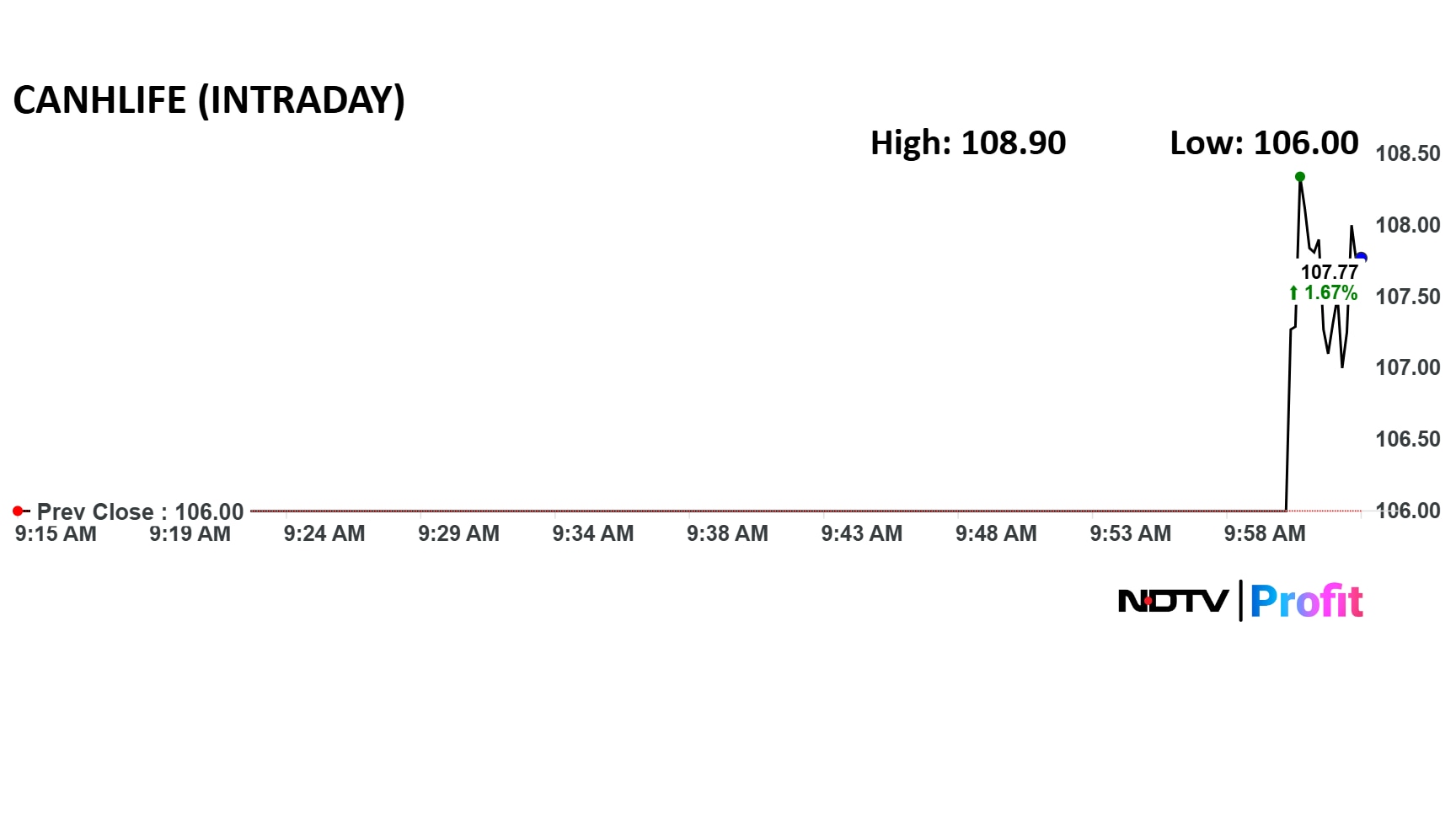

Canara HSBC Life Insurance Co. made an underwhelming debut on the stock market on Friday, listing at its IPO price. The scrip opened at Rs 106 on the NSE and BSE, the same as the issue price. The stock climbed nearly 3% minuted after listing.

The last grey market premium for the Canara HSBC Life IPO was Rs 3, indicating a listing gain of around 3%.

The Canara HSBC Life IPO was a book build issue of Rs 2,517.5 crore and entirely an offer for sale of 23.75 crore shares. The proceeds from the OFS went to the selling shareholders, Canara Bank and HSBC Insurance (Asia-Pacific) Holding Ltd.

The initial public offering was oversubscribed 2.29 times, with investors bidding for 38,21,62,200 against the 16,67,15,000 shares on offer. The public issue was subscribed to 2.3 times on day three. The bids were led by Qualified institutional investors (7.05 times). The portion for non-institutional investors and retail investors were undersubscribed.

Canara HSBC Life Insurance is a private life insurer in India, jointly promoted by Canara Bank and HSBC Insurance (Asia-Pacific) Holdings, a member of the HSBC Group. The company ranked third in assets under management among public sector bank-promoted life insurers as of March 31, 2025.

Incorporated in 2007, the company has established itself as a leading bank-led private life insurer. Its Annualised Premium Equivalent (APE) has shown consistent growth, supported by a diversified product portfolio and expanding market presence. The company's profit after tax increased at a CAGR of 13.26%, rising from Rs 91.2 crore in fiscal 2023 to Rs 116.9 crore in fiscal 2025.

At the upper end of the price band, the company is valued at a P/EV multiple of 1.6x, which appears fully priced relative to peers, according to Choice Equity Broking Pvt. The company benefits from strong brand equity, institutional backing, and operational credibility.

As of March 31, 2025, the company held a 1.81% market share in individual weighted premium income.

"While valuations offer limited near-term upside, the company's strong parentage, diversified product portfolio, and scalable platform support a sustainable growth outlook," the analysts said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.