Shares of Central Depository Services Ltd. dropped over 7% on Tuesday, extending a two-day losing streak and reaching a five-month low. This 16% decline in the last three sessions followed a sequential dip in profit and revenue for the quarter ending December.

The revenue drop was attributed to lower transaction charges, online data charges, and other income. CDSL reduced transaction fees to Rs 3.5 per debit, down from a range of Rs 3.75 to Rs 5.

Transaction charges income fell to Rs 59 crore from Rs 83 crore in the September quarter, while other income nearly halved, according to the investor presentation. Despite stable annual issuer income at Rs 81 crore, IPO or CA income rose to Rs 58 crore from Rs 52 crore in the previous quarter.

"The sluggish sentiments contributed by geopolitical issues, overall slowdown in the world, certain regulatory changes in the futures and options, etcetera, have led to a muted participation, which is seen across the board, whether it be transaction volume, delivery volumes, and hence, the market-based delivery transaction income for CDSL," said Nehal Vora, managing director and chief executive officer at CDSL.

Additionally, the net accounts opened during the quarter fell to 92 lakh from 118 lakh, and demat custody dropped to Rs 75 lakh crore from Rs 78 lakh crore in the prior quarter.

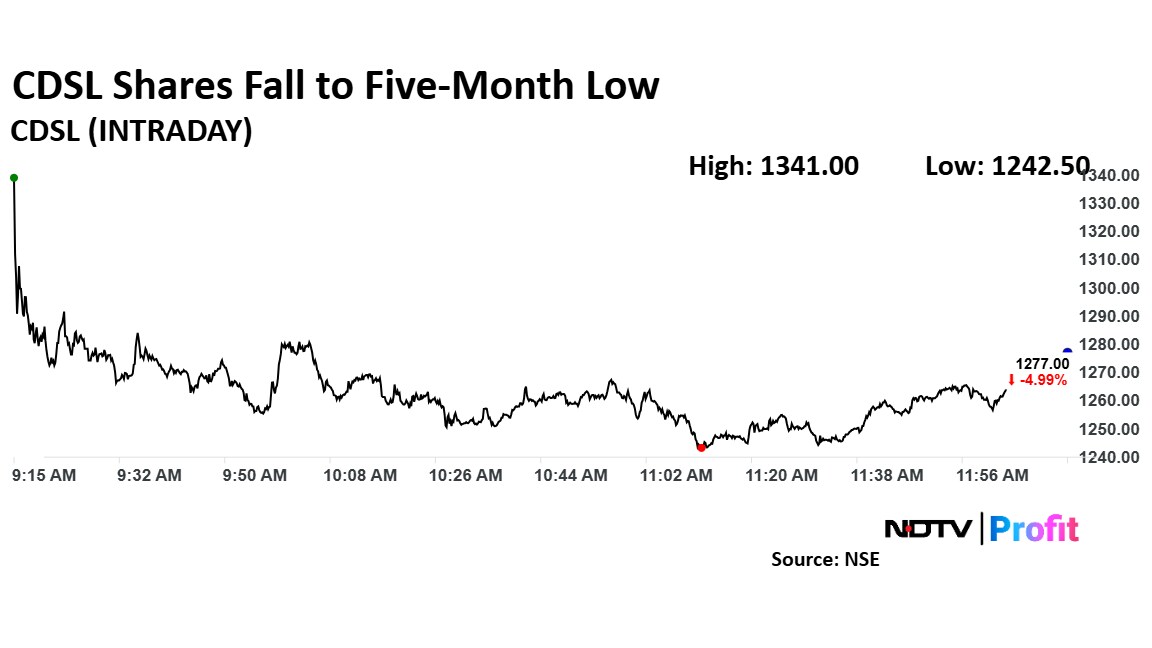

CDSL Shares Fall

The shares of CDSL fell as much as 7.56% to Rs 1,341 apiece, the lowest level since Aug. 9, 2024. They pared losses to trade 5.70% lower at Rs 1,267.40 apiece, as of 12:08 p.m. This compares to a 0.87% advance in the NSE Nifty 50.

The stock has risen 43.58% in the last 12 months. Total traded volume so far in the day stood at 4.4 times its 30-day average. The relative strength index was at 19, indicating that it is oversold.

Out of 10 analysts tracking the company, two maintain a 'buy' rating, five recommend a 'hold' and three suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 7.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.