The Nifty 50 index continues to consolidate within a newly defined range, with no change in outlook, according to the latest technical note by CLSA's Laurence Balanco. The index is currently trading between 24,337–24,432 on the lower end and 25,448–25,669 on the upper end, reflecting a pause in momentum following the breakout from the February–April double-bottom pattern.

Balanco highlights a critical support zone just below the lower boundary of this range, which aligns with the 200-day moving average and the upper edge of the earlier basing pattern. This support area, spanning 23,708–24,157, is seen as pivotal for the market's next directional move.

“As long as price action holds above this key support level, there remains a case to favour the upside,” Balanco noted, adding that the eventual resumption of the February–April pattern could still push the Nifty toward a measured target of 26,333.

Earlier in June, CLSA was of the view that the NSE Nifty 50 may hit 26,333 or a record high in calendar year 2025.

Meanwhile, In July, JPMorgan projected that the Nifty 50 could trade between 26,500 and 30,000 over the next six to nine months. JPMorgan saw the first quarter as a transition phase, moving from underwhelming results to a more robust recovery, driven by a low base and improving economic momentum.

While CLSA's near-term view is more technical and range-bound, the broader market narrative remains constructive, provided key support levels are respected.

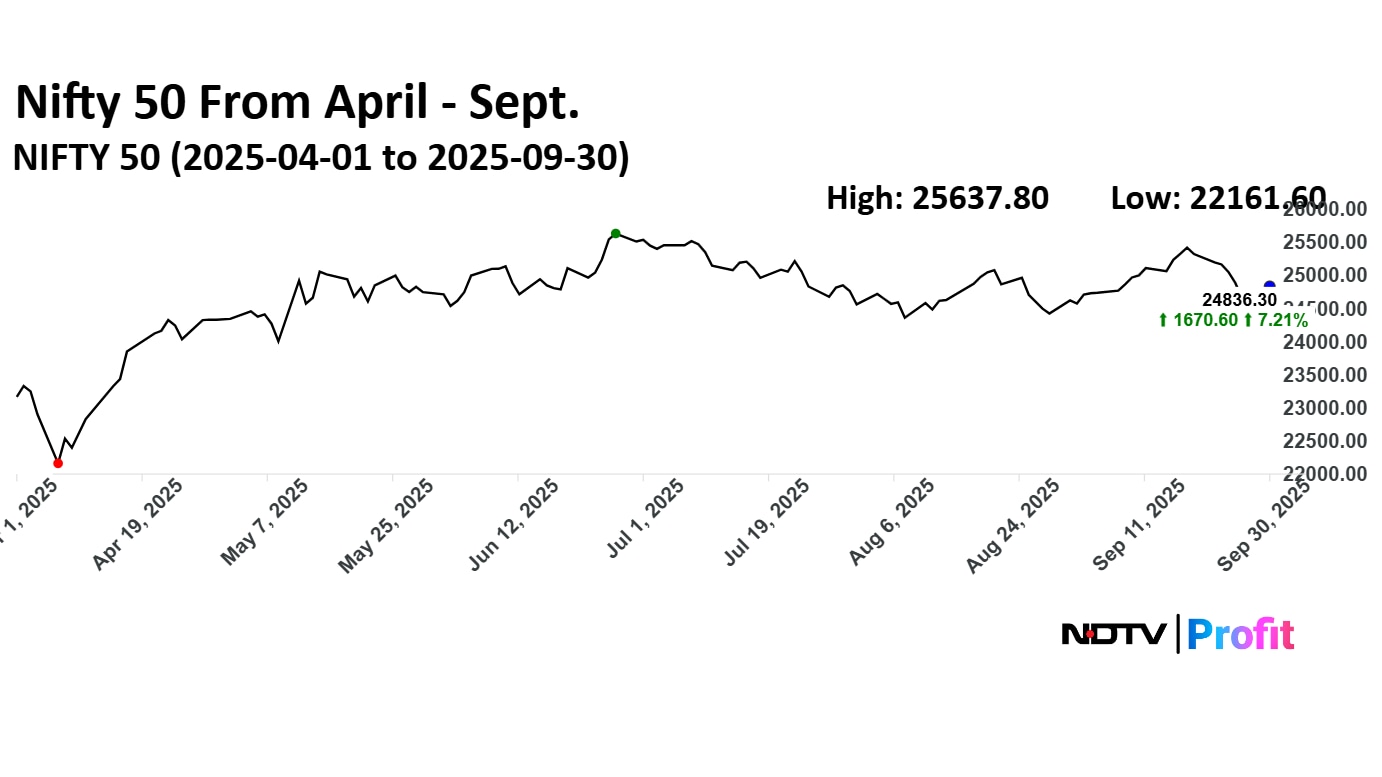

Nifty 50 has risen 6.24% between April to Sept. 2025. Meanwhile, year to date the benchmark has gained 5.04%. However, on an annual basis the benchmark is down 1.64%.

Out of 50 analysts tracking the benchmark, 31 maintain a 'buy' rating, 19 recommend a 'hold,' and none suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 13.8%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.