Shares of Castrol India Ltd. were trading nearly 7% lower on Tuesday after the shares turned ex-dividend. The industrial lubricant manufacturer had declared a total dividend of Rs 13 per equity share.

The total dividend included a final dividend of Rs 9.50 per share and a special dividend of Rs 4.50 apiece to commemorate 125 years of the company's existence. The dividend was announced by the company in February, when it announced results for the quarter ended December 2024.

The record date for the dividend was set as March 18. Shareholders listed on the Register of Members as of this date are eligible to receive the dividend within 30 days of its declaration.

Castrol's Q4 Performance

Castrol's fourth-quarter profit rose 12% year-on-year to Rs 271 crore in the three months through Dec. 31, 2024. Revenue from operations in the quarter ended December rose 7% to Rs 1,354 crore. Bloomberg analysts' consensus estimate for the revenue stood at Rs 1,353 crore.

Castrol's earnings before interest, taxes, depreciation, and amortisation rose 14% to Rs 376 crore, while the margin expanded to 27.8%.

Castrol Shares Decline

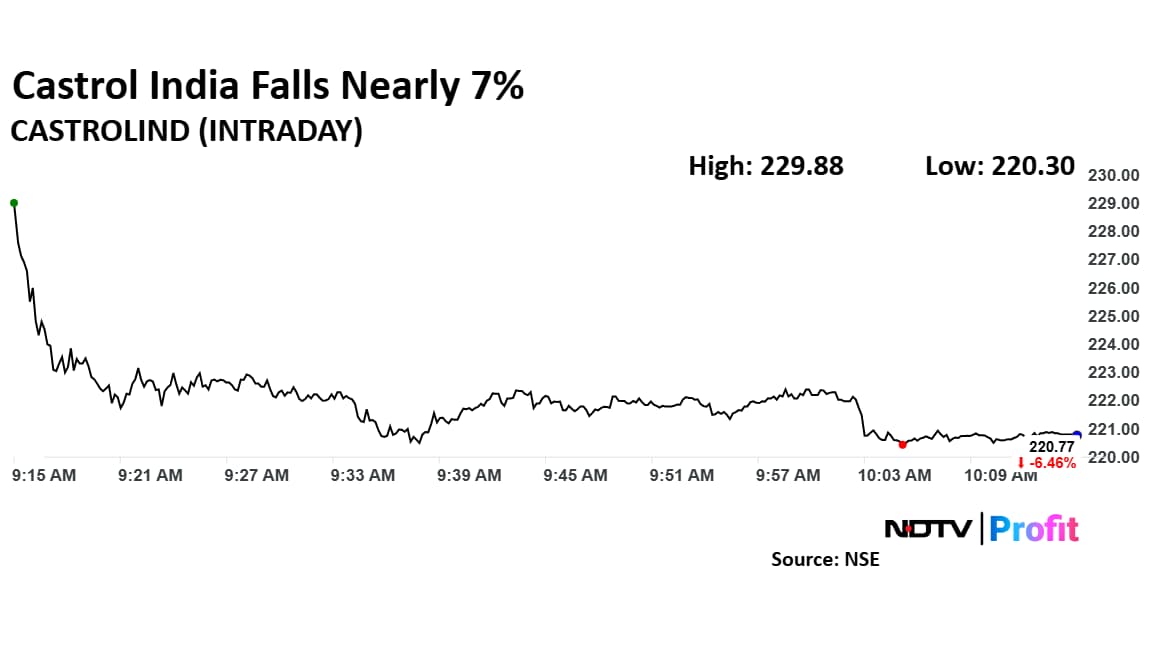

Shares of Castrol India fell as much as 6.66% to Rs 220.30 apiece, the lowest level since March 4. It pared losses to trade 6.49% lower at Rs 220.71 apiece, as of 10:27 a.m. This compares to a 0.99% advance in the NSE Nifty 50.

The stock has risen 9.86% in the last 12 months and 8.34% year-to-date. Total traded volume so far in the day stood at 1.3 times its 30-day average. The relative strength index was at 51.

Out of four analysts tracking the company, three maintain a 'buy' rating and one recommends a 'hold', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 5.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.