Cipla Shares Fall 4% After USFDA Flags Compliance Issues At Pharmathen's Rodopi Facility

The form includes nine observations highlighting serious concerns over current Good Manufacturing Practices (cGMP).

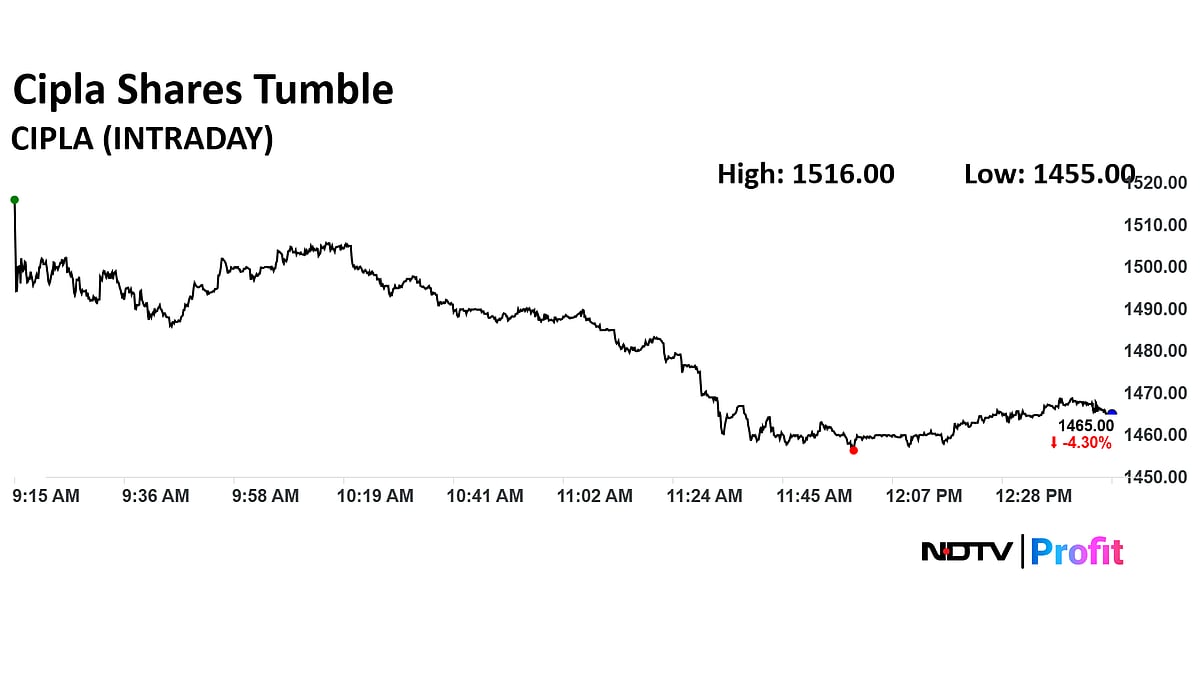

Shares of Cipla fell 4% on Wednesday with the stock currently trading at Rs 1471.50 apiece. Cipla’s shares have come under pressure as investors weigh the implications of possible supply chain challenges with the US.

The US Food and Drug Administration (FDA) has issued a Form 483 to Pharmathen, Cipla’s contract manufacturing partner for Lanreotide, following an inspection at its Rodopi facility.

The form includes nine observations highlighting serious concerns over current Good Manufacturing Practices (cGMP).

The key issues flagged by the FDA include microbiological contamination risks involving gram-negative bacteria, poor aseptic practices, higher particulate reject limits, rejected batches, and inadequate investigations into out-of-specification (OOS) results. One observation also appears to point toward potential data integrity challenges.

The Form 483 is critical of Pharmathen’s compliance standards, raising questions about the robustness of its manufacturing processes.

According to Cipla’s labelling, Lanreotide is produced at Pharmathen’s Rodopi unit, making any disruption at the site a potential risk to Cipla’s revenue from the drug. Lanreotide is Cipla’s largest product in the U.S. market.

Cipla Share Price Today

Cipla Share Price Today

The scrip fell as much as 4% to Rs 1467.50 apiece. This compares to a 0.31% decline in the NSE Nifty 50 Index.

Total traded volume so far in the day stood at 1.04 times its 30-day average. The relative strength index was at 62.40

Out of 39 analysts tracking the company, 21 maintain a 'buy' rating, 10 recommend a 'hold' rating, and eight maintain a 'sell' rating, according to Bloomberg data. The average 12-month consensus price target of Rs 1664.28 implies an upside of 13.4%.