Shares of Colgate Palmolive (India) Ltd. hit a 52-week low during early trade on Tuesday after the company pointed to lingering pain in the ongoing quarter amid a demand slowdown.

The management spoke to select analysts where they indicated muted growth in the fourth quarter of the current year due to high base and weaker demand.

The toothpaste-maker continues to face profitability pressures due to increased spending on promotions and discounts. Although the company implemented price hikes, the benefits may be partially offset by the higher costs associated with schemes and promotions, potentially limiting the positive impact on earnings, executive told analysts.

This coupled by revenue-led operating deleverage will keep margins weaker on an annual basis.

Analysts expect a meagre 1.5% revenue growth, 1% volume growth and a 9% decline in operating income (Ebitda) and net profit in the January-March period. Such projection can reduce earnings estimates by 3% for the current fiscal and beyond, they said.

Notably, Colgate Palmolive might continue performing ahead of listed oral care peers, according to the management.

Colgate Palmolive Share Price Down

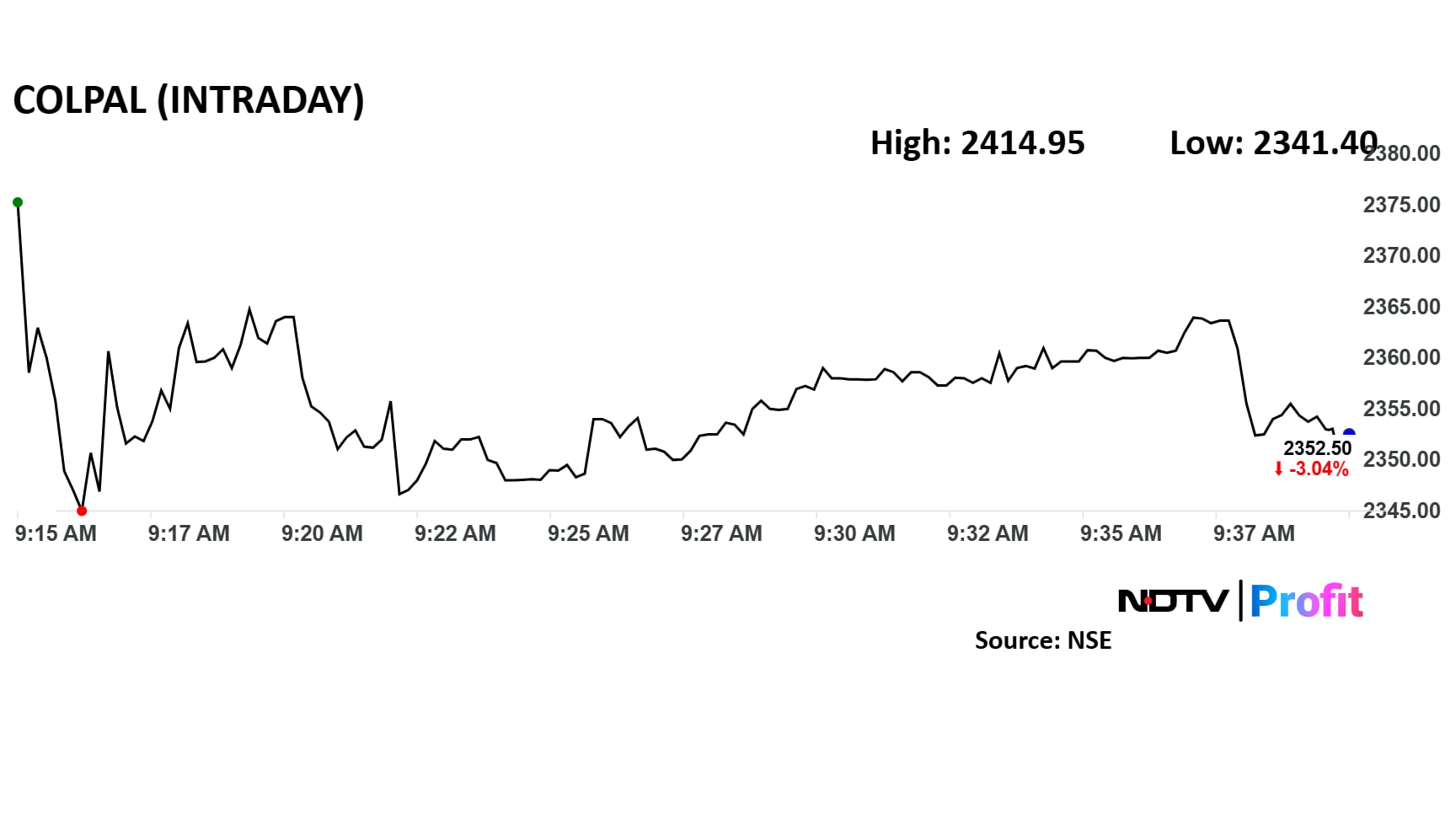

Colgate Palmolive share price fell 3.5% intraday to Rs 2,341 apiece.

Colgate Palmolive share price fell 3.5% intraday to Rs 2,341 apiece. The scrip was trading 3% lower by 9:40 a.m. The benchmark NSE Nifty 50 was up 0.54%.

The stock has fallen 13% in the last 12 months and 12% on a year-to-date basis. The total traded volume so far in the day stood at 9.2 times its 30-day average. The relative strength index was at 48.

Eight out of the 34 analysts tracking the company have a 'buy' rating on the stock, 13 recommend a 'hold' and 13 suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price target implies a potential upside of 20%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.