The media sector in India continues to face a challenging advertising environment, but CLSA's latest report highlights several stocks that are poised for recovery, with PVR Inox, Zee Entertainment, and DB Corp emerging as key players. Despite the ongoing softness in advertising revenue, particularly from FMCG-led national ad spends, these companies are seen as well-positioned for a rebound, driven by strong box office performance, subscription growth, and strategic content investments.

CLSA has maintained an "Outperform" rating on PVR Inox Ltd. with a target price of Rs 2,450, offering a potential upside of 53%. The report highlights PVR Inox's robust recovery in the second quarter of financial year 2025, with a 28% quarter-on-quarter rise in admissions and a 36% QoQ increase in revenue.

The company's success in re-releasing popular films has been a significant driver of growth, with nearly 6% of total admissions in Q2 coming from such re-releases. The recovery in the Indian box office, particularly driven by Hindi movies, also bolstered PVR Inox's performance, with collections increasing by 40% QoQ. CLSA believes that with festive season content lined up and improving occupancy rates, PVR Inox is well-positioned to continue benefiting in the coming quarters.

CLSA has an 'Outperform' rating on Zee Entertainment Enterprises Ltd., with a target price of Rs 170, reflecting an upside potential of 21%. Zee's advertising revenue in the second quarter of financial year 2025 saw an 8% year-on-year decline, but the company continues to benefit from strong subscription growth, which was up by 11% YoY.

The growth is attributed to the implementation of NTO 3.0, which allowed Zee to increase prices for its pay TV channels, and the growing success of its OTT platform, ZEE5. Despite a soft ad environment, Zee's diversified revenue streams are seen as a key strength, positioning the company well for a recovery in ad spends as the market improves.

In the print media segment, DB Corp remains a top pick for CLSA, with an "Outperform" rating and a target price of Rs 450. Despite a 4-9% YoY decline in ad revenue, DB Corp continues to benefit from lower newsprint prices and its strong circulation base. The company is expected to deliver 10% CAGR in earnings and trade at an attractive 10x PER for FY26. However, CLSA has reduced its revenue and Ebitda estimates for the print media sector by 5-16% due to the ongoing softness in advertising, particularly in the FMCG segment.

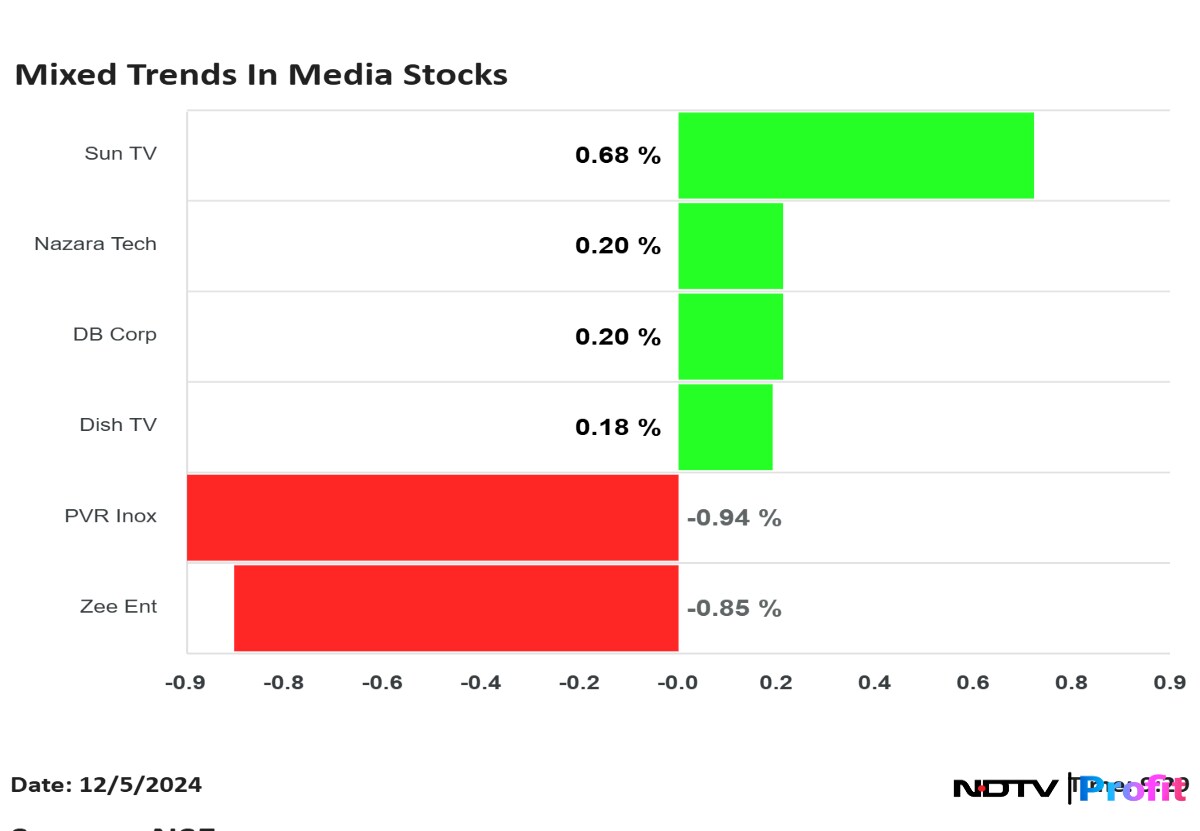

Other Key Media Stocks: Sun TV, Dish TV, and Nazara

CLSA has cut its revenue and Ebitda estimates for Sun TV Network Ltd. by 3-9% due to the challenging ad environment. However, the stock remains a "Hold" with a target price of Rs 766, as the company continues to generate solid subscription revenue growth despite the weak ad market.

Dish TV India Ltd. is also facing difficulties, with subscription revenue declining by 30% YoY in the second quarter of financial year 2025, leading CLSA to lower its estimates by 10-25%. Despite this, the stock remains a "Hold" with a rolled-over target price of Rs 11.

In the gaming space, Nazara Technologies Ltd. remains an "Underperform" pick due to its high valuation, currently trading at 50x FY26 PE. Although the company's recent acquisition of a stake in PokerBaazi is not yet factored into CLSA's estimates, the stock is considered expensive at current levels.

While the advertising environment remains soft, particularly for national advertisers in sectors like FMCG, the media sector as a whole is expected to benefit from growing subscription revenues, strong content offerings, and improving occupancy in multiplexes.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.