- Gold price rose over 2% this week amid expectations of US interest-rate cuts

- Deutsche Bank and Goldman Sachs raised gold price forecasts for 2026 and beyond

- Federal Reserve rate cut odds at 80% for December due to weak retail and confidence data

Gold advanced on rising expectations for US interest-rate cuts, while Deutsche Bank AG joined Goldman Sachs Group Inc. in increasing its price forecast for next year.

Bullion trade near $4,170 an ounce, up by more than 2% so far this week. Bets the Federal Reserve will lower rates next month have gained traction, with data showing slowing retail sales and declining consumer confidence. Swaps now price in an 80% chance of a quarter-point cut in December.

Reinforcing prospects for lower rates, a key economic advisor to Donald Trump is emerging as the frontrunner to be the next Fed chair and is seen as someone who would bring the president's approach to monetary policy. Gold typically benefits when rates are low, as it doesn't pay interest.

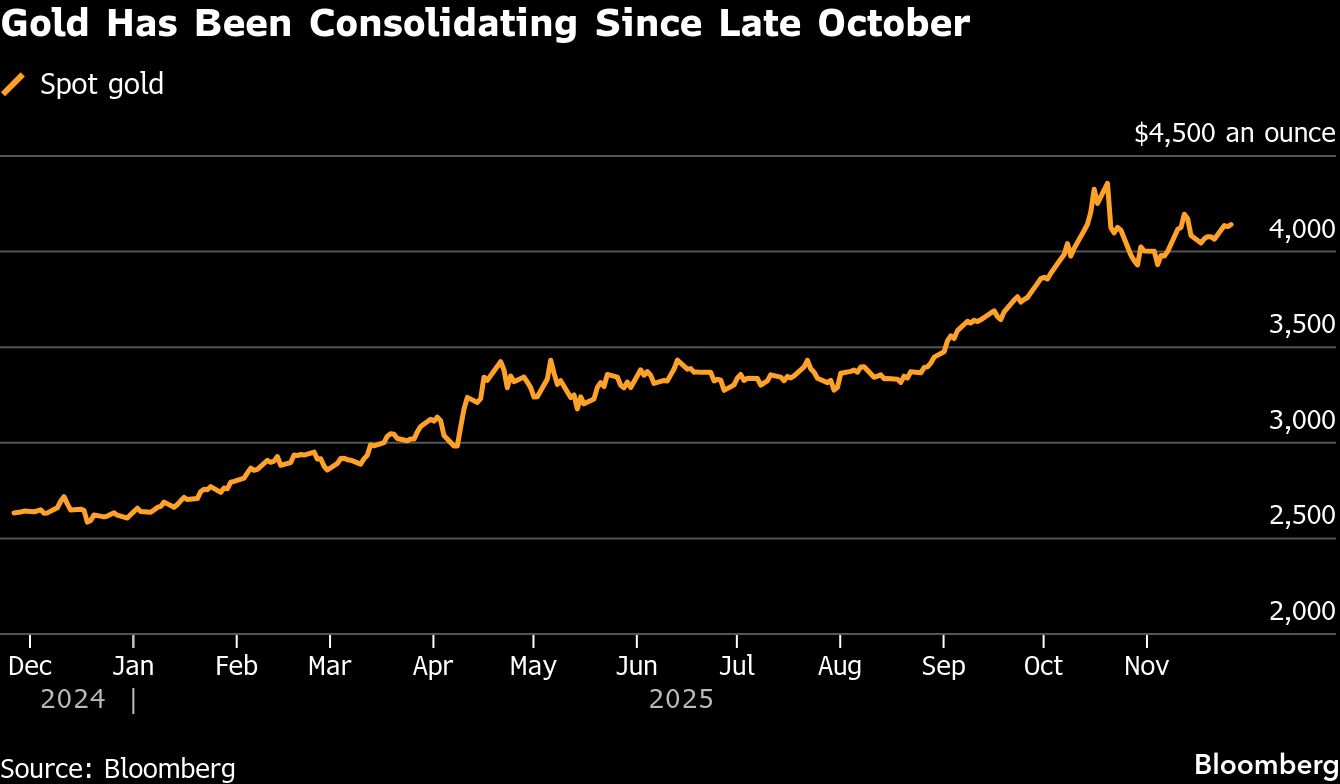

Gold has consolidated above the $4,000-an-ounce threshold after retreating from last month's peak above $4,380 an ounce. The metal — on track for its best annual performance since 1979 — has risen more than 55% this year, boosted by central-bank purchases and strong retail demand on the back of the so-called debasement trade, where investors avoid sovereign debt and currencies.

Deutsche Bank raised its 2026 forecast for gold to an average of $4,450 an ounce over the year, up from $4,000 previously. Goldman Sachs last month boosted its projection for the end of next year to $4,900 an ounce from $4,300, citing ETF inflows and central-bank buying.

“The positive structural picture shows inelastic demand from central banks and ETF investment diverting supply from the jewelery market,” Deutsche analyst Michael Hsueh wrote in a note Wednesday.

Hsueh also said third-quarter supply-demand data supports continued central bank buying, and that the most recent pullback suggests that a $3,900-an-ounce support will hold.

Spot gold rose 0.9% to $4,167.91 an ounce as of 11:55 a.m. London time. The Bloomberg Dollar Spot Index was steady after falling 0.3% on Tuesday. Silver advanced 2%, while platinum and palladium also gained.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.