Shares of Oil and Natural Gas Corp. were up over 4% in early trade on Tuesday after CLSA identified the company as a top pick, forecasting a 42% upside with a new target price of Rs 360 per share. The brokerage highlighted multiple volume and realisation triggers in 2025, alongside a significant undervaluation and an attractive 6% dividend yield.

ONGC's eastern offshore KG-98 field is expected to hit peak production of 45kbpd oil and 10mmscmd gas before the end of 2025, the brokerage said. This ramp-up could boost the company's domestic oil and gas output by 10% and 18%, respectively, over fiscal 2024 levels. CLSA estimates this field alone could contribute an incremental PAT of Rs 6,300 crore at peak production, accounting for 11% of its fiscal 2027 PAT forecast.

The government's revised gas pricing policy is a game-changer for ONGC, CLSA said. Gas from well interventions is now priced at a higher 12% slope compared to legacy gas, and CLSA projects that by fiscal 2027, 40% of ONGC's gas output will fetch these higher realisations, driving meaningful earnings upgrades.

The removal of the windfall tax could allow ONGC to benefit from crude prices exceeding $75 per barrel, further enhancing its profitability, the brokerage said.

Factoring in these triggers, CLSA has raised its earnings per share estimates for ONGC by 2-8% for fiscals 2025 to 2027.

With multiple material growth drivers, including peak production from the KG basin, higher gas realisations, and a potential crude price boost, ONGC is poised for significant upside. Its current undervaluation and strong dividend yield make it an attractive bet for long-term investors, as per the report.

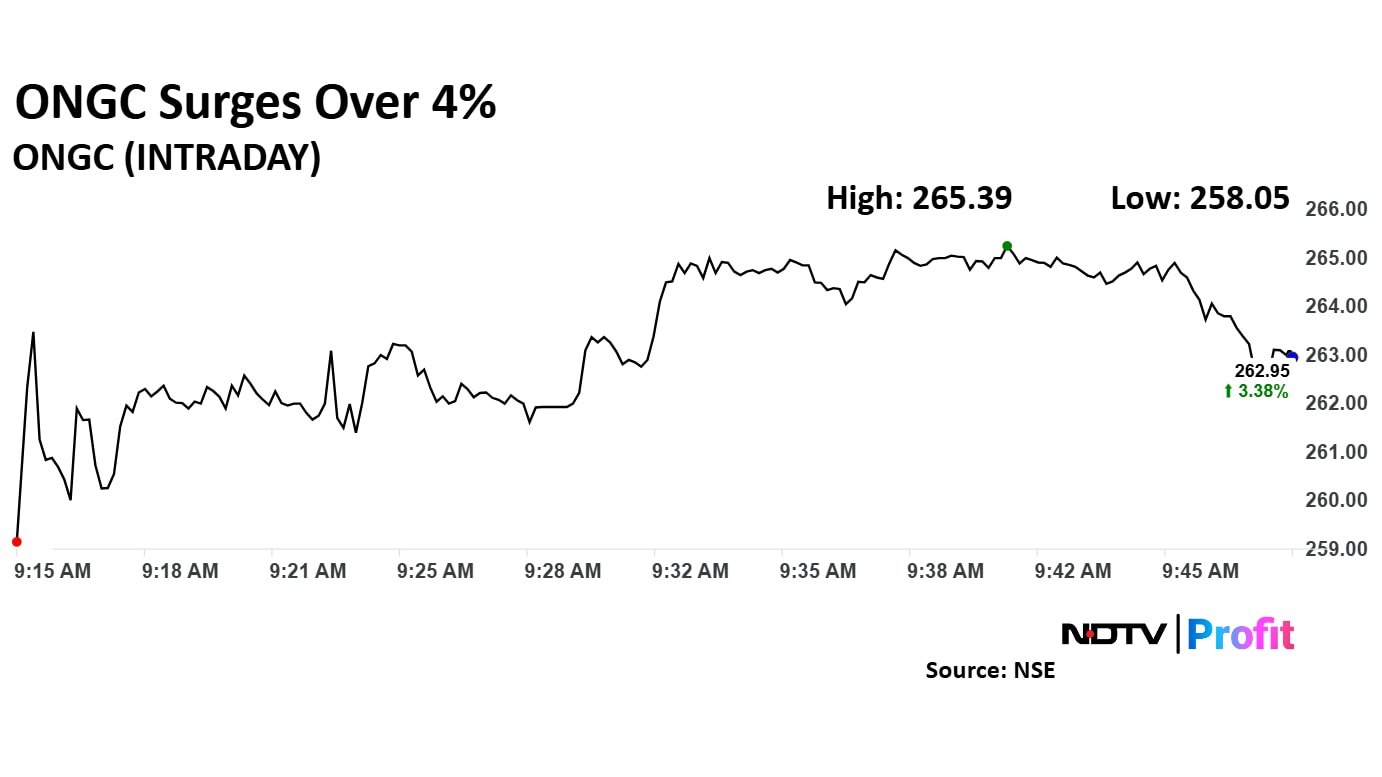

ONGC Share Price Today

The scrip rose as much as 4.30% to Rs 265.30 apiece, the highest level since Nov. 8, 2024. It pared gains to trade 4.06% higher at Rs 264.68 apiece, as of 09:45 a.m. This compares to a 0.67% advance in the NSE Nifty 50.

It has risen 21.44% in the last 12 months. Total traded volume so far in the day stood at 4.9 times its 30-day average. The relative strength index was at 62.5.

Out of 30 analysts tracking the company, 20 maintain a 'buy' rating, five recommend a 'hold' and five suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 20.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.