CEAT is aiming to grow ahead of the industry with plans to increase its market share in both the passenger car radial and truck and bus radial segments by fiscal 2026, according to takeaways from its annual investor meet held on June 3. Nomura maintained its 'buy' call on the stock, with a target price of Rs 3,945, implying a potential upside of 7% from current levels.

In the PCR segment, CEAT is targeting a market share increase from 16% to 17.0-17.5% through a higher share of premium 17-inch+ tyres, OEM partnerships, and AI-enhanced distribution.

In the TBR segment, the company aims to grow domestic share from 10% to 12-13% by fiscal 2026 by focusing on sub-segments like mining and tubeless tyres and launching new products in the US.

Management highlighted that the Camso acquisition strengthens CEAT's position in construction tyres and tracks, despite pricing pressure from peers like Michelin. Estimated Camso revenue is pegged at $150 million by 2026, down from $220 million in 2023.

CEAT expects margin gains in the second half of fiscal 2026, helped by easing raw material costs. It also sees mid-teens consolidated revenue growth in PCR and TBR, supported by structural demand, AI-driven efficiencies, and product innovation.

Nomura remains positive, projecting an 11% revenue compound growth for the next two fiscals and expecting the Off-Highway Tyres mix to rise to 25% in fiscal 2026.

Camso's contribution could boost margins but may pose risks if revenues fall short, said the brokerage. A 10% lower Camso revenue could impact EPS by 3%, Nomura noted.

The firm also flagged broader consumption slowdowns impacting urban markets but sees rural demand holding up. It expects CEAT to benefit from premiumisation trends and the rising popularity of SUVs.

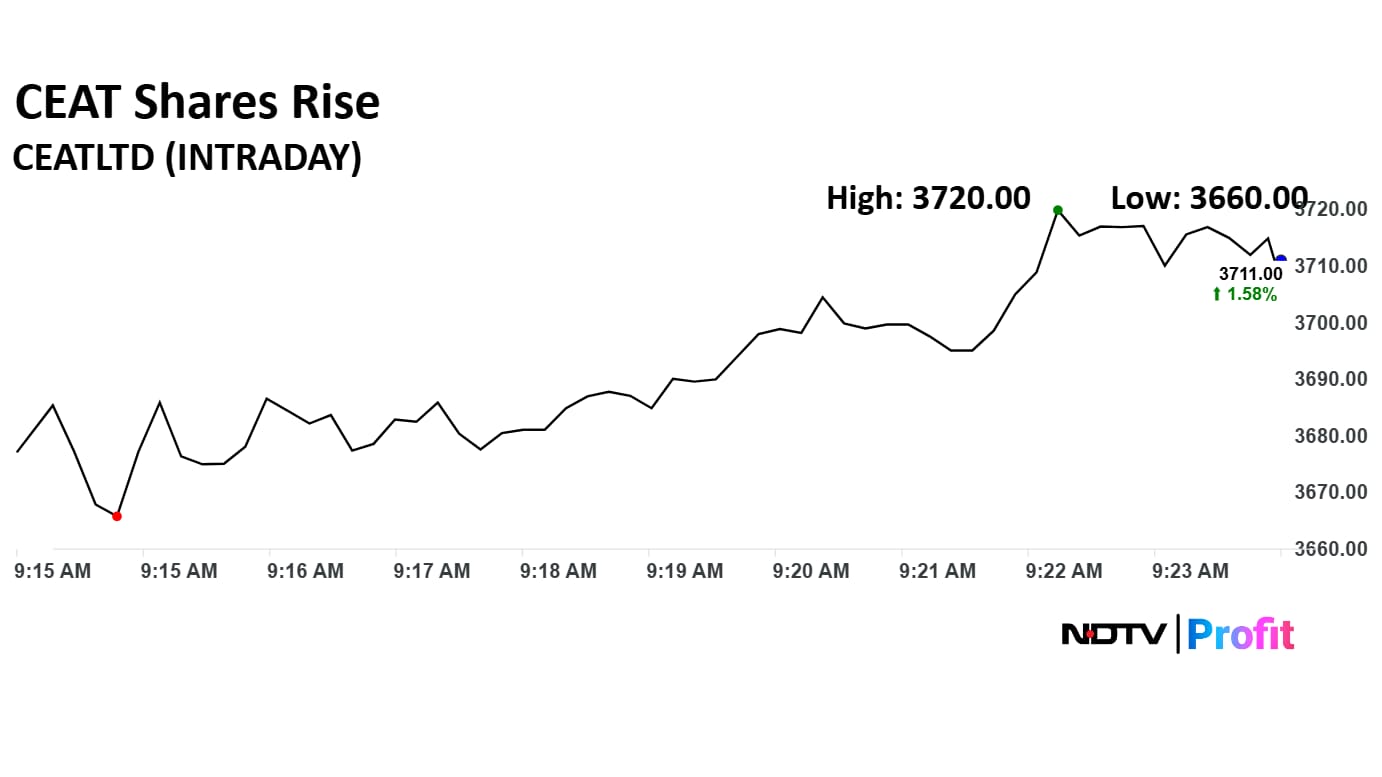

CEAT Share Price Today

The scrip rose as much as 1.82% to Rs 3,720 apiece. It pared gains to trade 1.68% higher at Rs 3,714.90 apiece, as of 09:30 a.m. This compares to a 0.16% advance in the NSE Nifty 50.

It has risen 14.22% on a year-to-date basis, and 56.75% in the last 12 months. The relative strength index was at 28.67.

Out of 21 analysts tracking the company, 15 maintain a 'buy' rating, three recommend a 'hold' and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.