The shares of Cochin Shipyard fell 8.19% on Thursday hitting a two-month low after consolidated net profit plunged 43% to Rs 108 crore in the July-September period, compared to Rs 189 crore in the corresponding quarter last year. Higher expenses contributed to the decline.

Revenue from operations of the PSU ship maker fell 2% to Rs 1,119 crore, marking another quarter of decline.

The company's operational performance fared poorly. Earnings before interest, tax, depreciation and amortisation fell 63% to Rs 74 crore, compared to Rs 197 crore. Margin contracted to 6.6% from 17.3%.

Income from shipbuilding segment dropped 12%, while ship repair rose 27%.

Cochin Shipyard declared an interim dividend of Rs 4 per fully paid up equity share with a face value of Rs 5 for FY26, as per an exchange filing on Wednesday.

The record date to determine the number of eligible shareholders has been declared as Nov. 18, 2025, while payment or disbursement of the said interim dividend will be done on or before Dec. 11.

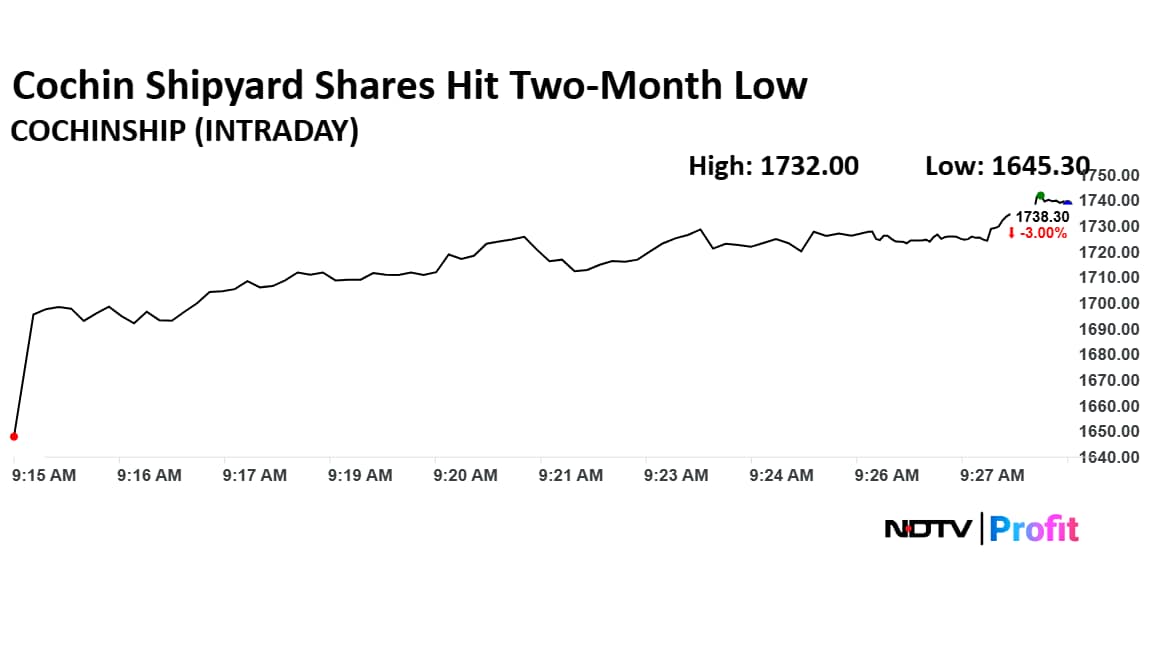

Cochin Shipyard Share Price Today

The scrip fell as much as 8.19% to Rs 1,645.30 apiece on Thursday, the lowest since Sept. 12. It pared losses to trade 3.69% lower at Rs 1,726.80 apiece, as of 9:25 a.m. This compares to a 0.03% decline in the NSE Nifty 50 Index.

It has risen 31.03% in the last 12 months and 12.19% year-to-date. Total traded volume so far in the day stood at 1.06 times its 30-day average. The relative strength index was at 61.42.

Out of three analysts tracking the company, one maintains a 'buy' rating and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target of Rs 1578 implies a downside of 4.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.