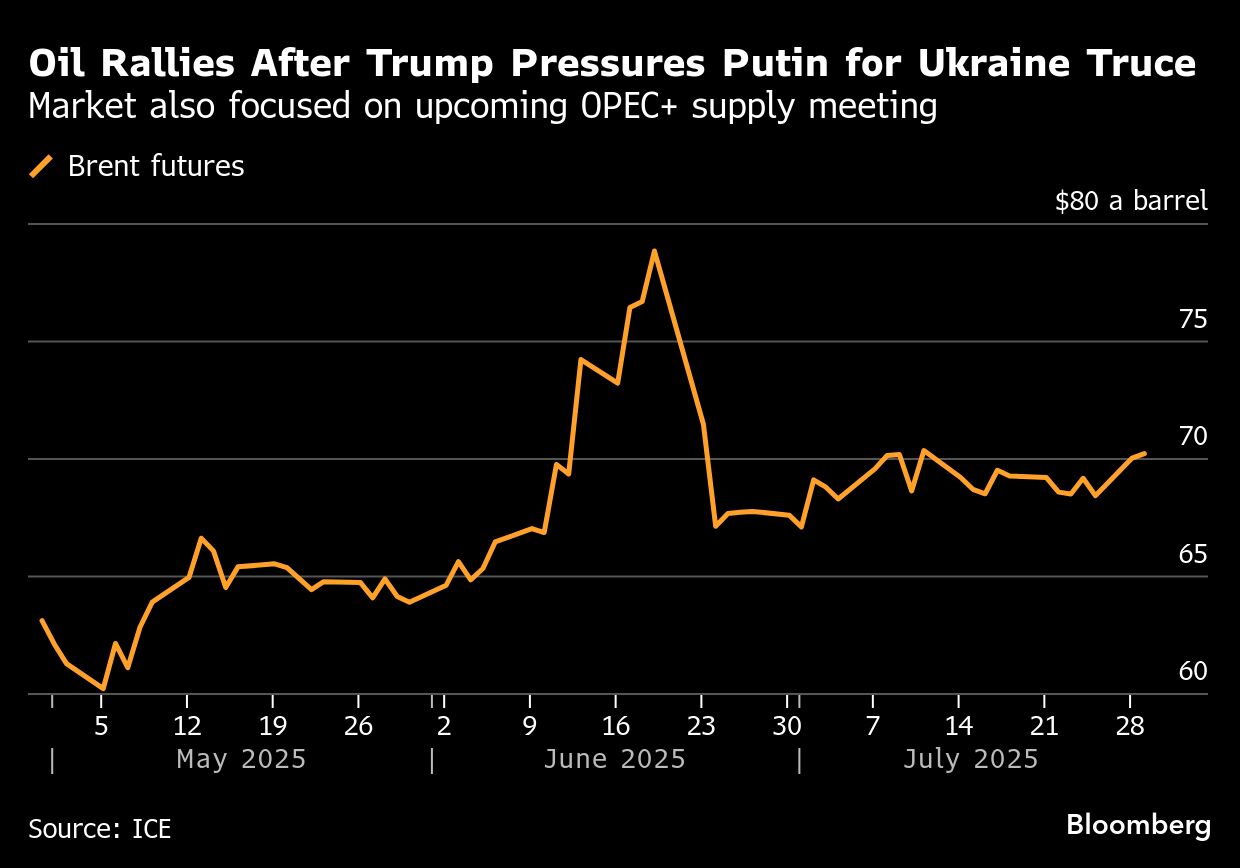

Oil extended gains on concerns crude supplies from Russia could be disrupted by potential US penalties, after President Donald Trump pushed the OPEC+ producer for a swift truce with Ukraine.

Brent traded above $70 a barrel following a 2.3% increase in the previous session, the biggest in two weeks. Trump warned of “secondary sanctions” if Moscow doesn't reach a ceasefire deal within 10-12 days — an ultimatum that was met by silence in the Kremlin.

Wider market gauges also bounced after Trump's comments, with bullish options on the Brent benchmark commanding a premium to bearish ones for the first time in two weeks.

“This reduced timeline is seen as escalatory by the market,” said Keshav Lohiya, founder of consultant Oilytics. “Given Trump's past few actions, he will back down if this leads to a further flat price rally.”

Trump's action follows the latest round of sanctions by the European Union on Russia, which included penalties on India's Nayara Energy, which has trimmed processing rates at a refinery as a result of the measures. Global markets are also focused on the US deadline for trade deals by Aug. 1, and the upcoming OPEC+ meeting that will decide supply policy for September.

Oil is heading for a third monthly gain on signs of tight stockpiles in some regions and robust demand during the Northern Hemisphere summer, the peak season for consumption. Still, the market is on track for a glut toward the end of the year as OPEC and its allies keep adding barrels.

Prices:

Brent for September settlement added 0.6% to $70.46 a barrel at 10:40 a.m. in London.

WTI for September delivery climbed 0.7% to $67.21 a barrel.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.