Shares of Cochin Shipyard rose over 4% on Thursday ahead of announcing its fourth quarter results, extending a gaining streak for the fifth straight day. The board will also consider the recommendation for a dividend.

In addition, the shipbuilding and ship repair company, achieved a significant milestone on Wednesday with the steel-cutting ceremony for the second hybrid Service Operation Vessel (SOV) for the North Star Shipping (Aberdeen) Limited, UK.

The 86 m hybrid-electric SOV is designed by VARD AS, Norway. The VARD 4 19 SOV is the second of the two SOVs being constructed by Cochin Shipyard for North Star. Once commissioned, the vessel is expected to revolutionise service, maintenance, and operating tasks, as it has been designed especially to satisfy the demanding requirements of the offshore wind sector.

Shares of Cochin Shipyard have added over 17% since April 22 and have risen 20.99% in the last five sessions. This surge came in the backdrop of 'Operation Sindoor'—a large-scale precision strike by the Indian armed forces on terrorist infrastructure in Pakistan and Pakistan-occupied Kashmir.

The operation marked India's most significant tri-service action since the 1971 war. The military action was in direct response to the Pahalgam terror attack that claimed the lives of 26 civilians.

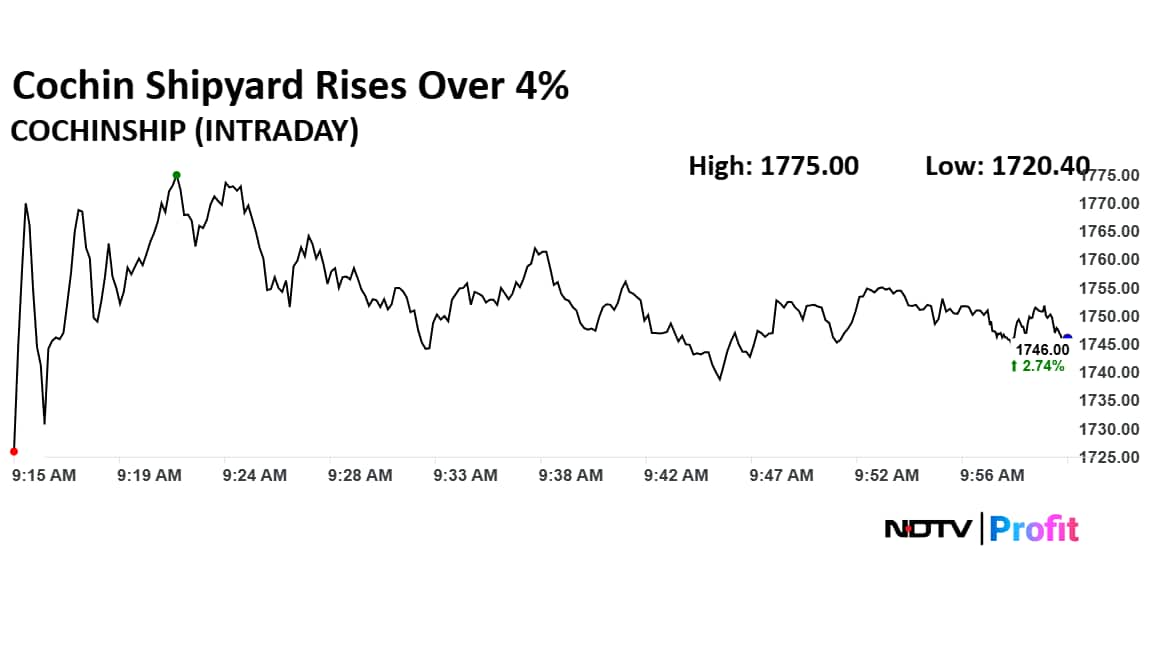

Cochin Shipyard Share Price Rises

Shares of Cochin Shipyard rose as much as 4.45% to Rs 1,775 apiece, the highest level since May 14. It pared gains to trade 2.78% higher at Rs 1,746.60 apiece, as of 9:57 a.m. This compares to a 0.41% advance in the NSE Nifty 50.

It has risen 31.48% in the last 12 months and 13.56% year-to-date. Total traded volume so far in the day stood at 6.7 times its 30-day average. The relative strength index was at 63.

Out of five analysts tracking the company, three maintain a 'buy' rating, one recommends a 'hold' and one suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 4.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.