CreditAccess Grameen's share price fell to hit its lowest level since Jan. 31, 2023 following Goldman Sachs double downgrade of its rating for the stock to a 'sell' from 'buy'. The brokerage has also cut its target price significantly.

The stock fell Friday after gaining consecutively in the last five sessions when it had added 14.5%.

In its report, Goldman Sachs highlighted significant risks to CreditAccess Grameen's earnings visibility, which it attributes to several factors, including a high exposure to over-leveraged borrowers and industry-wide stress.

The brokerage has lowered its 12-month price target for the stock by 60% to Rs 564. The new target implies a 42.9% downside from the previous close.

Goldman Sachs further expressed concerns about the recent downturn in asset quality, driven by both climatic disruptions and regulatory changes. Goldman Sachs predicts that these factors will continue to pressure the company's financial performance, projecting credit costs to rise sharply to 6.6% in fiscal 2025 and 4.5% in fiscal 2026.

Earlier, this month sentiment was positive after MicroFinance Industry Network said that there was "good adherence" to the guardrails issued in July, based on monitoring of credit bureau data for August and September.

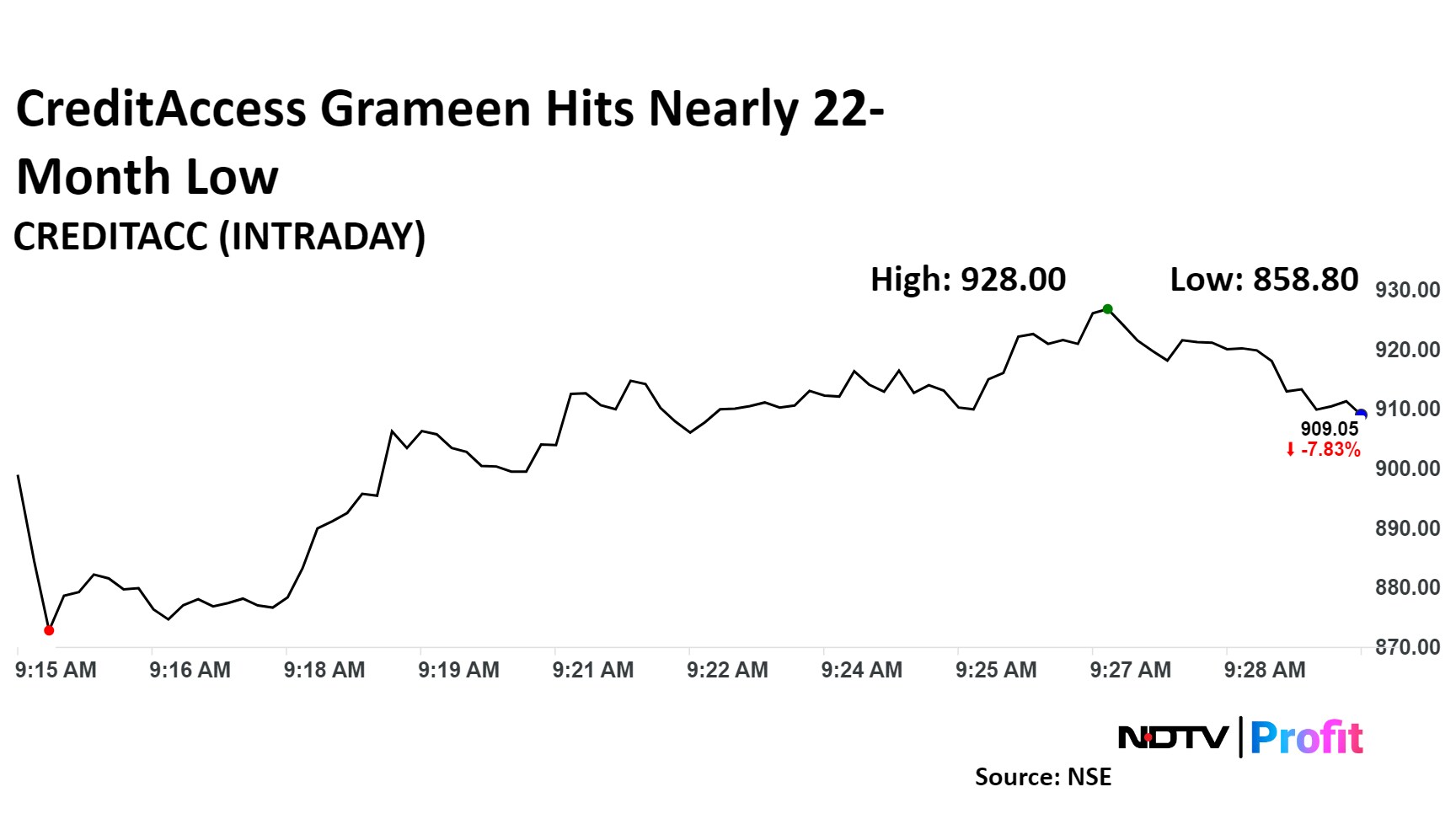

The scrip fell as much as 12.93% to Rs 858.90 apiece, the lowest level since January 31, 2023. It pared losses to trade 7.2% lower at Rs 915.75 apiece, as of 9:44 a.m. This compares to a 0.4% advance in the NSE Nifty 50 Index.

It has fallen 42% on a year-to-date basis. Total traded volume so far in the day stood at 5.20 times its 30-day average. The relative strength index was at 40.97.

Out of the 19 analysts tracking the company, 14 maintain a 'buy' rating, three recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 20%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.