Goldman Sachs cut the price target for FMCG giant Colgate Palmolive to Rs Rs 2,375 from 2,630, after its annual revenue dropped nearly 2%. The brokerage also cited factors like low urban consumption demand along with increase in competitive intensity. It has a 'sell' rating on the stock.

"Colgate delivered weak revenue numbers in 4QFY25, with revenue declining 1.8% YoY. The management stated they are facing primarily two headwinds, both of which are expected to continue in 1HFY26," Goldman said in its report.

Weaker urban consumption demand is on account of strain on consumer finances, leading to less usage of toothpaste per brushing occassion and slump in volumes. Lower demand trends along with higher intensity in competition, particularly on trade promotions is projected to extend into the first half of fiscal 2026, as per the note.

However, the company expects to rebound in the second half of financial year 2026. The company's medium term focus will be on "premiumisation". "Colgate is seeing success in its efforts towards building a premium portfolio of toothpastes. The Colgate Total portfolio has grown 4x of the overall toothpaste category growth in FY25 and Colgate has taken many initiatives like lowering prices, doubling distribution and increasing marketing spends," GS mentioned.

Key Risks:

According to GS key upside risks include:

1. Reversal of consumer preference toward naturals.

2. A strong move toward premiumisation.

3. Successful expansion to categories beyond oral care in the India business.

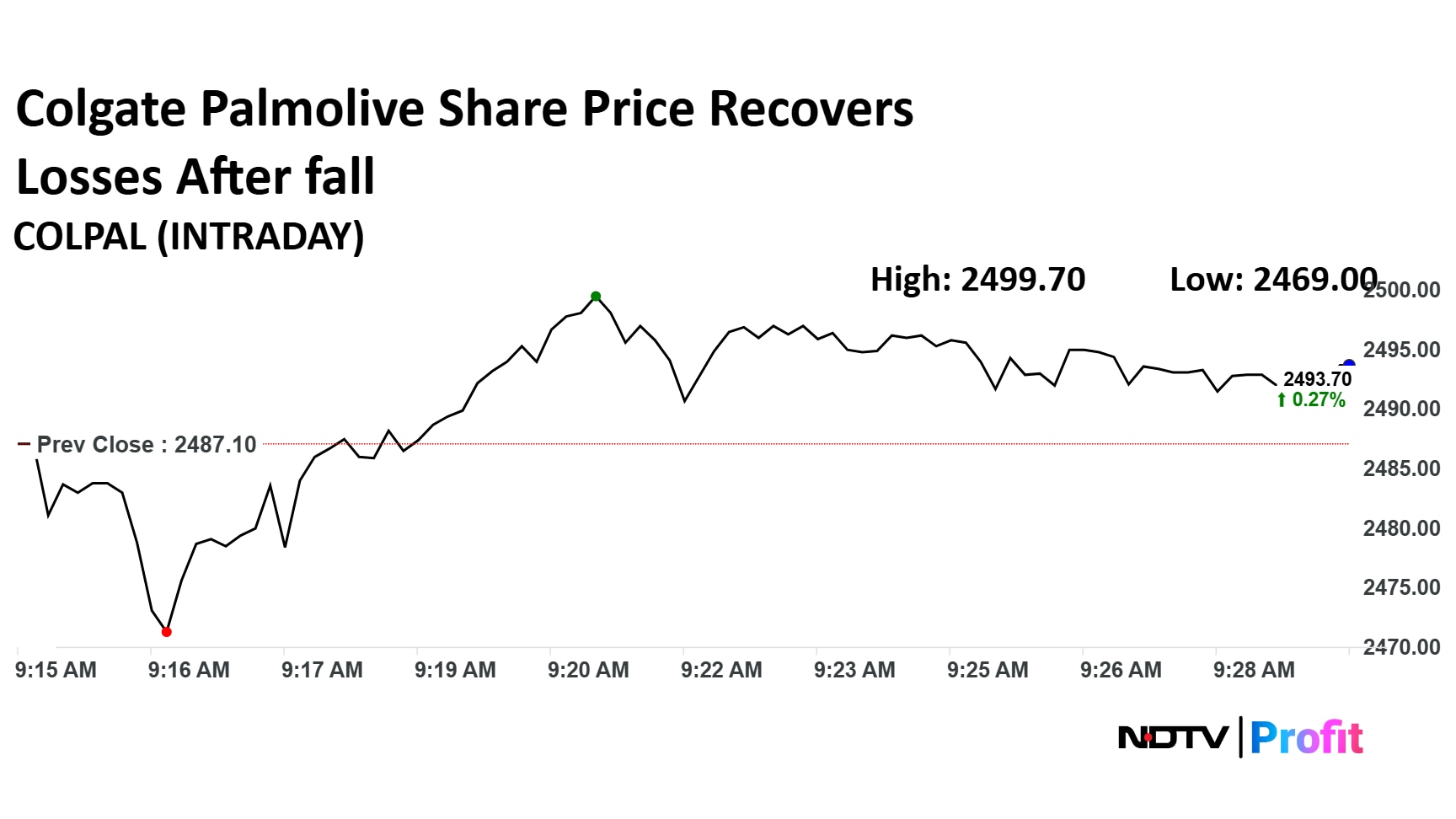

Colgate Palmolive Share Price Today

Share price for Colgate Palmolive fell as much as 0.73% to Rs 2,469 apiece, the lowest level since April 2025. It pared losses to trade 0.36% higher at Rs 2,469.30 apiece, as of 9:23 a.m. This compares to a 0.40% advance in the NSE Nifty 50.

The stock has fallen 6.93% on a year-to-date basis, and is down 8.20% in the last 12 months. Total traded volume so far in the day stood at 3 times its 30-day average. The relative strength index was at 31.81.

Out of 34 analysts tracking the company, 10 maintain a 'buy' rating, 12 recommend a 'hold' and 12 suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 7.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.