- Shares of Canara Robeco AMC listed at Rs 280.25, above the IPO price of Rs 266

- The market capitalisation was nearly Rs 5,800 crore on the NSE at listing

- The IPO was a Rs 1,326.13 crore offer for sale by promoters Canara Bank and Orix

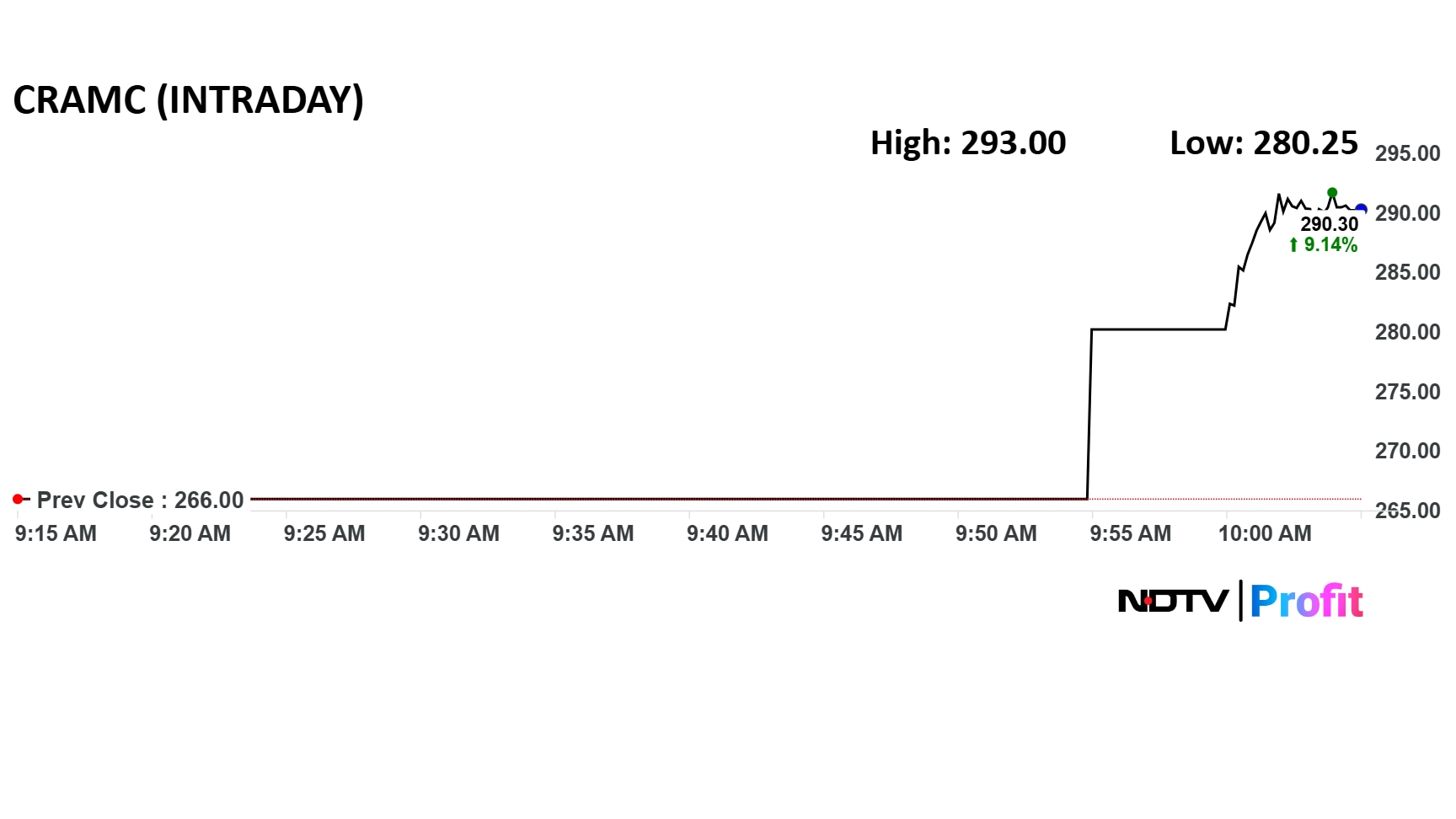

Shares of Canara Robeco Asset Management Co. listed on the stock market with a small premium over the IPO price on Thursday. The scrip opened at Rs 280.25 on the NSE and BSE, compared to the issue price of Rs 266.

The market cap stood at nearly Rs 5,800 crore on the NSE. The stock rose as much as 10% minutes after listing.

The last grey market premium of the Canara Robeco IPO was Rs 20, estimating a listing price of Rs 286.

The Canara Robeco IPO was a book build issue of Rs 1,326.13 crore. It was a pure offer for sale, with promoters offloading up to 4.98 crore shares. Canara Bank sold 2.59 crore shares, while Orix Corporation Europe sold 2.39 crore shares.

The IPO closed on Monday with a robust subscription. The mainboard IPO was subscribed 9.74 times on the third and final day, with investors bidding for 33,99,83,448 shares against the 3,48,98,051 shares on offer.

Qualified Institutional Buyers (QIBs) led the demand for the issue by booking their quota over 25 times, bidding for 25,83,96,488 shares against the 99,70,872 shares on offer, as per data from BSE.

Canara Robeco Asset Management Company is an asset management firm. It is the investment manager for Canara Robeco Mutual Fund. The AMC is a 51-49 joint venture between Canara Bank and OCE. OCE was earlier known as Robeco Groep before being acquired by Japan's Orix Corp.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.