UltraTech Cement Ltd., Ambuja Cements Ltd., and Shree Cement Ltd. are set to benefit as the cement industry moves towards higher pricing and GST cuts could fast track the premiumisation process, according to Nomura.

The GST Council will meet on Sept. 3 and 4 to decide on the Centre's proposed two-rate GST system. Cement is presently taxed at 28% and is expected to be migrated to the 18% bracket under the proposed reform.

Analysts at Nomura see the GST cut as structurally positive for the industry, as it would make premium and Category A products more affordable for customers, thus increasing the adoption rate.

The domestic cement industry can be categorised into four broad segments based on pricing — Premium, Category A, Category B and Category C. "We estimate Category A accounts for around 40% of total volumes at the moment; the GST reforms could increase this to around 55-60% by FY30 versus our base case of 50%," a note said.

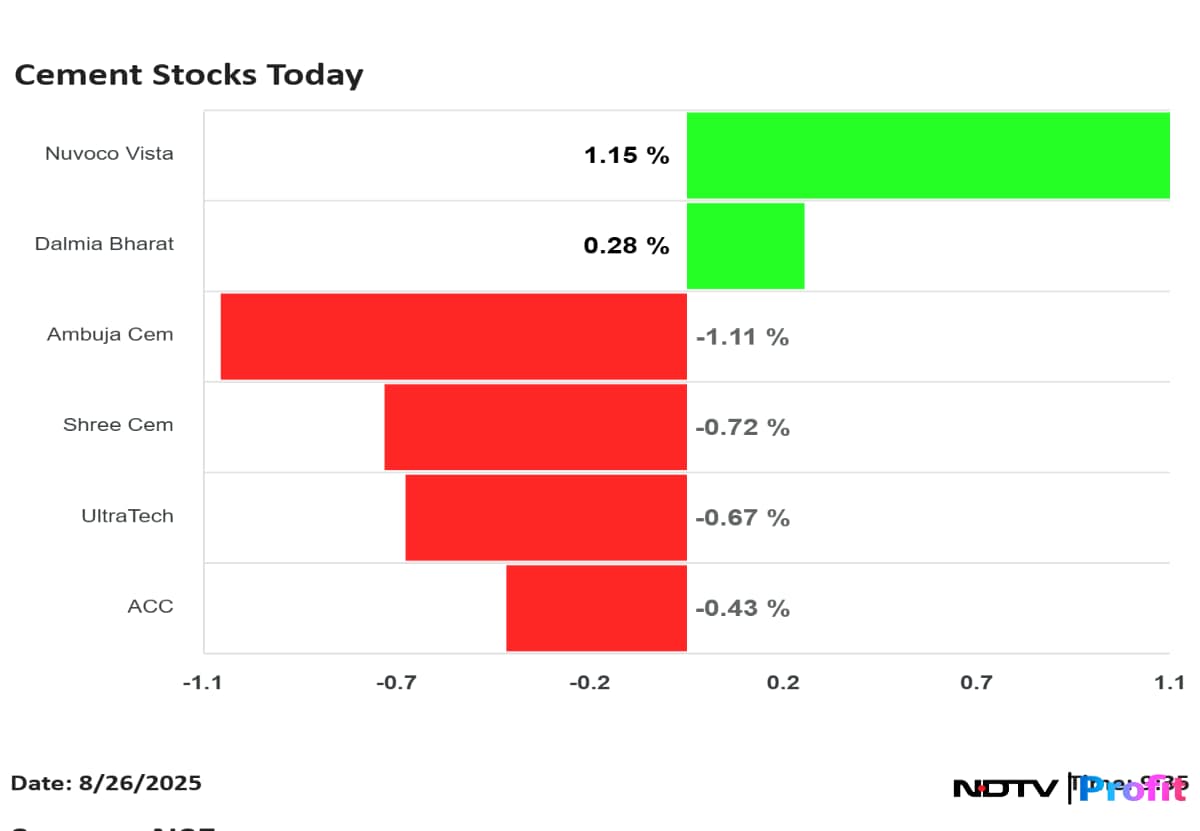

UltraTech, Ambuja, Shree Cement, Dalmia Bharat, Nuvoco share price movement today.

Pan-India players such as UltraTech and Ambuja/ACC will benefit the most, as the penetration of their premium products such as UltraTech's Weather Plus and ACC's F2R and Gold will increase multifolds across India. Nomura has a 'buy' rating on both UltraTech and Ambuja.

For Shree Cements, Nomura said dealer checks suggest the company has successfully narrowed the pricing gap with category A players. The category B company has shifted its focus on improving realisation by working on its branding.

Moreover, recent official cement price hike in West Bengal before the GST rate cut might attract unwanted attention from the GST authorities. This could be positive for Dalmia Bharat Ltd. and Nuvoco Vistas Corp.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.