Brokerage firm Avendus Spark bought back the extra shares of Clean Science and Technology Ltd. sold in the open market after erroneously selling twice the equity on offer in a block deal, as per sources.

The stock plunged to a 52-week low during the early session on Thursday. The promoter sold equity via large trades. Avendus Spark was the dealer to the transaction.

Around 60 million shares were traded in block deals compared to 25.5 million (24% equity) planned. So far, 90 million shares of Clean Science have been traded on both the exchanges.

The floor price of the offer was Rs 1,030 apiece, nearly 13% discount to Wednesday's closing price, according to Bloomberg. The promoter stake is 74.97% as of June.

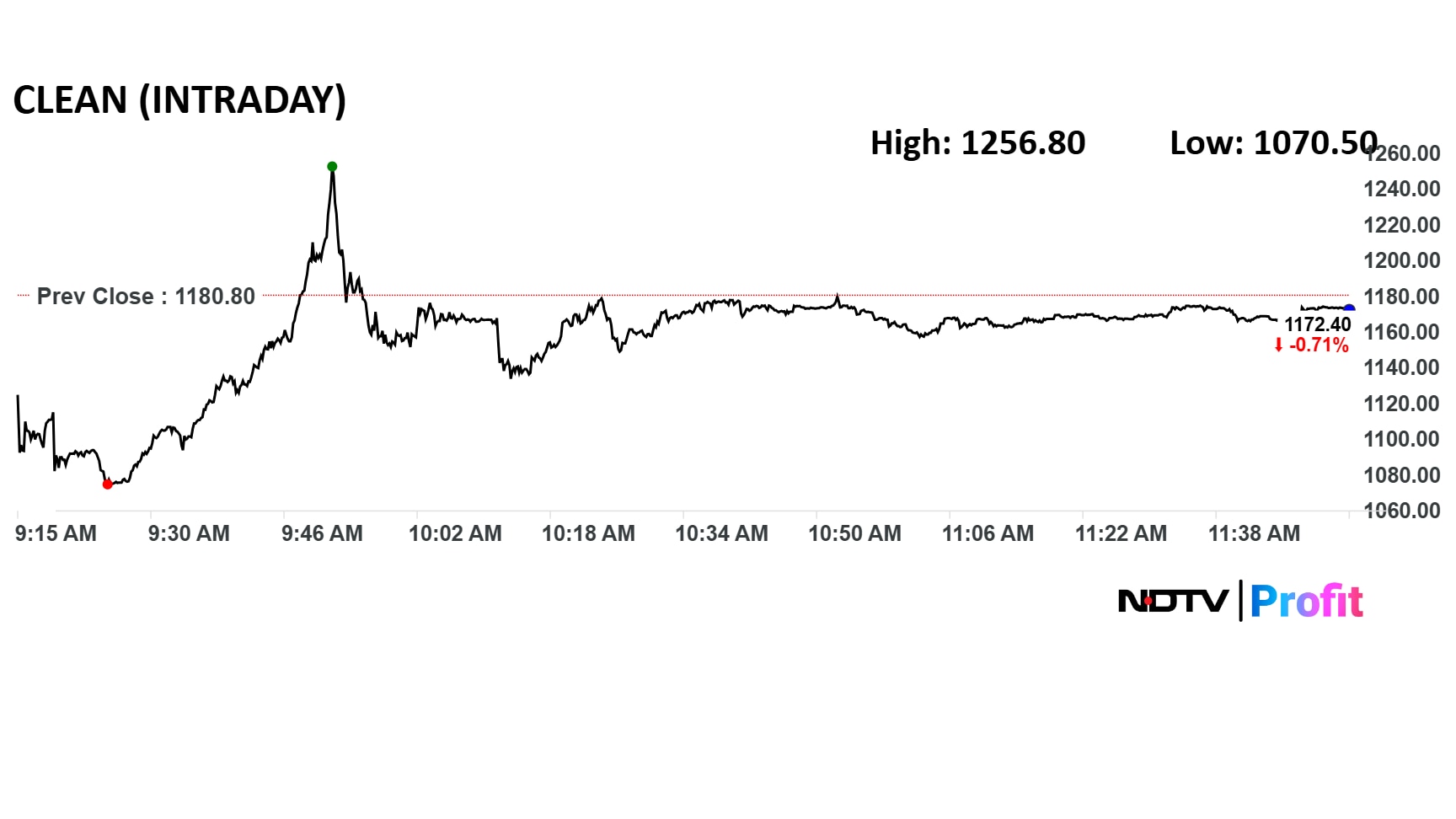

Clean Science share price declined 9.3% intraday to Rs 1,070.5 apiece on the NSE. It soon pared losses to trade marginally lower by noon.

Avendus Spark said in a statement that they are "reviewing the facts with utmost priority and remain fully committed to addressing this matter responsibly and in line with the highest standards of governance".

Clean Science pays the price for Avendus Spark's mistake

August 21, 2025

A double block deal from #CleanScience rattled investors, pushing the stock down. It later turned out to be a mistake by broker #AvendusSpark.@_nirajshah explains the costly mistake.

Read: https://t.co/ePBSIxn1AM pic.twitter.com/iaxtCBXbL6The total traded volume so far in the day stood at 215 times its 30-day average. The relative strength index was at 69.

On the BSE, the total traded value was Rs 7,038 crore.

The stock has fallen 18% in the last 12 months and 25% on a year-to-date basis.

Eight out of the 14 analysts tracking Clean Science have a 'buy' rating on the stock, two recommend a 'hold' and four suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price target implies a potential upside of 27%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.