Canara Bank rose to hit its highest since October 1 following the Reserve Bank of India's approval letter for divesting its shareholding in Canara Robeco Asset Management Company Ltd and Canara HSBC Life Insurance Company Ltd by 13% and 14.5%, respectively, through IPO.

Further, RBI has intimated that in accordance with the exemption granted by the Government of India, the bank should adhere to the October 31, 2029, timeline for bringing its stake in these entities up to 30%, an exchange filing said.

Subsequent to this, the bank will initiate the process of IPO and shall keep exchanges informed about the material developments in this regard, duly complying with SEBI regulations.

Canara HSBC Life Insurance Company Limited is a joint venture promoted by Canara Bank, which holds 51%, and HSBC Insurance Holdings Ltd., which has a 26% stake. In 2007, Canara Bank partnered with the Robeco Group by way of a joint venture, and the mutual fund was renamed as Canara Robeco Mutual Fund.

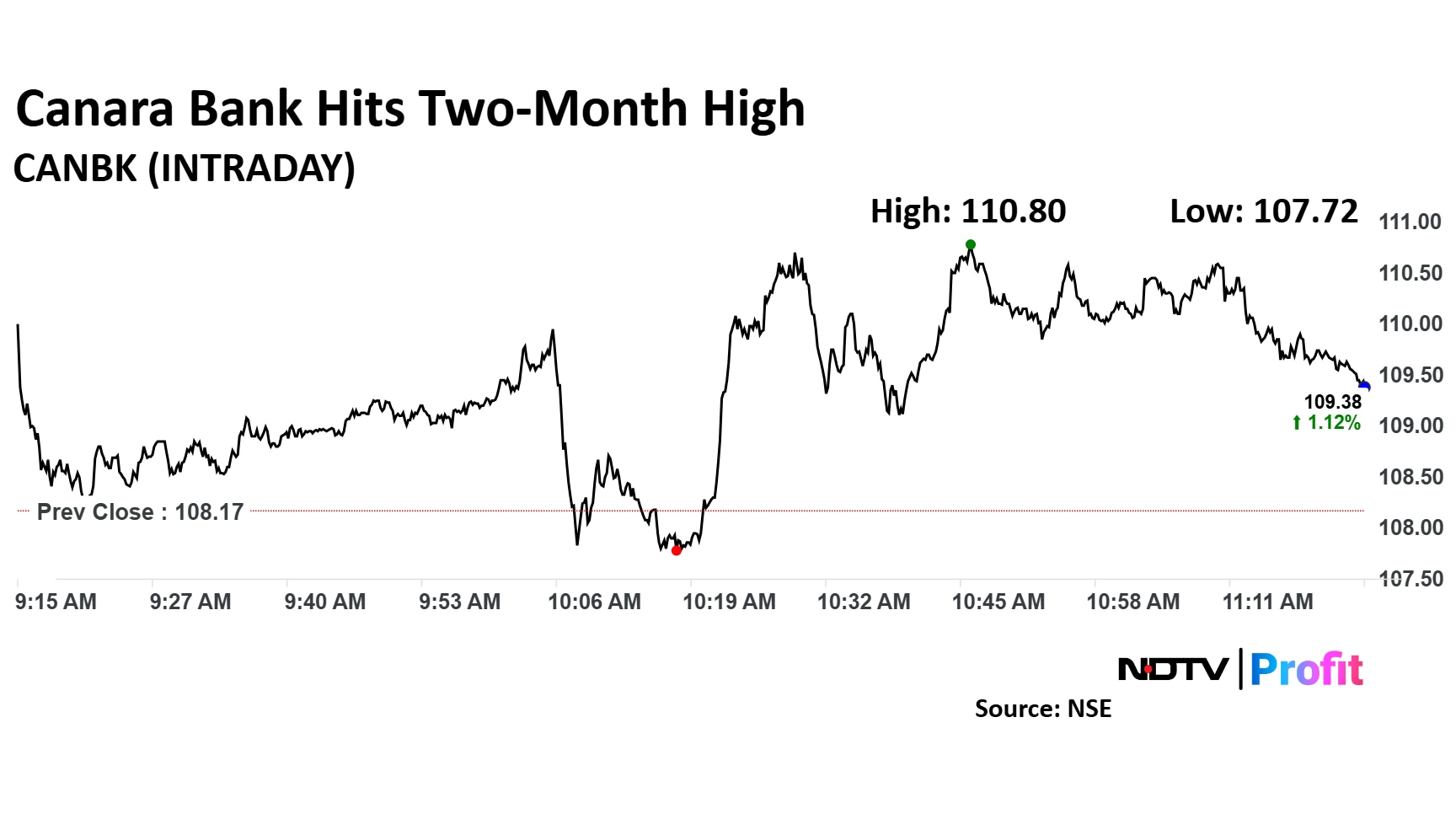

The scrip rose as much as 2.4% to Rs 110.8 apiece, the highest level since Oct. 1. It pared gains to trade 1.2% higher at Rs 109.42 apiece, as of 11:26 a.m. This compares to a 0.1% decline in the NSE Nifty 50 Index.

It has risen 24.7% on a year-to-date basis. Total traded volume so far in the day stood at 1.86 times its 30-day average. The relative strength index was at 64.3.

Out of the 18 analysts tracking the company, 11 maintain a 'buy' rating, four recommend a 'hold,' and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 9.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.