Shares of ITC Ltd. jumped nearly 4% to an all-time high on Wednesday after Jefferies India Pvt. upgraded the stock to 'buy' from 'hold'. It also raised the earnings-per-share estimates by 1–2% and the target price to Rs 585 per share from Rs 435 earlier, implying a potential upside of 25% from the previous close.

With the demand outlook for the staple sector improving, ITC comes out as a clear winner as the Union government left tobacco taxes unchanged in Budget 2024–25 on Tuesday, Jefferies said in a note on July 23, pointing out that "no news is great news" for the tobacco maker.

The goods and services tax is also likely to stay stable until March 2026 till the central government settles the states' dues, it said. "A modest price hike this year will set a base for next year."

The last tobacco tax hike was at 2% in February 2023 and this should allow ITC to focus on volume by taking minimal product price hikes, according to the brokerage. "With clarity on cigarette taxation, we believe ITC in well-placed to accelerate cigarette-revenue growth through a blend of volumes, price hikes and better mix of input cost"

Jefferies expects the growth in earnings before interest and taxes for tobacco to accelerate from 4% in the second half of the last financial year to 7% in the first half of the current fiscal.

With improving demand outlook, especially in rural, we expect FMCG revenue growth to accelerate through the course of FY25, in line with peers.Jefferies

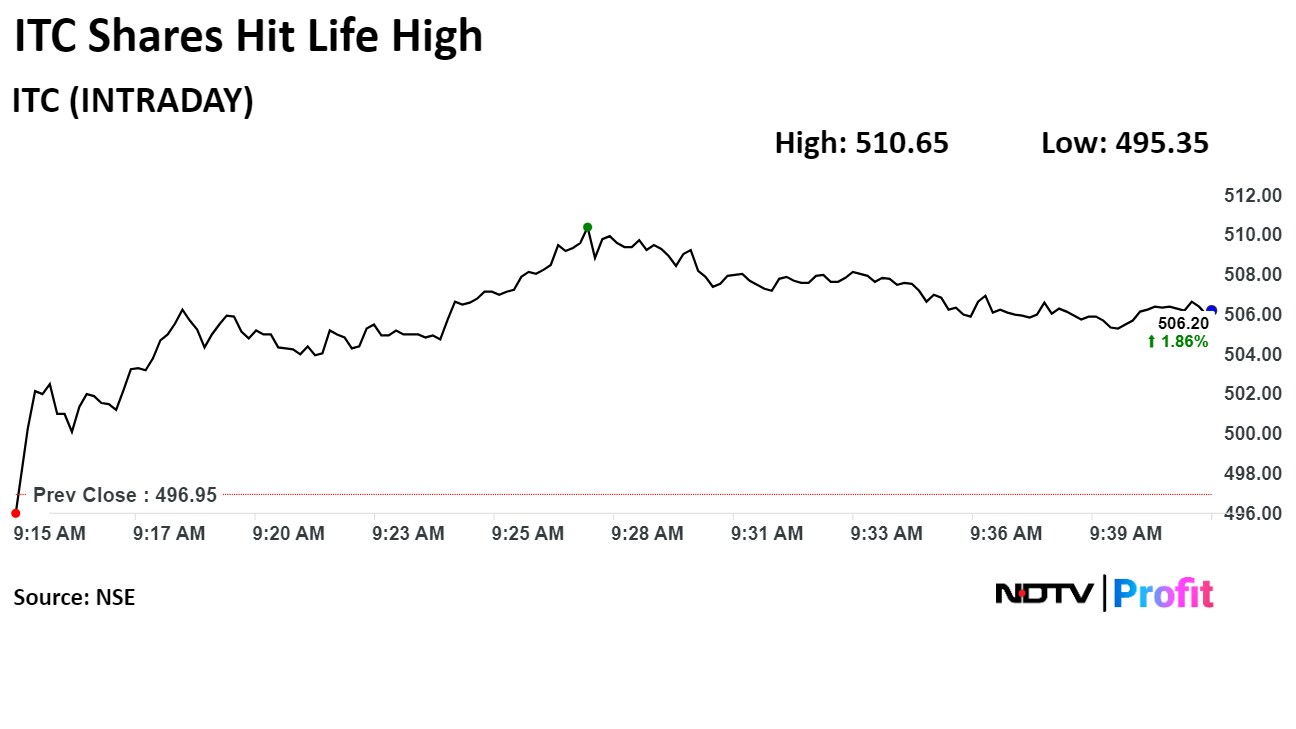

ITC's stock rose as much as 3.75% in early trade to Rs 510.6 apiece on the NSE. It was trading 3.13% higher at Rs 507.6 per share, compared to a 0.06% advance in the benchmark Nifty at 09:36 a.m.

The shares rose as much as 6.6% on Tuesday as there was no announcement in the budget regarding the tax for cigarettes.

The share price has risen 7.3% in the last 12 months and 9.5% on a year-to-date basis. The total traded volume so far in the day stood at 11 times its 30-day average. The relative strength index was at 82, implying that the stock is overbought.

Thirty-six out of the 39 analysts tracking the company have a 'buy' rating on the stock, one recommends 'hold' and two suggest 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 0.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.