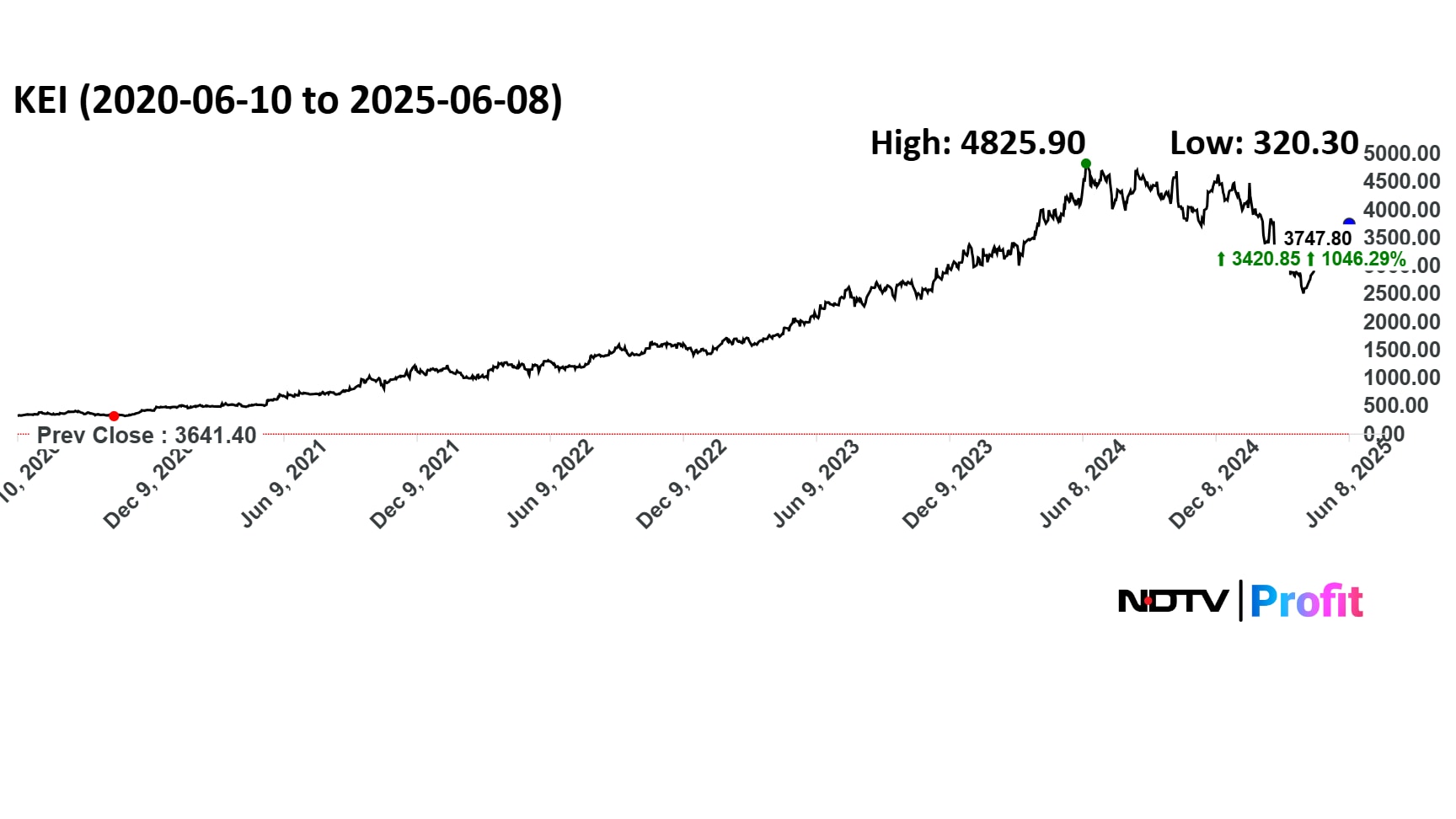

KEI Industries Ltd., a manufacturer of wires and cables, is a multibagger stock that has rallied over 1000% over the last five years.

The share price has risen from the low of Rs 303 in June 2020 to an all-time high of Rs 5,040 in June 2024. Since then, the stock has corrected 22% to Rs 3,748 apiece as of last week's closing.

On a year-to-date basis alone, KEI Industries stock is down 20%.

Among close peers, the company trades at 51.42 price-to earnings, compared to 45.5 for Polycab India Ltd., 51.3 for RR Kabel Ltd. and 64.5 for Havells India Ltd.

A brief review of the company's business performance, analyst price targets and sector outlook provides a deeper insight to whether there is further room for the stock rally.

About KEI Industries

KEI Industries operates in three key segments: cables and wires, stainless steel wire, and Engineering, Procurement and Construction (EPC) projects. It manufactures a wide range of wires and cables, including high voltage (EHV, HV, LV), control and instrumentation cables, house wires and communication cables.

The company operates eight manufacturing plants across Rajasthan and the Union Territory of Dadra and Nagar Haveli.

Exports accounted for 13% of sales in FY25. KEI Industries' order book for exports stood at Rs 810 crore (including EPC and EHV) as of March, 2025.

Solid Revenue Growth, But Margin Tepid

KEI Industries has seen double-digit consolidated revenue growth over the last five financial years.

Income has more than doubled from Rs 4,185 crore in the financial year ending March 2021 to Rs 9,722 crore in the previous financial year. During this period, revenue from operations have surged on an average 17% every year, as per Bloomberg data.

However, operational profitability has remained flattish. The Ebitda margin has averaged at 10.8%, even as the headline net profit nearly surged from Rs 270 crore in 2020-21 to Rs 696 crore in 2024-25.

For the current and the next financial year, analysts consensus estimates compiled by Bloomberg indicates 18% and 19% revenue growth, respectively. Margin will remain above the five-year average.

Share Price Target

Out of the 21 analysts tracking KEI Industries, 17 have a 'buy' rating on the stock and four recommend a 'hold', according to Bloomberg data. The average of 12-month analyst price target of Rs 3,853 implies a potential upside of 3%.

Since September 2024, the stock has significantly trailed the consensus price target until recently, even as 'buy' rating remained the most.

In a recent note, multinational investment bank Jefferies placed a bull case target of Rs 5,625 on the stock and a base case target of Rs 4,000.

The firm expects KEI Industries' earnings to compound at a 31% annualised rate over financial year 2025-2027 and margins improve during the same period as retail margins surprise on the upside.

Exports and retail share in the overall revenue mix declining is a key risk for KEI, according to Jefferies.

Rising Competition

While India speeds up its transition from fossil fuels towards electrification of its energy and transport systems, demand is only projected to grow multifold for cables and wires.

In an investor presentation, KEI Industries said India's wires and cables market is projected to grow at 11-13% annualised rate by FY29 and the export market by 10-11%.

What potentially weighs on KEI Industries is therefore competition.

UltraTech Cements Ltd., a major player in the cement sector, plans to enter the market, initially focusing on domestic wires. Its extensive distribution network and strong contractor relationships make it a formidable competitor to established companies like KEI, Havells India, Polycab India, and V-Guard Industries.

This increased competition, particularly after 2027, could hurt the profitability of these companies, according to brokerages.

Besides, raw material costs of minerals like copper are tied to global commodity markets that have been swinging wildly to the trade tensions caused by the US tariff policies and global economic uncertainity.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.